- Canada

- /

- Oil and Gas

- /

- TSX:FRU

Undiscovered Canadian Gems with Promising Potential This July 2025

Reviewed by Simply Wall St

As Canadian markets navigate the complexities of rising tariffs and resilient inflation, investors remain cautiously optimistic, buoyed by stable economic indicators and positive trade negotiations. In this environment, identifying stocks with strong fundamentals and potential for growth can be particularly rewarding, especially those that effectively manage supply chain challenges and leverage lower energy costs.

Top 10 Undiscovered Gems With Strong Fundamentals In Canada

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Pulse Seismic | NA | 11.60% | 32.30% | ★★★★★★ |

| Mako Mining | 6.32% | 19.64% | 64.11% | ★★★★★★ |

| TWC Enterprises | 4.02% | 13.46% | 16.81% | ★★★★★★ |

| Majestic Gold | 9.90% | 11.70% | 9.35% | ★★★★★★ |

| Pinetree Capital | 0.20% | 63.68% | 65.79% | ★★★★★★ |

| Itafos | 25.35% | 11.11% | 49.69% | ★★★★★★ |

| BMTC Group | NA | -4.13% | -8.71% | ★★★★★☆ |

| Corby Spirit and Wine | 57.06% | 9.84% | -5.44% | ★★★★☆☆ |

| Genesis Land Development | 48.16% | 31.08% | 55.45% | ★★★★☆☆ |

| Dundee | 2.02% | -35.84% | 57.23% | ★★★★☆☆ |

Here's a peek at a few of the choices from the screener.

Corby Spirit and Wine (TSX:CSW.A)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Corby Spirit and Wine Limited, along with its subsidiaries, is engaged in the manufacturing, marketing, and importing of spirits, wines, and ready-to-drink cocktails across Canada, the United States, the United Kingdom, and internationally with a market capitalization of approximately CA$399.25 million.

Operations: Corby generates revenue primarily from Case Goods, contributing CA$206.78 million, and Commissions, adding CA$29.95 million. The company also earns from Other Services with a revenue of CA$4.58 million.

Corby Spirit and Wine, a small player in Canada's beverage industry, has shown some compelling figures. Over the past year, earnings surged by 25.4%, outpacing the industry's -4.5% performance. Despite a high net debt to equity ratio of 54%, interest payments are well covered with EBIT at 5.6 times coverage. Trading at 77% below its estimated fair value suggests potential upside for investors seeking value opportunities. Recent financial results reveal steady sales of CAD 174.79 million for nine months ending March 2025, with net income climbing to CAD 21.23 million from CAD 19.12 million previously, reflecting solid profitability trends amidst market challenges.

- Take a closer look at Corby Spirit and Wine's potential here in our health report.

Understand Corby Spirit and Wine's track record by examining our Past report.

Freehold Royalties (TSX:FRU)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Freehold Royalties Ltd. is engaged in acquiring and managing royalty interests in crude oil, natural gas, natural gas liquids, and potash properties across Canada and the United States, with a market cap of CA$2.17 billion.

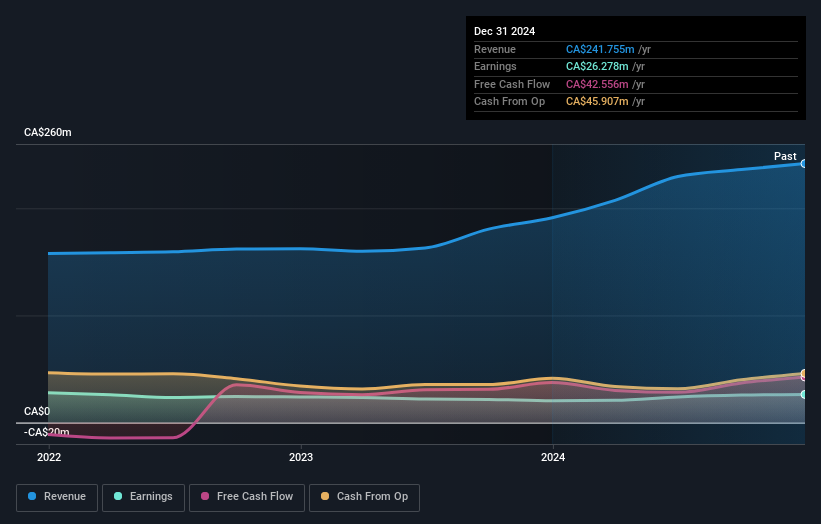

Operations: Revenue primarily stems from royalty interests in oil and gas exploration and production, totaling CA$326.27 million.

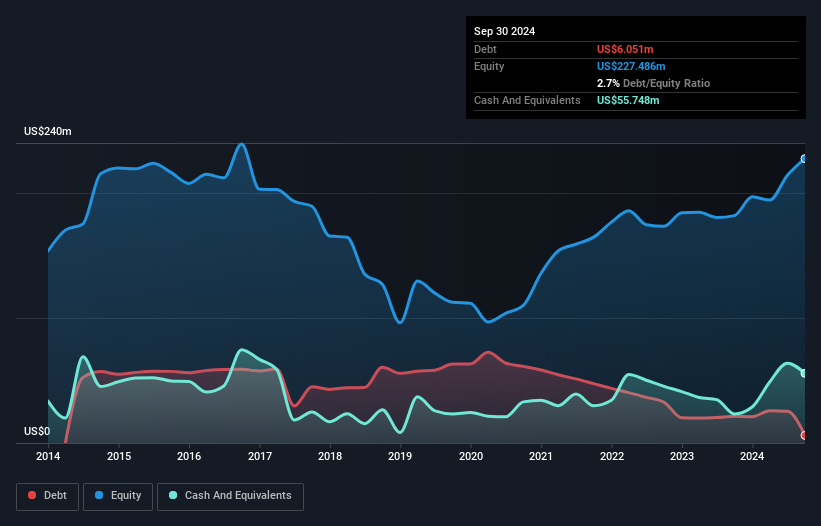

Freehold Royalties, a player in Canada's energy sector, has been making strides with a 13.2% earnings growth over the past year, outpacing the Oil and Gas industry's 4.2%. Trading at 67.3% below its estimated fair value suggests potential upside for investors. The company's net debt to equity ratio stands at a satisfactory 27%, although it has risen from 15.1% over five years, indicating increased leverage but still within acceptable limits. Recent strategic moves include appointing Shaina Morihira as CFO and launching a share repurchase program targeting up to 8.35% of its outstanding shares, reflecting confidence in its financial health and future prospects.

- Dive into the specifics of Freehold Royalties here with our thorough health report.

Explore historical data to track Freehold Royalties' performance over time in our Past section.

Mandalay Resources (TSX:MND)

Simply Wall St Value Rating: ★★★★★★

Overview: Mandalay Resources Corporation is involved in the acquisition, exploration, extraction, processing, and reclamation of mineral properties across Australia, Sweden, Chile, and Canada with a market cap of CA$427.48 million.

Operations: Mandalay Resources generates revenue primarily from its Metals & Mining segment, focusing on gold and other precious metals, with reported revenues of $263.21 million. The company's financial performance includes a notable net profit margin trend worth examining for insights into operational efficiency and profitability dynamics.

Mandalay Resources, a small Canadian mining company, is making waves with its strategic focus on high-margin production and cost efficiency. The firm's financial health is robust, boasting more cash than total debt and an impressive 102x EBIT coverage for interest payments. Over the past year, earnings skyrocketed by 329.7%, significantly outpacing the industry's 37.1% growth rate. Recent exploration successes at Costerfield and Björkdal promise potential reserve expansions, while a $12 million exploration budget for 2025 underlines commitment to future growth. However, challenges like limited mine life at Costerfield could impact revenue if not mitigated through successful exploration efforts.

Taking Advantage

- Click here to access our complete index of 45 TSX Undiscovered Gems With Strong Fundamentals.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:FRU

Freehold Royalties

Acquires and manages royalty interests in the crude oil, natural gas, natural gas liquids, and potash properties in Canada and the United States.

Adequate balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives