Market Still Lacking Some Conviction On Big Rock Brewery Inc. (TSE:BR)

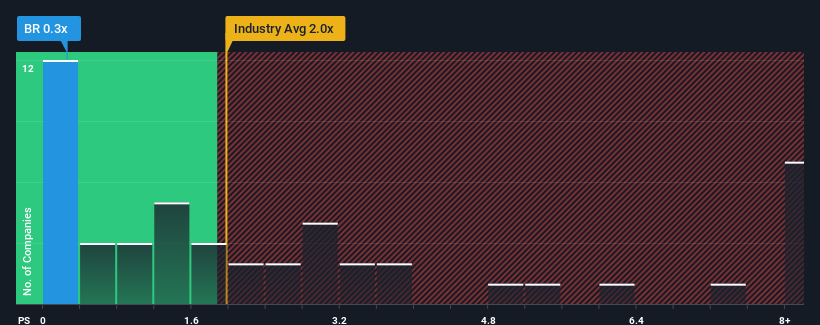

When you see that almost half of the companies in the Beverage industry in Canada have price-to-sales ratios (or "P/S") above 1.2x, Big Rock Brewery Inc. (TSE:BR) looks to be giving off some buy signals with its 0.3x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

View our latest analysis for Big Rock Brewery

What Does Big Rock Brewery's Recent Performance Look Like?

Big Rock Brewery has been doing a good job lately as it's been growing revenue at a solid pace. Perhaps the market is expecting this acceptable revenue performance to take a dive, which has kept the P/S suppressed. Those who are bullish on Big Rock Brewery will be hoping that this isn't the case, so that they can pick up the stock at a lower valuation.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Big Rock Brewery's earnings, revenue and cash flow.Do Revenue Forecasts Match The Low P/S Ratio?

In order to justify its P/S ratio, Big Rock Brewery would need to produce sluggish growth that's trailing the industry.

Taking a look back first, we see that the company managed to grow revenues by a handy 10% last year. Revenue has also lifted 14% in aggregate from three years ago, partly thanks to the last 12 months of growth. Therefore, it's fair to say the revenue growth recently has been respectable for the company.

Comparing that to the industry, which is predicted to deliver 6.2% growth in the next 12 months, the company's momentum is pretty similar based on recent medium-term annualised revenue results.

In light of this, it's peculiar that Big Rock Brewery's P/S sits below the majority of other companies. Apparently some shareholders are more bearish than recent times would indicate and have been accepting lower selling prices.

The Bottom Line On Big Rock Brewery's P/S

Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

The fact that Big Rock Brewery currently trades at a low P/S relative to the industry is unexpected considering its recent three-year growth is in line with the wider industry forecast. There could be some unobserved threats to revenue preventing the P/S ratio from matching the company's performance. medium-term

You always need to take note of risks, for example - Big Rock Brewery has 4 warning signs we think you should be aware of.

If you're unsure about the strength of Big Rock Brewery's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Valuation is complex, but we're here to simplify it.

Discover if Big Rock Brewery might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSX:BR

Big Rock Brewery

Produces, markets, and distributes craft beers, ciders, and ready-to-drink beverages primarily in Canada.

Mediocre balance sheet low.