The excitement of investing in a company that can reverse its fortunes is a big draw for some speculators, so even companies that have no revenue, no profit, and a record of falling short, can manage to find investors. Unfortunately, these high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson. A loss-making company is yet to prove itself with profit, and eventually the inflow of external capital may dry up.

Despite being in the age of tech-stock blue-sky investing, many investors still adopt a more traditional strategy; buying shares in profitable companies like WesCan Energy (CVE:WCE). Now this is not to say that the company presents the best investment opportunity around, but profitability is a key component to success in business.

View our latest analysis for WesCan Energy

WesCan Energy's Earnings Per Share Are Growing

If you believe that markets are even vaguely efficient, then over the long term you'd expect a company's share price to follow its earnings per share (EPS) outcomes. That means EPS growth is considered a real positive by most successful long-term investors. To the delight of shareholders, WesCan Energy has achieved impressive annual EPS growth of 45%, compound, over the last three years. While that sort of growth rate isn't sustainable for long, it certainly catches the eye of prospective investors.

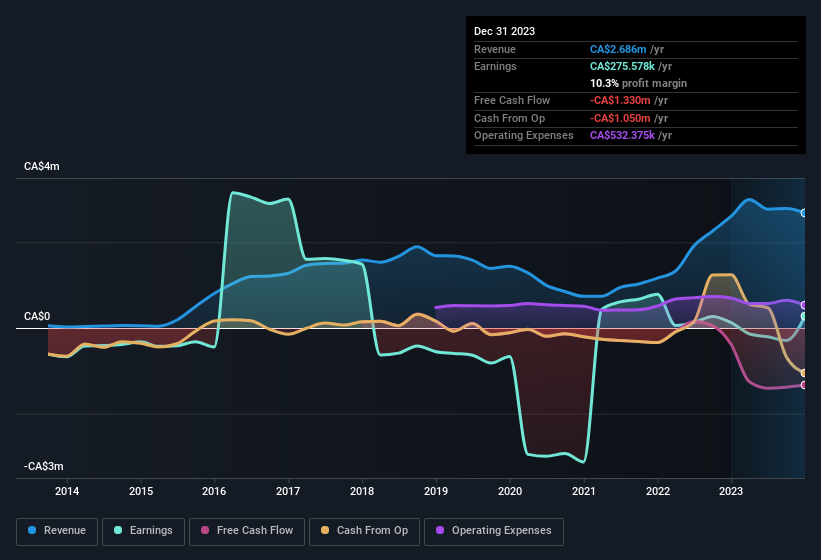

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. While WesCan Energy did well to grow revenue over the last year, EBIT margins were dampened at the same time. So it seems the future may hold further growth, especially if EBIT margins can remain steady.

The chart below shows how the company's bottom and top lines have progressed over time. For finer detail, click on the image.

Since WesCan Energy is no giant, with a market capitalisation of CA$3.7m, you should definitely check its cash and debt before getting too excited about its prospects.

Are WesCan Energy Insiders Aligned With All Shareholders?

Investors are always searching for a vote of confidence in the companies they hold and insider buying is one of the key indicators for optimism on the market. Because often, the purchase of stock is a sign that the buyer views it as undervalued. However, small purchases are not always indicative of conviction, and insiders don't always get it right.

Belief in the company remains high for insiders as there hasn't been a single share sold by the management or company board members. But more importantly, Interim CEO & Chairman Leo N. Berezan spent CA$93k acquiring shares, doing so at an average price of CA$0.04. It seems at least one insider has seen potential in the company's future - and they're willing to put money on the line.

Should You Add WesCan Energy To Your Watchlist?

WesCan Energy's earnings per share have been soaring, with growth rates sky high. Most growth-seeking investors will find it hard to ignore that sort of explosive EPS growth. And indeed, it could be a sign that the business is at an inflection point. If this these factors intrigue you, then an addition of WesCan Energy to your watchlist won't go amiss. We don't want to rain on the parade too much, but we did also find 5 warning signs for WesCan Energy (4 can't be ignored!) that you need to be mindful of.

There are plenty of other companies that have insiders buying up shares. So if you like the sound of WesCan Energy, you'll probably love this curated collection of companies in CA that have an attractive valuation alongside insider buying in the last three months.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Valuation is complex, but we're here to simplify it.

Discover if WesCan Energy might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSXV:WCE

WesCan Energy

A junior public resource company, explores for, develops, and produces oil and gas properties in Alberta, Canada; and Texas, the United States.

Slight and slightly overvalued.

Market Insights

Community Narratives