- Canada

- /

- Oil and Gas

- /

- TSXV:VUX

We Think The Compensation For Vital Energy Inc.'s (CVE:VUX) CEO Looks About Right

Key Insights

- Vital Energy to hold its Annual General Meeting on 6th of December

- Salary of CA$210.0k is part of CEO Yingchuan Wu's total remuneration

- Total compensation is similar to the industry average

- Vital Energy's EPS declined by 67% over the past three years while total shareholder return over the past three years was 69%

Performance at Vital Energy Inc. (CVE:VUX) has been reasonably good and CEO Yingchuan Wu has done a decent job of steering the company in the right direction. As shareholders go into the upcoming AGM on 6th of December, CEO compensation will probably not be their focus, but rather the steps management will take to continue the growth momentum. Based on our analysis of the data below, we think CEO compensation seems reasonable for now.

Check out our latest analysis for Vital Energy

How Does Total Compensation For Yingchuan Wu Compare With Other Companies In The Industry?

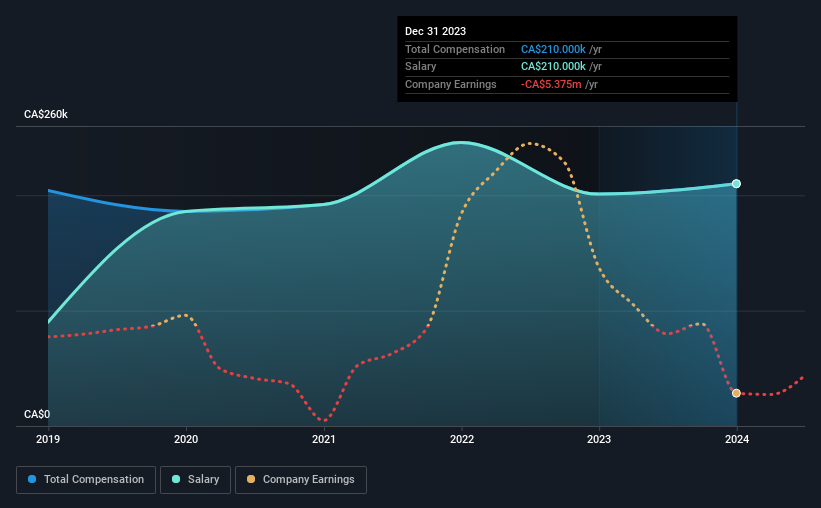

According to our data, Vital Energy Inc. has a market capitalization of CA$18m, and paid its CEO total annual compensation worth CA$210k over the year to December 2023. That's a fairly small increase of 4.5% over the previous year. Notably, the salary of CA$210k is the entirety of the CEO compensation.

On comparing similar-sized companies in the Canadian Oil and Gas industry with market capitalizations below CA$280m, we found that the median total CEO compensation was CA$252k. So it looks like Vital Energy compensates Yingchuan Wu in line with the median for the industry.

| Component | 2023 | 2022 | Proportion (2023) |

| Salary | CA$210k | CA$201k | 100% |

| Other | - | - | - |

| Total Compensation | CA$210k | CA$201k | 100% |

On an industry level, roughly 49% of total compensation represents salary and 51% is other remuneration. At the company level, Vital Energy pays Yingchuan Wu solely through a salary, preferring to go down a conventional route. If salary dominates total compensation, it suggests that CEO compensation is leaning less towards the variable component, which is usually linked with performance.

Vital Energy Inc.'s Growth

Vital Energy Inc. has reduced its earnings per share by 67% a year over the last three years. It achieved revenue growth of 40% over the last year.

Investors would be a bit wary of companies that have lower EPS On the other hand, the strong revenue growth suggests the business is growing. These two metrics are moving in different directions, so while it's hard to be confident judging performance, we think the stock is worth watching. Although we don't have analyst forecasts, you might want to assess this data-rich visualization of earnings, revenue and cash flow.

Has Vital Energy Inc. Been A Good Investment?

Most shareholders would probably be pleased with Vital Energy Inc. for providing a total return of 69% over three years. This strong performance might mean some shareholders don't mind if the CEO were to be paid more than is normal for a company of its size.

To Conclude...

Vital Energy pays CEO compensation exclusively through a salary, with non-salary compensation completely ignored. Some shareholders will be pleased by the relatively good results, however, the results could still be improved. Despite robust revenue growth, until EPS growth improves, shareholders may be hesitant to increase CEO pay by too much.

While it is important to pay attention to CEO remuneration, investors should also consider other elements of the business. That's why we did some digging and identified 1 warning sign for Vital Energy that you should be aware of before investing.

Important note: Vital Energy is an exciting stock, but we understand investors may be looking for an unencumbered balance sheet and blockbuster returns. You might find something better in this list of interesting companies with high ROE and low debt.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSXV:VUX

Vital Energy

A junior oil and gas company, engages in the acquisition, exploration, and development of crude oil and natural gas in Western Canada.

Acceptable track record and slightly overvalued.

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Perdana Petroleum Berhad is a Zombie Business with a 27.34% Profit Margin and inflation adjusted revenue Business

Many trends acting at the same time

Engineered for Stability. Positioned for Growth.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026