- Canada

- /

- Energy Services

- /

- TSX:CFW

March 2025 Penny Stock Picks On The TSX

Reviewed by Simply Wall St

In 2025, the Canadian stock market has experienced volatility and negative returns, with diversification emerging as a key strategy amid softened growth outlooks for both Canada and the U.S. Despite these challenges, certain sectors have shown resilience, emphasizing the importance of balanced portfolios. While the term "penny stock" might seem outdated, it still highlights smaller or newer companies that can offer significant value when backed by strong financials. We've identified three such penny stocks on the TSX that combine financial stability with potential for growth, offering investors an opportunity to explore promising smaller firms in today's diverse market landscape.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Rewards & Risks |

| NTG Clarity Networks (TSXV:NCI) | CA$1.83 | CA$81.36M | ✅ 4 ⚠️ 2 View Analysis > |

| NamSys (TSXV:CTZ) | CA$1.10 | CA$29.55M | ✅ 2 ⚠️ 2 View Analysis > |

| Madoro Metals (TSXV:MDM) | CA$0.04 | CA$3.58M | ✅ 2 ⚠️ 5 View Analysis > |

| Orezone Gold (TSX:ORE) | CA$0.98 | CA$420.81M | ✅ 3 ⚠️ 2 View Analysis > |

| Amerigo Resources (TSX:ARG) | CA$1.90 | CA$314.55M | ✅ 2 ⚠️ 1 View Analysis > |

| Alvopetro Energy (TSXV:ALV) | CA$4.60 | CA$167.62M | ✅ 3 ⚠️ 2 View Analysis > |

| PetroTal (TSX:TAL) | CA$0.68 | CA$632.31M | ✅ 2 ⚠️ 2 View Analysis > |

| McCoy Global (TSX:MCB) | CA$2.87 | CA$78.28M | ✅ 3 ⚠️ 2 View Analysis > |

| Findev (TSXV:FDI) | CA$0.485 | CA$14.32M | ✅ 2 ⚠️ 4 View Analysis > |

| BluMetric Environmental (TSXV:BLM) | CA$1.07 | CA$36.92M | ✅ 3 ⚠️ 4 View Analysis > |

Click here to see the full list of 935 stocks from our TSX Penny Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

Calfrac Well Services (TSX:CFW)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Calfrac Well Services Ltd., along with its subsidiaries, offers specialized oilfield services across Canada, the United States, and Argentina, with a market cap of CA$312.56 million.

Operations: Calfrac Well Services Ltd. does not report specific revenue segments.

Market Cap: CA$312.56M

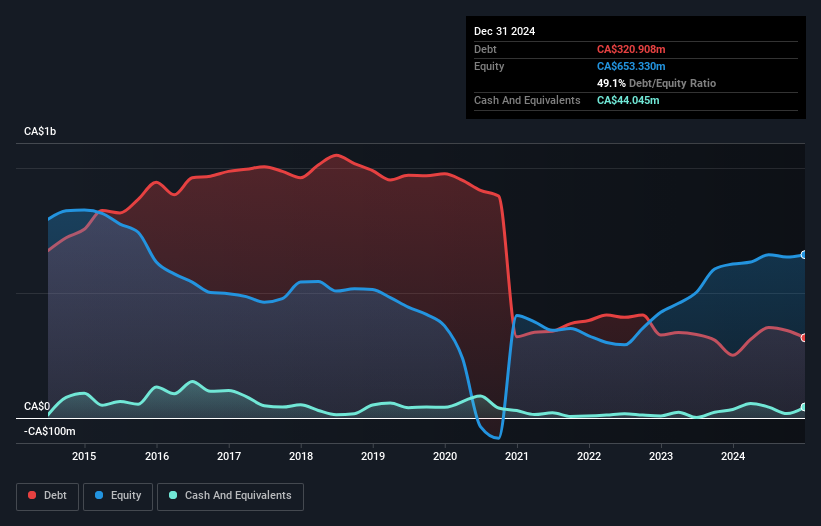

Calfrac Well Services Ltd. faces challenges with a recent CEO resignation and declining financial performance, reporting a net loss of CA$5.13 million in Q4 2024 compared to a profit the previous year. Despite these setbacks, the company maintains a solid short-term asset position exceeding its liabilities and has reduced its debt-to-equity ratio significantly over five years. However, interest payments are not well covered by earnings, and profit margins have decreased to 0.5% from 10.6% last year. Analysts forecast earnings growth of 47.61% annually, but volatility remains stable at 4%.

- Dive into the specifics of Calfrac Well Services here with our thorough balance sheet health report.

- Review our growth performance report to gain insights into Calfrac Well Services' future.

Globex Mining Enterprises (TSX:GMX)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Globex Mining Enterprises Inc. focuses on acquiring, exploring, and developing mineral properties in North America, with a market cap of CA$84.14 million.

Operations: The company generates revenue from its Metals & Mining segment, specifically in Gold & Other Precious Metals, amounting to CA$4.45 million.

Market Cap: CA$84.14M

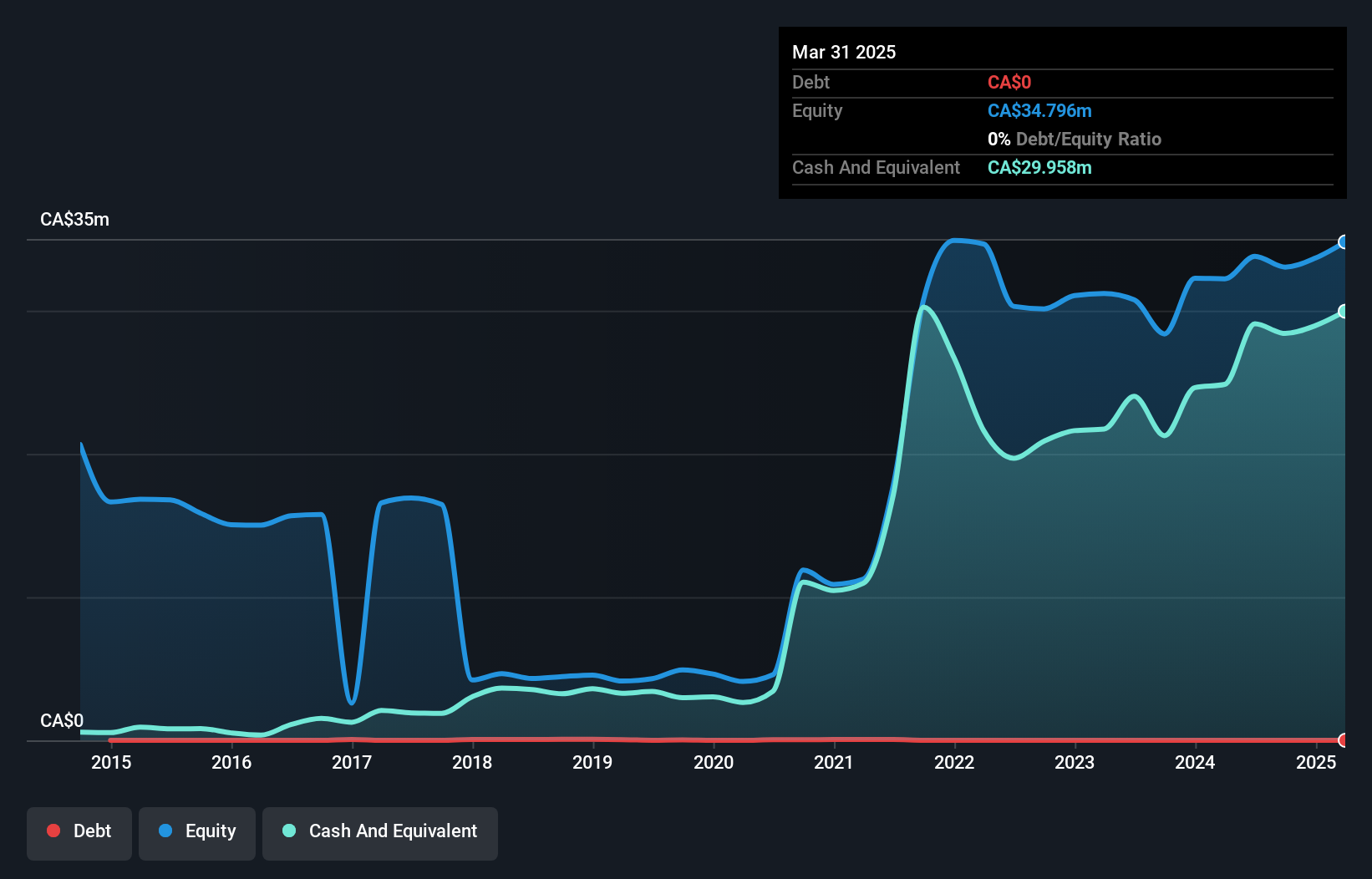

Globex Mining Enterprises Inc., with a market cap of CA$84.14 million, primarily focuses on mineral property development in North America. Despite limited revenue of CA$4.45 million, recent developments indicate potential growth opportunities. The company has become profitable recently and is debt-free, enhancing its financial stability. Notably, Globex holds significant royalties and interests in properties like the Bell Mountain gold project and Tyrone property near promising mineral discoveries by Azimut Exploration Inc., which could impact future valuation positively. Additionally, the company's shares have not been meaningfully diluted over the past year, maintaining shareholder value amidst these strategic advancements.

- Click here and access our complete financial health analysis report to understand the dynamics of Globex Mining Enterprises.

- Understand Globex Mining Enterprises' track record by examining our performance history report.

Sintana Energy (TSXV:SEI)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Sintana Energy Inc. is involved in the exploration and development of crude oil and natural gas in Colombia, with a market cap of CA$223.97 million.

Operations: Sintana Energy Inc. currently does not report any revenue segments.

Market Cap: CA$223.97M

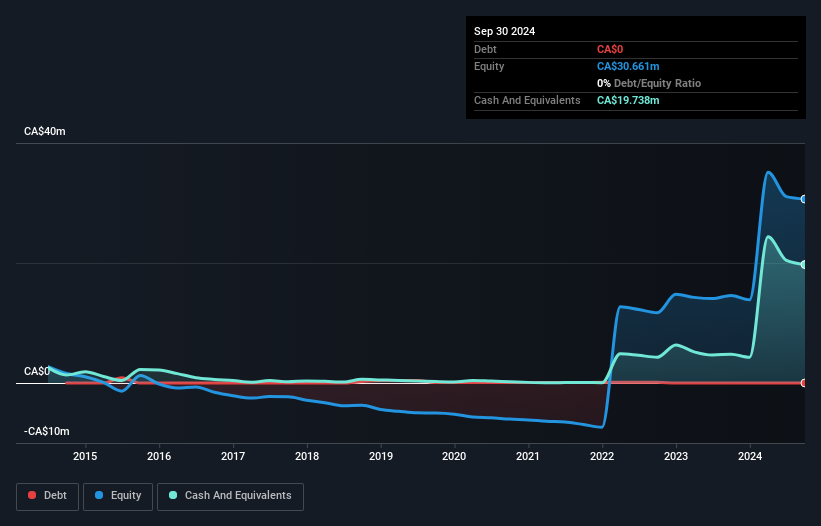

Sintana Energy Inc., with a market cap of CA$223.97 million, is pre-revenue and unprofitable, facing a negative return on equity of -41.72%. Despite this, it remains debt-free and has short-term assets exceeding liabilities by a significant margin. Recent developments in Namibia's Orange Basin present potential exploration opportunities; however, securing an alternate partner for PEL 87 is critical following Woodside's withdrawal. The company filed a CAD 50 million shelf registration to potentially fund future activities. Insider selling has been significant recently, but the management team and board are experienced with average tenures of 7.5 and 10.5 years respectively.

- Click to explore a detailed breakdown of our findings in Sintana Energy's financial health report.

- Gain insights into Sintana Energy's historical outcomes by reviewing our past performance report.

Key Takeaways

- Click through to start exploring the rest of the 932 TSX Penny Stocks now.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:CFW

Calfrac Well Services

Provides specialized oilfield services in Canada, the United States, and Argentina.

Good value with moderate growth potential.

Similar Companies

Market Insights

Community Narratives