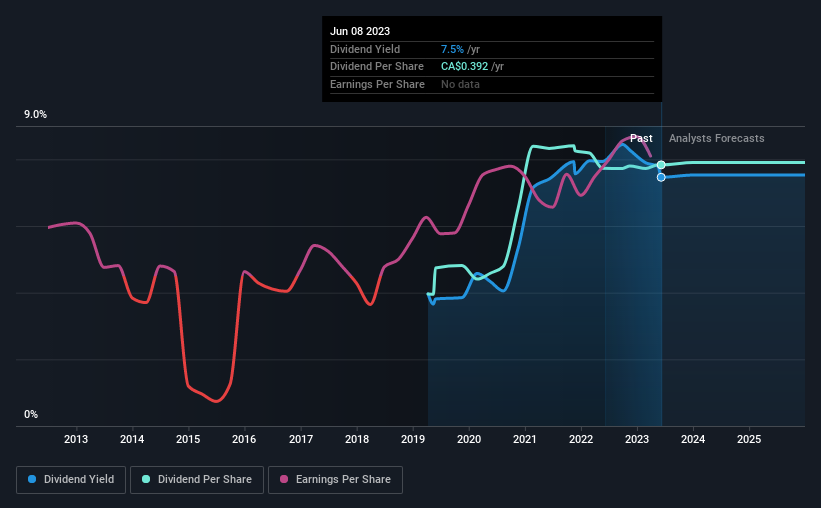

Orca Energy Group Inc. (CVE:ORC.B) will pay a dividend of $0.10 on the 14th of July. This means the annual payment is 7.5% of the current stock price, which is above the average for the industry.

View our latest analysis for Orca Energy Group

Orca Energy Group's Payment Has Solid Earnings Coverage

While it is great to have a strong dividend yield, we should also consider whether the payment is sustainable. However, prior to this announcement, Orca Energy Group's dividend was comfortably covered by both cash flow and earnings. This means that most of its earnings are being retained to grow the business.

Looking forward, earnings per share could rise by 31.3% over the next year if the trend from the last few years continues. If the dividend continues on this path, the payout ratio could be 32% by next year, which we think can be pretty sustainable going forward.

Orca Energy Group Doesn't Have A Long Payment History

The dividend has been pretty stable looking back, but the company hasn't been paying one for very long. This makes it tough to judge how it would fare through a full economic cycle. Since 2019, the annual payment back then was $0.148, compared to the most recent full-year payment of $0.293. This implies that the company grew its distributions at a yearly rate of about 19% over that duration. We're not overly excited about the relatively short history of dividend payments, however the dividend is growing at a nice rate and we might take a closer look.

The Dividend Looks Likely To Grow

Investors could be attracted to the stock based on the quality of its payment history. Orca Energy Group has impressed us by growing EPS at 31% per year over the past five years. Rapid earnings growth and a low payout ratio suggest this company has been effectively reinvesting in its business. Should that continue, this company could have a bright future.

We Really Like Orca Energy Group's Dividend

Overall, we think that this is a great income investment, and we think that maintaining the dividend this year may have been a conservative choice. Distributions are quite easily covered by earnings, which are also being converted to cash flows. Taking this all into consideration, this looks like it could be a good dividend opportunity.

Investors generally tend to favour companies with a consistent, stable dividend policy as opposed to those operating an irregular one. Still, investors need to consider a host of other factors, apart from dividend payments, when analysing a company. As an example, we've identified 1 warning sign for Orca Energy Group that you should be aware of before investing. Is Orca Energy Group not quite the opportunity you were looking for? Why not check out our selection of top dividend stocks.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSXV:ORC.B

Orca Energy Group

Engages in the exploration, development, production, and supply of petroleum and natural gas to the power and industrial sectors in Tanzania.

Excellent balance sheet, good value and pays a dividend.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026