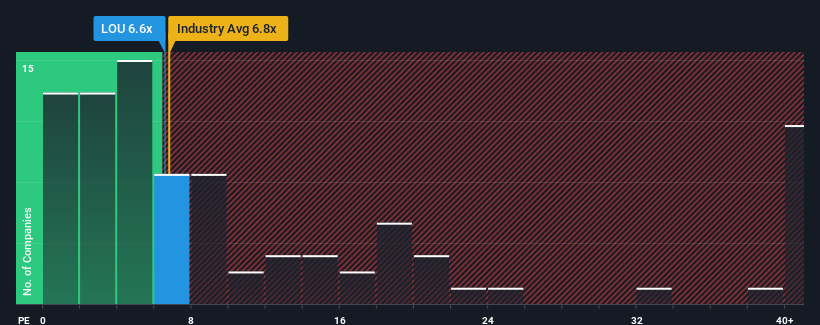

With a price-to-earnings (or "P/E") ratio of 6.6x Lucero Energy Corp. (CVE:LOU) may be sending bullish signals at the moment, given that almost half of all companies in Canada have P/E ratios greater than 13x and even P/E's higher than 27x are not unusual. However, the P/E might be low for a reason and it requires further investigation to determine if it's justified.

With earnings that are retreating more than the market's of late, Lucero Energy has been very sluggish. The P/E is probably low because investors think this poor earnings performance isn't going to improve at all. If you still like the company, you'd want its earnings trajectory to turn around before making any decisions. Or at the very least, you'd be hoping the earnings slide doesn't get any worse if your plan is to pick up some stock while it's out of favour.

Check out our latest analysis for Lucero Energy

Does Growth Match The Low P/E?

In order to justify its P/E ratio, Lucero Energy would need to produce sluggish growth that's trailing the market.

Retrospectively, the last year delivered a frustrating 29% decrease to the company's bottom line. This has erased any of its gains during the last three years, with practically no change in EPS being achieved in total. Therefore, it's fair to say that earnings growth has been inconsistent recently for the company.

Shifting to the future, estimates from the one analyst covering the company suggest earnings growth is heading into negative territory, declining 14% over the next year. With the market predicted to deliver 17% growth , that's a disappointing outcome.

In light of this, it's understandable that Lucero Energy's P/E would sit below the majority of other companies. Nonetheless, there's no guarantee the P/E has reached a floor yet with earnings going in reverse. Even just maintaining these prices could be difficult to achieve as the weak outlook is weighing down the shares.

The Key Takeaway

We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

As we suspected, our examination of Lucero Energy's analyst forecasts revealed that its outlook for shrinking earnings is contributing to its low P/E. Right now shareholders are accepting the low P/E as they concede future earnings probably won't provide any pleasant surprises. It's hard to see the share price rising strongly in the near future under these circumstances.

A lot of potential risks can sit within a company's balance sheet. Take a look at our free balance sheet analysis for Lucero Energy with six simple checks on some of these key factors.

If you're unsure about the strength of Lucero Energy's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSXV:LOU

Lucero Energy

An independent oil company, engages in the acquisition, development, and production of oil-weighted assets in the Bakken and Three Forks formations in the Williston Basin area of North Dakota.

Flawless balance sheet and undervalued.

Market Insights

Community Narratives