- Canada

- /

- Oil and Gas

- /

- TSXV:EOG

TSX Penny Stocks To Watch In November 2024

Reviewed by Simply Wall St

As the Canadian economy experiences a cooling labor market and anticipates further rate cuts by the Bank of Canada, investors are keeping a close eye on potential opportunities in the financial markets. Penny stocks, often seen as smaller or newer companies, continue to hold promise for those looking to uncover hidden value. These stocks can offer a unique blend of affordability and growth potential when backed by robust financials, making them worth watching for discerning investors seeking under-the-radar opportunities.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Financial Health Rating |

| Alvopetro Energy (TSXV:ALV) | CA$4.98 | CA$182.32M | ★★★★★★ |

| PetroTal (TSX:TAL) | CA$0.65 | CA$593.32M | ★★★★★★ |

| Amerigo Resources (TSX:ARG) | CA$1.75 | CA$290.15M | ★★★★★☆ |

| Pulse Seismic (TSX:PSD) | CA$2.31 | CA$117.59M | ★★★★★★ |

| Foraco International (TSX:FAR) | CA$2.25 | CA$222.65M | ★★★★★☆ |

| Findev (TSXV:FDI) | CA$0.40 | CA$11.46M | ★★★★★☆ |

| Winshear Gold (TSXV:WINS) | CA$0.18 | CA$5.66M | ★★★★★★ |

| Mandalay Resources (TSX:MND) | CA$3.42 | CA$321.48M | ★★★★★★ |

| Vox Royalty (TSX:VOXR) | CA$4.06 | CA$205.39M | ★★★★★★ |

| Enterprise Group (TSX:E) | CA$2.16 | CA$132.27M | ★★★★☆☆ |

Click here to see the full list of 962 stocks from our TSX Penny Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

Eco (Atlantic) Oil & Gas (TSXV:EOG)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Eco (Atlantic) Oil & Gas Ltd. focuses on identifying, acquiring, exploring, and developing petroleum, natural gas, and shale gas properties in Namibia and Guyana with a market cap of CA$72.18 million.

Operations: Eco (Atlantic) Oil & Gas Ltd. currently does not report any revenue segments.

Market Cap: CA$72.18M

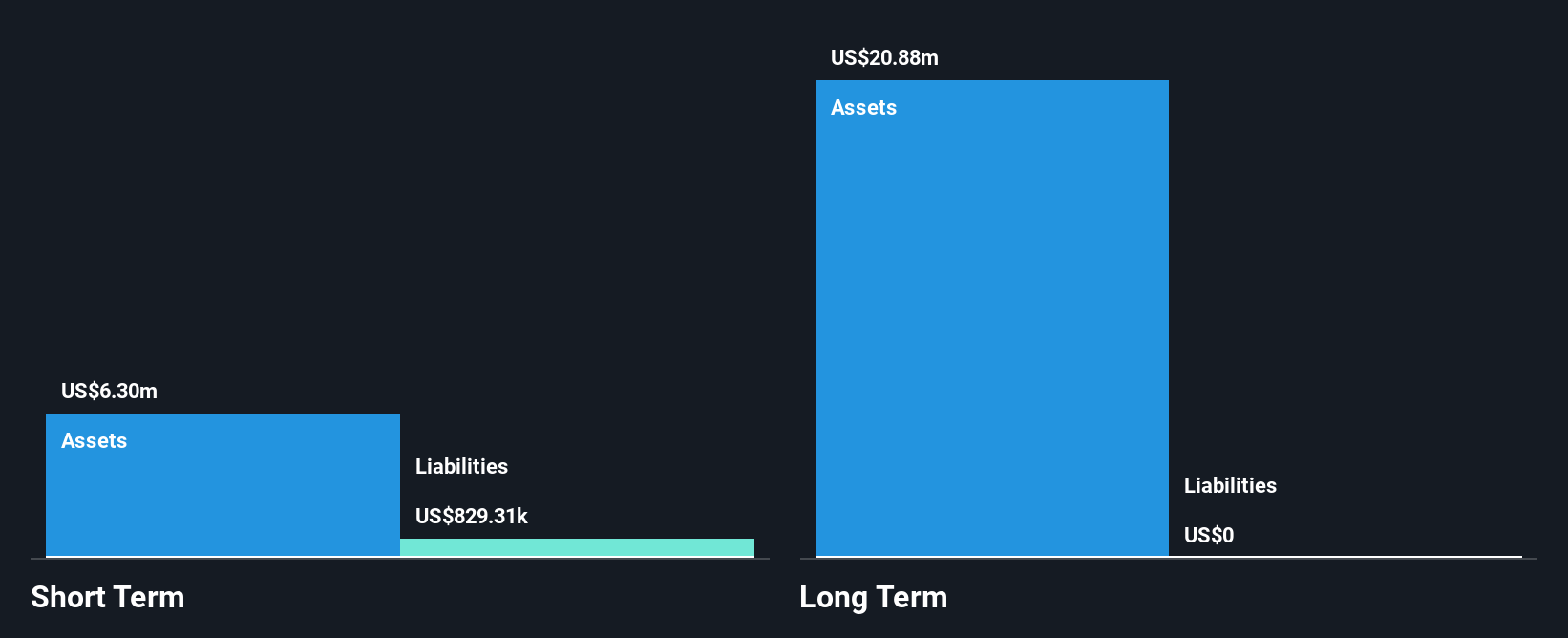

Eco (Atlantic) Oil & Gas Ltd., with a market cap of CA$72.18 million, is pre-revenue and currently unprofitable, reporting minimal revenue of US$0.003 million for Q1 2024. Despite having no long-term liabilities and being debt-free for the past five years, the company faces financial challenges with less than a year of cash runway based on current free cash flow trends. Its seasoned management team has an average tenure of 13 years, but profitability isn't expected in the near term. Shareholders have not experienced significant dilution recently, although losses have increased over the past five years.

- Click here to discover the nuances of Eco (Atlantic) Oil & Gas with our detailed analytical financial health report.

- Assess Eco (Atlantic) Oil & Gas' future earnings estimates with our detailed growth reports.

Mayfair Gold (TSXV:MFG)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Mayfair Gold Corp. is an exploration-stage company focused on acquiring, exploring, evaluating, and developing mineral properties with a market cap of CA$248.93 million.

Operations: Mayfair Gold Corp. has not reported any revenue segments as it is currently in the exploration stage, concentrating on mineral property development.

Market Cap: CA$248.93M

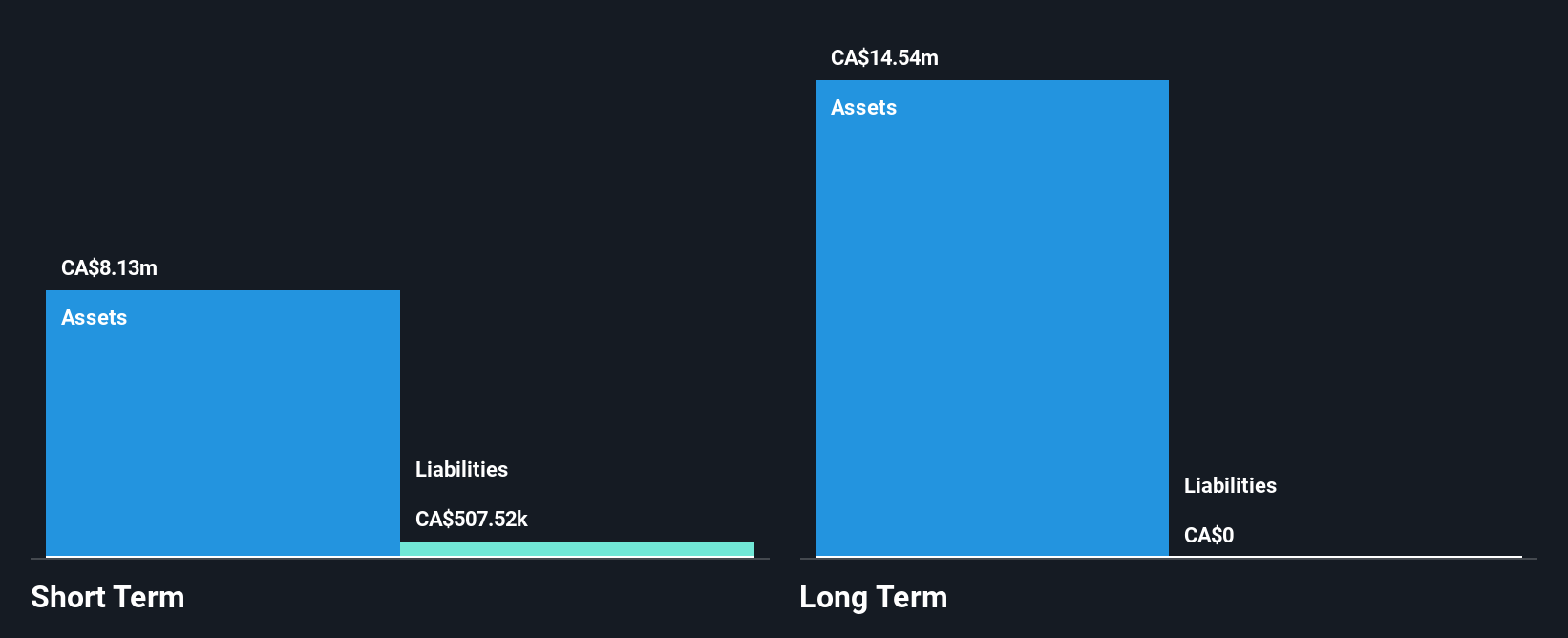

Mayfair Gold Corp., with a market cap of CA$248.93 million, is pre-revenue and focused on mineral property development. The company recently raised CA$6.01 million through private placements, indicating strong insider support, particularly from Muddy Waters Capital LLC. Despite being debt-free and having short-term assets exceeding liabilities, Mayfair faces financial constraints with only a five-month cash runway based on free cash flow estimates before the recent capital raise. The board and management team are relatively new, averaging 0.4 years in tenure each, while shareholders have experienced dilution over the past year as shares outstanding increased by 8.9%.

- Get an in-depth perspective on Mayfair Gold's performance by reading our balance sheet health report here.

- Gain insights into Mayfair Gold's historical outcomes by reviewing our past performance report.

Tornado Global Hydrovacs (TSXV:TGH)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Tornado Global Hydrovacs Ltd. designs, fabricates, manufactures, and sells hydrovac trucks in North America and China, with a market cap of CA$163.69 million.

Operations: The company's revenue is derived from CA$36.29 million in Canada and CA$92.42 million in the United States.

Market Cap: CA$163.69M

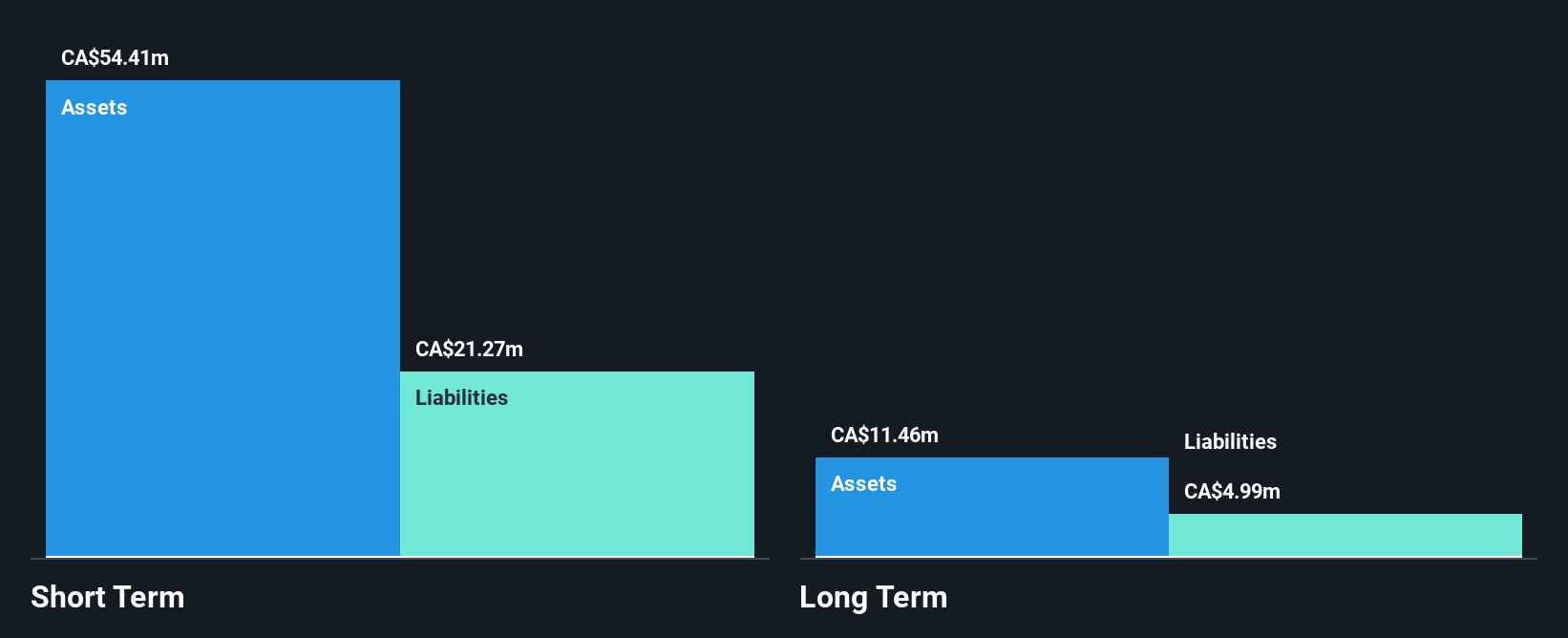

Tornado Global Hydrovacs Ltd., with a market cap of CA$163.69 million, shows strong financial health and growth potential. The company reported significant revenue increases in both Canada (CA$36.29 million) and the U.S. (CA$92.42 million), contributing to a robust earnings growth of 221.3% over the past year, far exceeding industry averages. Its interest payments are well-covered by EBIT, and operating cash flow adequately covers debt levels, indicating sound financial management with a satisfactory net debt to equity ratio of 0.9%. Furthermore, Tornado's seasoned management team supports its strategic direction amid stable weekly volatility and high-quality earnings reports.

- Dive into the specifics of Tornado Global Hydrovacs here with our thorough balance sheet health report.

- Gain insights into Tornado Global Hydrovacs' future direction by reviewing our growth report.

Next Steps

- Dive into all 962 of the TSX Penny Stocks we have identified here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Eco (Atlantic) Oil & Gas might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSXV:EOG

Eco (Atlantic) Oil & Gas

Engages in the identification, acquisition, exploration, and development of the petroleum, natural gas, and shale gas properties in the Republic of Namibia and the Co-Operative Republic of Guyana.

Flawless balance sheet low.

Market Insights

Community Narratives