- Canada

- /

- Oil and Gas

- /

- TSXV:EOG

TSX Penny Stocks To Watch In December 2025

Reviewed by Simply Wall St

As the Canadian market navigates policy shifts and global uncertainties, the TSX is on track for its strongest calendar-year return since 2009, offering investors much to be thankful for. In this context of robust equity gains, identifying promising investment opportunities remains crucial. Penny stocks, though an older term, still represent a viable area for finding smaller or less-established companies with potential. By focusing on those with strong financials and growth potential, investors can uncover valuable opportunities in these under-the-radar stocks.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Rewards & Risks |

| Westbridge Renewable Energy (TSXV:WEB) | CA$2.17 | CA$53.59M | ✅ 3 ⚠️ 3 View Analysis > |

| Canso Select Opportunities (TSXV:CSOC.A) | CA$4.11 | CA$21.03M | ✅ 2 ⚠️ 2 View Analysis > |

| Sailfish Royalty (TSXV:FISH) | CA$3.36 | CA$249.69M | ✅ 1 ⚠️ 4 View Analysis > |

| Zoomd Technologies (TSXV:ZOMD) | CA$1.37 | CA$139.1M | ✅ 4 ⚠️ 2 View Analysis > |

| Montero Mining and Exploration (TSXV:MON) | CA$0.445 | CA$4.01M | ✅ 2 ⚠️ 4 View Analysis > |

| CEMATRIX (TSX:CEMX) | CA$0.35 | CA$54.82M | ✅ 3 ⚠️ 1 View Analysis > |

| Thor Explorations (TSXV:THX) | CA$1.23 | CA$838.27M | ✅ 3 ⚠️ 2 View Analysis > |

| Automotive Finco (TSXV:AFCC.H) | CA$1.14 | CA$22.79M | ✅ 2 ⚠️ 4 View Analysis > |

| Pulse Seismic (TSX:PSD) | CA$3.16 | CA$159.88M | ✅ 2 ⚠️ 1 View Analysis > |

| Hemisphere Energy (TSXV:HME) | CA$2.15 | CA$200.61M | ✅ 3 ⚠️ 2 View Analysis > |

Click here to see the full list of 392 stocks from our TSX Penny Stocks screener.

Let's review some notable picks from our screened stocks.

Aurion Resources (TSXV:AU)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Aurion Resources Ltd. focuses on the acquisition, exploration, and evaluation of mineral properties in Finland with a market cap of CA$178.10 million.

Operations: Aurion Resources Ltd. does not report any specific revenue segments, as its primary activities are centered around acquiring, exploring, and evaluating mineral properties in Finland.

Market Cap: CA$178.1M

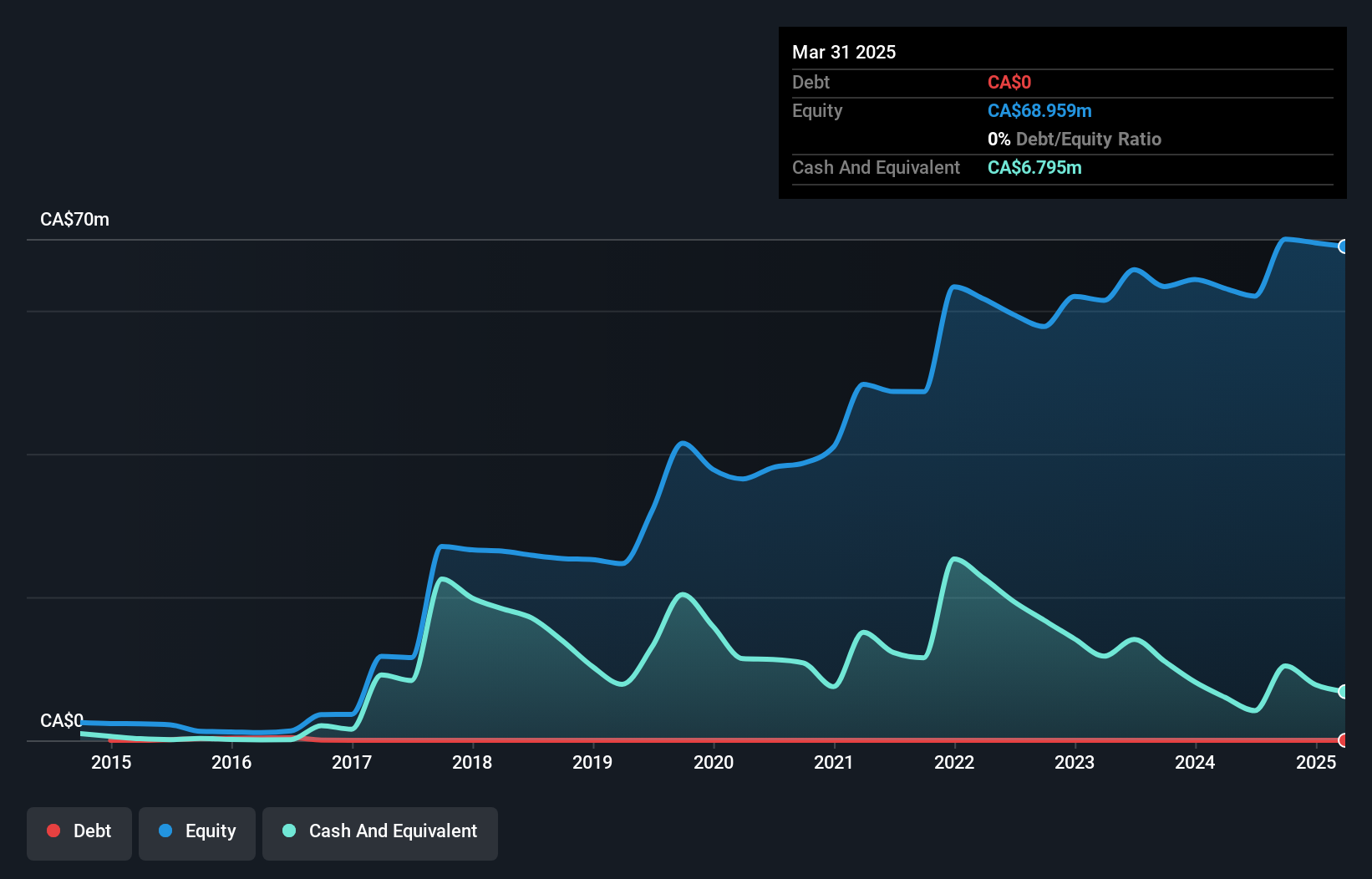

Aurion Resources Ltd., with a market cap of CA$178.10 million, is pre-revenue and focuses on mineral exploration in Finland. The company has stable weekly volatility and a seasoned management team with an average tenure of 6.2 years. Its short-term assets exceed both its short-term and long-term liabilities, providing financial stability without debt concerns. Recent drilling results at the Kaaresselka area indicate promising gold mineralization continuity, while ongoing partnerships like the joint venture with KoBold Metals aim to explore further potential in critical minerals beyond gold or silver discoveries, enhancing its exploration scope within the Central Lapland Greenstone Belt.

- Navigate through the intricacies of Aurion Resources with our comprehensive balance sheet health report here.

- Review our growth performance report to gain insights into Aurion Resources' future.

Empress Royalty (TSXV:EMPR)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Empress Royalty Corp. focuses on creating and investing in a portfolio of precious metal royalty and streaming interests in Canada, with a market cap of CA$144.63 million.

Operations: The company generates revenue through the acquisition of mining royalty and streaming interests, amounting to $13.34 million.

Market Cap: CA$144.63M

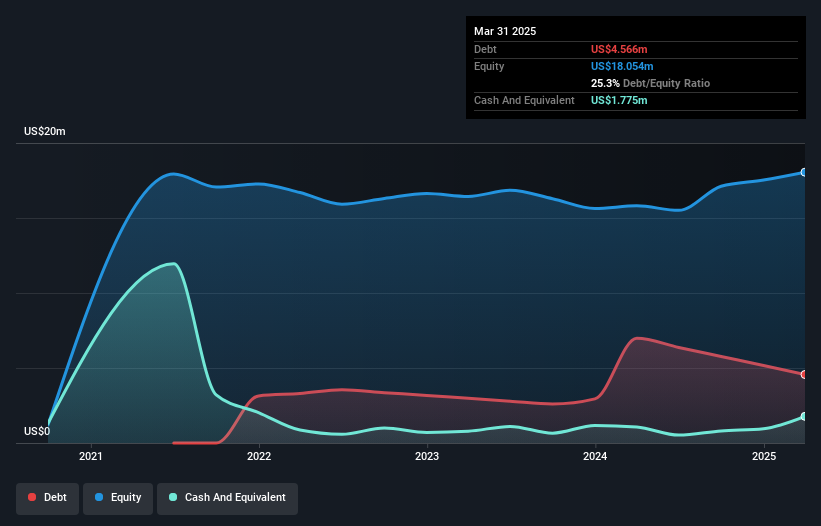

Empress Royalty Corp., with a market cap of CA$144.63 million, has transitioned to profitability, reporting net income of US$2.96 million for the first nine months of 2025. The company benefits from strong financial health, as its cash reserves exceed total debt and short-term assets surpass liabilities. Recent board additions enhance governance expertise, potentially driving strategic growth. Trading significantly below estimated fair value suggests potential investment appeal in the penny stock category. Revenue is forecasted to grow over 50% annually, though its return on equity remains relatively low at 14.8%. Empress's stable weekly volatility indicates consistent performance amidst market fluctuations.

- Jump into the full analysis health report here for a deeper understanding of Empress Royalty.

- Evaluate Empress Royalty's prospects by accessing our earnings growth report.

Eco (Atlantic) Oil & Gas (TSXV:EOG)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Eco (Atlantic) Oil & Gas Ltd. focuses on identifying, acquiring, and exploring oil and gas assets in Guyana, Namibia, and South Africa with a market cap of CA$45.71 million.

Operations: Currently, there are no reported revenue segments for Eco (Atlantic) Oil & Gas Ltd.

Market Cap: CA$45.71M

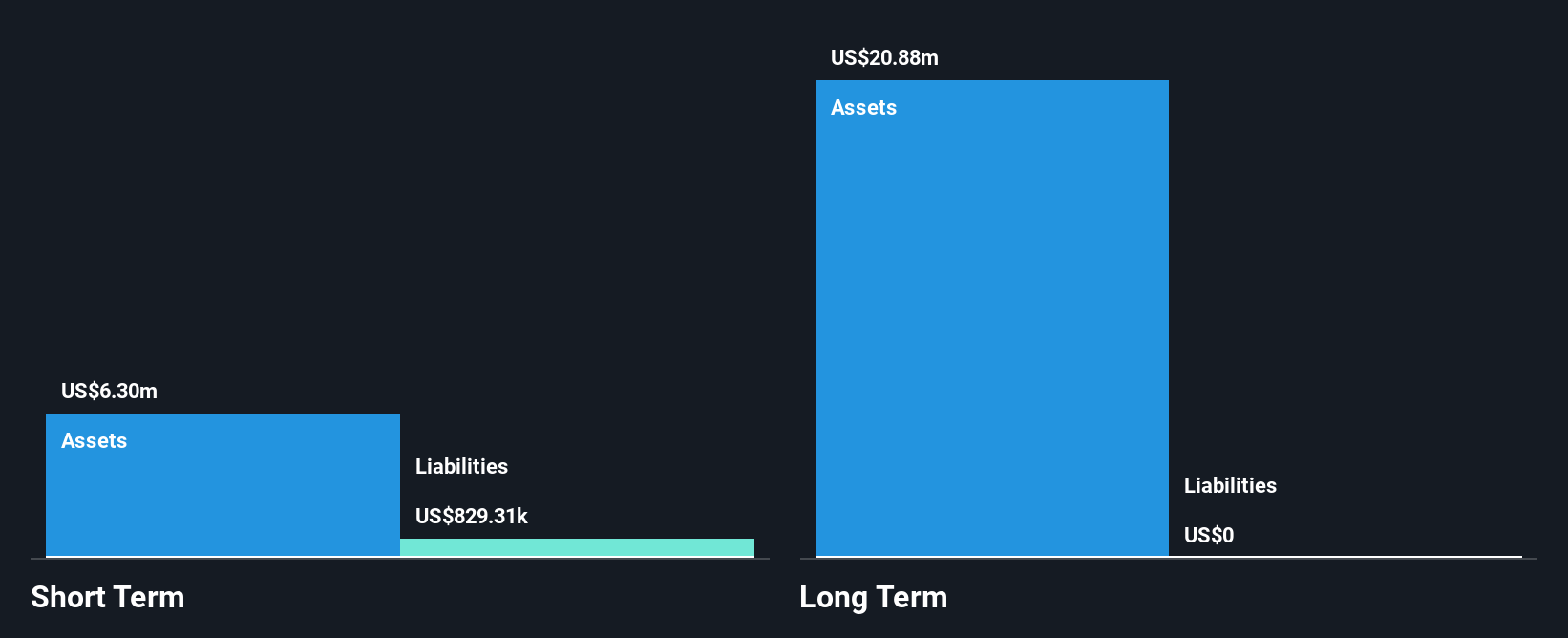

Eco (Atlantic) Oil & Gas Ltd., with a market cap of CA$45.71 million, is currently pre-revenue and faces financial challenges, including less than a year of cash runway and increasing net losses. Despite being debt-free and having no long-term liabilities, the company remains unprofitable with earnings forecasted to decline by 9% annually over the next three years. Recent strategic moves in Namibia, such as farming out its interest in PEL 98 to Lamda Energy, aim to optimize exploration focus while fostering local partnerships. The sudden passing of COO Colin Kinley has led to leadership adjustments within the company's operational teams.

- Click to explore a detailed breakdown of our findings in Eco (Atlantic) Oil & Gas' financial health report.

- Examine Eco (Atlantic) Oil & Gas' earnings growth report to understand how analysts expect it to perform.

Next Steps

- Click this link to deep-dive into the 392 companies within our TSX Penny Stocks screener.

- Want To Explore Some Alternatives? Trump's oil boom is here — pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Eco (Atlantic) Oil & Gas might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSXV:EOG

Eco (Atlantic) Oil & Gas

Engages in the identifying, acquiring, and exploring oil and gas assets in the Co-Operative Republic of Guyana, Republic of Namibia, and South Africa.

Moderate risk with adequate balance sheet.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026