Howard Marks put it nicely when he said that, rather than worrying about share price volatility, 'The possibility of permanent loss is the risk I worry about... and every practical investor I know worries about.' It's only natural to consider a company's balance sheet when you examine how risky it is, since debt is often involved when a business collapses. We note that Canadian Premium Sand Inc. (CVE:CPS) does have debt on its balance sheet. But should shareholders be worried about its use of debt?

What Risk Does Debt Bring?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. Part and parcel of capitalism is the process of 'creative destruction' where failed businesses are mercilessly liquidated by their bankers. While that is not too common, we often do see indebted companies permanently diluting shareholders because lenders force them to raise capital at a distressed price. Having said that, the most common situation is where a company manages its debt reasonably well - and to its own advantage. The first thing to do when considering how much debt a business uses is to look at its cash and debt together.

Check out our latest analysis for Canadian Premium Sand

How Much Debt Does Canadian Premium Sand Carry?

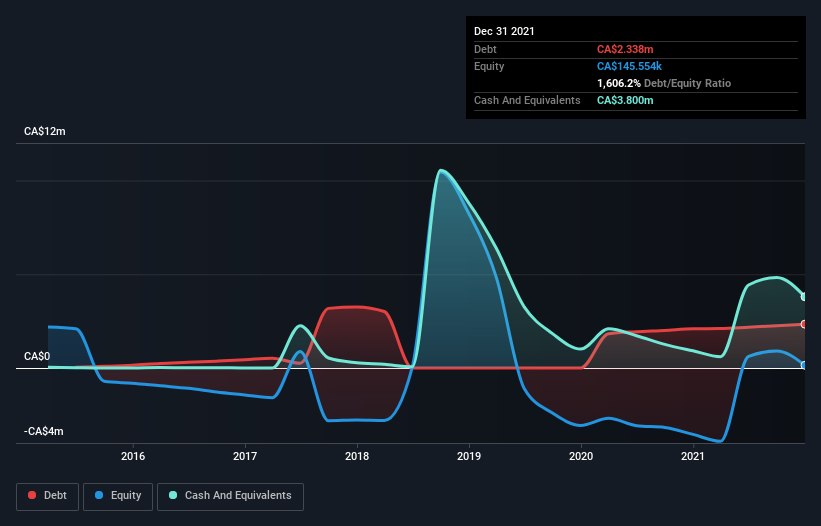

You can click the graphic below for the historical numbers, but it shows that as of December 2021 Canadian Premium Sand had CA$2.34m of debt, an increase on CA$2.09m, over one year. However, it does have CA$3.80m in cash offsetting this, leading to net cash of CA$1.46m.

How Healthy Is Canadian Premium Sand's Balance Sheet?

According to the last reported balance sheet, Canadian Premium Sand had liabilities of CA$1.28m due within 12 months, and liabilities of CA$2.42m due beyond 12 months. Offsetting these obligations, it had cash of CA$3.80m as well as receivables valued at CA$13.9k due within 12 months. So it can boast CA$112.6k more liquid assets than total liabilities.

Having regard to Canadian Premium Sand's size, it seems that its liquid assets are well balanced with its total liabilities. So it's very unlikely that the CA$21.9m company is short on cash, but still worth keeping an eye on the balance sheet. Simply put, the fact that Canadian Premium Sand has more cash than debt is arguably a good indication that it can manage its debt safely. There's no doubt that we learn most about debt from the balance sheet. But you can't view debt in total isolation; since Canadian Premium Sand will need earnings to service that debt. So when considering debt, it's definitely worth looking at the earnings trend. Click here for an interactive snapshot.

Given its lack of meaningful operating revenue, Canadian Premium Sand shareholders no doubt hope it can fund itself until it can sell some combustibles.

So How Risky Is Canadian Premium Sand?

We have no doubt that loss making companies are, in general, riskier than profitable ones. And we do note that Canadian Premium Sand had an earnings before interest and tax (EBIT) loss, over the last year. And over the same period it saw negative free cash outflow of CA$3.4m and booked a CA$2.9m accounting loss. With only CA$1.46m on the balance sheet, it would appear that its going to need to raise capital again soon. Overall, its balance sheet doesn't seem overly risky, at the moment, but we're always cautious until we see the positive free cash flow. When analysing debt levels, the balance sheet is the obvious place to start. However, not all investment risk resides within the balance sheet - far from it. For example Canadian Premium Sand has 6 warning signs (and 4 which are significant) we think you should know about.

At the end of the day, it's often better to focus on companies that are free from net debt. You can access our special list of such companies (all with a track record of profit growth). It's free.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSXV:CPS

Canadian Premium Sand

Explores for and develops silica sand deposits in Canada.

Slight with imperfect balance sheet.

Market Insights

Community Narratives