When Canadian Premium Sand Inc. (CVE:CPS) reported its results to September 2022 its auditors, PricewaterhouseCoopers LLP could not be sure that it would be able to continue as a going concern in the next year. It is therefore fair to assume that, based on those financials, the company should strengthen its balance sheet in the short term, perhaps by issuing shares. Even more worrying, the auditor has noted that their opinion of the accounts is qualified, which means that the company will probably have trouble with its lenders, as well as potential investors.

Since the company probably needs cash fairly quickly, it may be in a position where it has to accept whatever terms it can get. So current risks on the balance sheet could have a big impact on how shareholders fare from here. Debt is always a risk factor in these cases, as creditors could be in a position to wind up the company, in the worst case scenario.

See our latest analysis for Canadian Premium Sand

How Much Debt Does Canadian Premium Sand Carry?

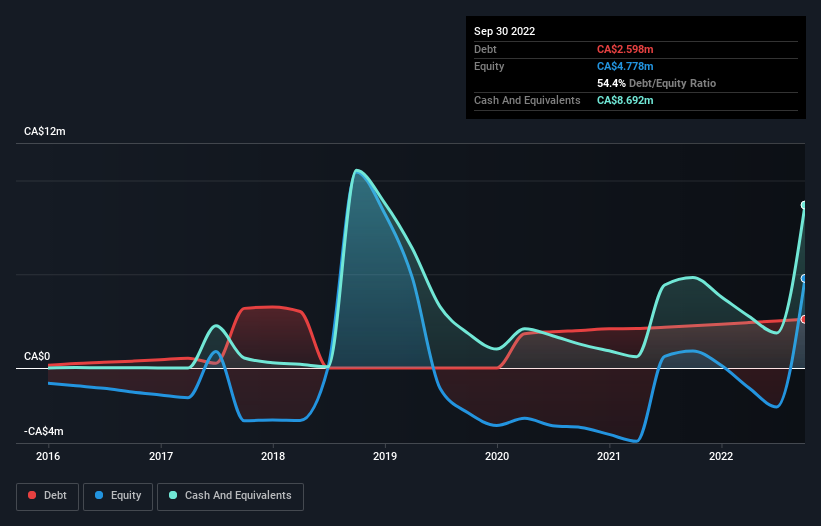

The image below, which you can click on for greater detail, shows that at September 2022 Canadian Premium Sand had debt of CA$2.60m, up from CA$2.26m in one year. However, it does have CA$8.69m in cash offsetting this, leading to net cash of CA$6.09m.

A Look At Canadian Premium Sand's Liabilities

Zooming in on the latest balance sheet data, we can see that Canadian Premium Sand had liabilities of CA$1.46m due within 12 months and liabilities of CA$2.68m due beyond that. Offsetting this, it had CA$8.69m in cash and CA$31.7k in receivables that were due within 12 months. So it actually has CA$4.58m more liquid assets than total liabilities.

This short term liquidity is a sign that Canadian Premium Sand could probably pay off its debt with ease, as its balance sheet is far from stretched. Succinctly put, Canadian Premium Sand boasts net cash, so it's fair to say it does not have a heavy debt load! There's no doubt that we learn most about debt from the balance sheet. But it is Canadian Premium Sand's earnings that will influence how the balance sheet holds up in the future. So when considering debt, it's definitely worth looking at the earnings trend. Click here for an interactive snapshot.

Given its lack of meaningful operating revenue, Canadian Premium Sand shareholders no doubt hope it can fund itself until it can sell some combustibles.

So How Risky Is Canadian Premium Sand?

By their very nature companies that are losing money are more risky than those with a long history of profitability. And the fact is that over the last twelve months Canadian Premium Sand lost money at the earnings before interest and tax (EBIT) line. Indeed, in that time it burnt through CA$5.0m of cash and made a loss of CA$5.4m. With only CA$6.09m on the balance sheet, it would appear that its going to need to raise capital again soon. Even though its balance sheet seems sufficiently liquid, debt always makes us a little nervous if a company doesn't produce free cash flow regularly. At the end of the day, recalling that the auditor has qualified their opinion of the accounts, we would strongly avoid owning this stock. When analysing debt levels, the balance sheet is the obvious place to start. But ultimately, every company can contain risks that exist outside of the balance sheet. For example Canadian Premium Sand has 3 warning signs (and 2 which are a bit unpleasant) we think you should know about.

If, after all that, you're more interested in a fast growing company with a rock-solid balance sheet, then check out our list of net cash growth stocks without delay.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSXV:CPS

Canadian Premium Sand

Explores for and develops silica sand deposits in Canada.

Slight with imperfect balance sheet.

Market Insights

Community Narratives