The harsh reality for Canadian Premium Sand Inc. (CVE:CPS) shareholders is that its auditors, PricewaterhouseCoopers LLP, expressed doubts about its ability to continue as a going concern, in its reported results to September 2021. It is therefore fair to assume that, based on those financials, the company should strengthen its balance sheet in the short term, perhaps by issuing shares.

Since the company probably needs cash fairly quickly, it may be in a position where it has to accept whatever terms it can get. So shareholders should absolutely be taking a close look at how risky the balance sheet is. The big consideration is whether it can repay its debt, since in the worst case scenario, creditors could force the company to bankruptcy.

See our latest analysis for Canadian Premium Sand

How Much Debt Does Canadian Premium Sand Carry?

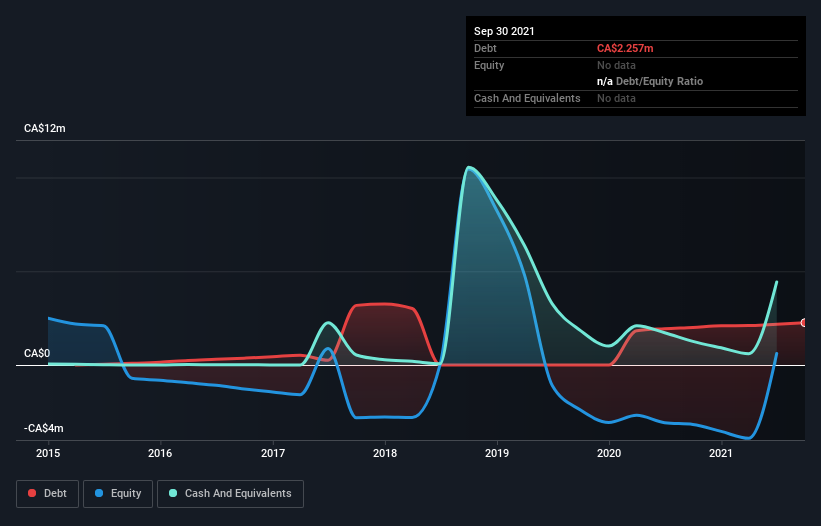

The image below, which you can click on for greater detail, shows that at September 2021 Canadian Premium Sand had debt of CA$2.26m, up from CA$2.00m in one year. However, its balance sheet shows it holds CA$4.83m in cash, so it actually has CA$2.57m net cash.

A Look At Canadian Premium Sand's Liabilities

The latest balance sheet data shows that Canadian Premium Sand had liabilities of CA$1.62m due within a year, and liabilities of CA$2.34m falling due after that. Offsetting this, it had CA$4.83m in cash and CA$8.3k in receivables that were due within 12 months. So it can boast CA$880.9k more liquid assets than total liabilities.

This surplus suggests that Canadian Premium Sand has a conservative balance sheet, and could probably eliminate its debt without much difficulty. Simply put, the fact that Canadian Premium Sand has more cash than debt is arguably a good indication that it can manage its debt safely. The balance sheet is clearly the area to focus on when you are analysing debt. But you can't view debt in total isolation; since Canadian Premium Sand will need earnings to service that debt. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

Given its lack of meaningful operating revenue, Canadian Premium Sand shareholders no doubt hope it can fund itself until it can sell some combustibles.

So How Risky Is Canadian Premium Sand?

By their very nature companies that are losing money are more risky than those with a long history of profitability. And we do note that Canadian Premium Sand had an earnings before interest and tax (EBIT) loss, over the last year. Indeed, in that time it burnt through CA$2.7m of cash and made a loss of CA$2.5m. With only CA$2.57m on the balance sheet, it would appear that its going to need to raise capital again soon. Even though its balance sheet seems sufficiently liquid, debt always makes us a little nervous if a company doesn't produce free cash flow regularly. We prefer to avoid a company after its auditor has expressed any uncertainty about its ability to continue as a going concern. That's because we find it more comfortable to invest in companies that always keep the balance sheet reasonably strong. There's no doubt that we learn most about debt from the balance sheet. But ultimately, every company can contain risks that exist outside of the balance sheet. Be aware that Canadian Premium Sand is showing 5 warning signs in our investment analysis , and 3 of those are significant...

Of course, if you're the type of investor who prefers buying stocks without the burden of debt, then don't hesitate to discover our exclusive list of net cash growth stocks, today.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSXV:CPS

Canadian Premium Sand

Explores for and develops silica sand deposits in Canada.

Slight with imperfect balance sheet.

Market Insights

Community Narratives