3 TSX Penny Stocks With Market Caps Under CA$500M To Consider

Reviewed by Simply Wall St

The early days of 2025 have seen significant market activity, with bond yields rising unexpectedly and impacting stock valuations. Amidst these shifts, investors might find opportunities in penny stocks—smaller or newer companies that can offer unexpected potential despite their somewhat outdated label. By focusing on those with strong financial health, investors may uncover hidden value and growth prospects within the Canadian market.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Financial Health Rating |

| Silvercorp Metals (TSX:SVM) | CA$4.45 | CA$985.56M | ★★★★★★ |

| Mandalay Resources (TSX:MND) | CA$4.18 | CA$388.78M | ★★★★★★ |

| Findev (TSXV:FDI) | CA$0.465 | CA$14.32M | ★★★★★★ |

| Pulse Seismic (TSX:PSD) | CA$2.41 | CA$123.54M | ★★★★★★ |

| PetroTal (TSX:TAL) | CA$0.70 | CA$669.36M | ★★★★★★ |

| Foraco International (TSX:FAR) | CA$2.35 | CA$229.35M | ★★★★★☆ |

| NamSys (TSXV:CTZ) | CA$1.11 | CA$29.82M | ★★★★★★ |

| East West Petroleum (TSXV:EW) | CA$0.04 | CA$3.17M | ★★★★★★ |

| Hemisphere Energy (TSXV:HME) | CA$1.83 | CA$179.61M | ★★★★★☆ |

| Tornado Infrastructure Equipment (TSXV:TGH) | CA$1.03 | CA$137.56M | ★★★★★☆ |

Click here to see the full list of 935 stocks from our TSX Penny Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

NanoXplore (TSX:GRA)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: NanoXplore Inc. is a graphene company that manufactures and supplies graphene powder for industrial markets in Australia, with a market cap of CA$426.52 million.

Operations: The company generates its revenue primarily from Advanced Materials, Plastics and Composite Products, amounting to CA$134.69 million, with a smaller contribution from Battery Cells at CA$0.04 million.

Market Cap: CA$426.52M

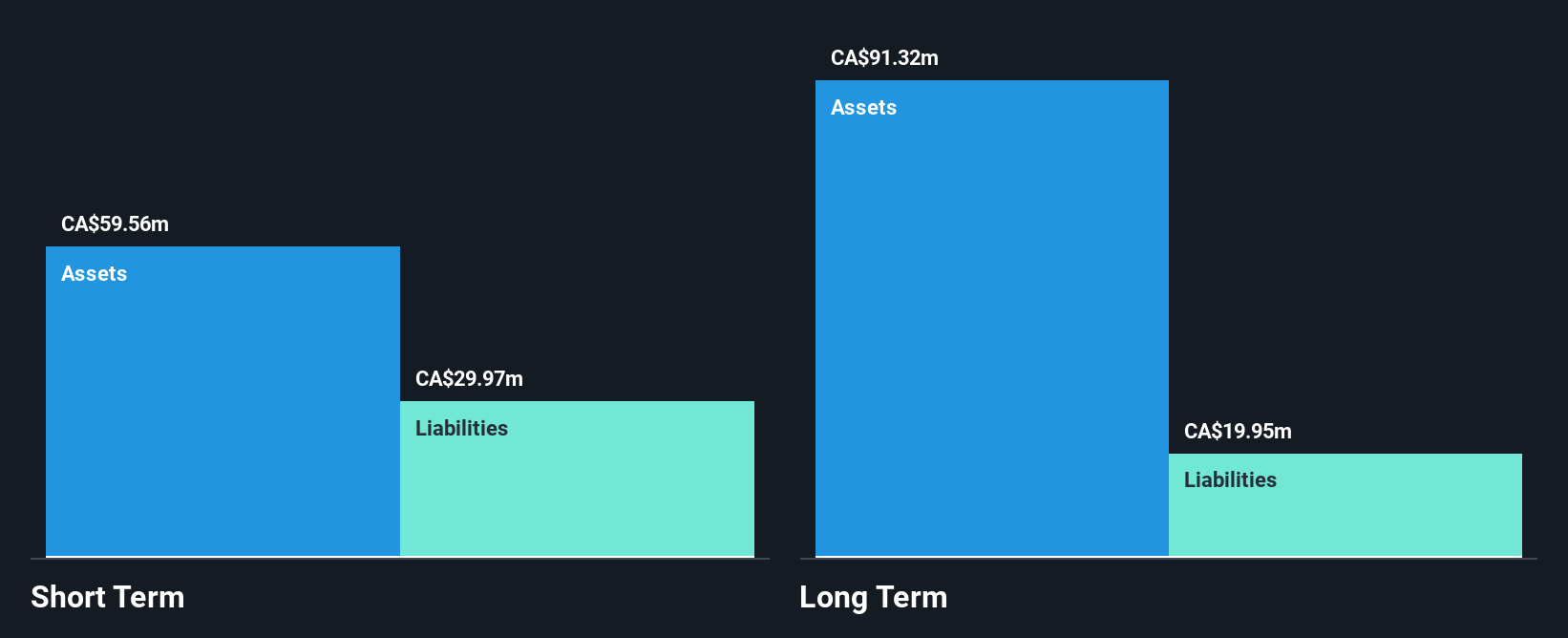

NanoXplore Inc., with a market cap of CA$426.52 million, has shown revenue growth in its recent earnings report, reaching CA$33.67 million for the first quarter ended September 30, 2024. Despite being unprofitable, it has reduced its debt to equity ratio significantly over five years and maintains more cash than total debt. The company’s management and board are experienced, with average tenures of 2.7 and 6.8 years respectively. NanoXplore’s short-term assets exceed both short-term and long-term liabilities, providing a solid financial footing amid forecasts for substantial earnings growth annually.

- Dive into the specifics of NanoXplore here with our thorough balance sheet health report.

- Understand NanoXplore's earnings outlook by examining our growth report.

Coelacanth Energy (TSXV:CEI)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Coelacanth Energy Inc. is an oil and natural gas company focused on acquiring, developing, exploring, and producing oil and natural gas reserves in northeastern British Columbia, Canada, with a market cap of CA$424.21 million.

Operations: The company generates revenue of CA$10.65 million from its oil and gas exploration and production activities.

Market Cap: CA$424.21M

Coelacanth Energy Inc., with a market cap of CA$424.21 million, remains unprofitable but has demonstrated significant revenue growth, reporting CA$7.31 million for the nine months ended September 30, 2024. The company is debt-free and its short-term assets significantly exceed both short-term and long-term liabilities, indicating a stable financial position despite having less than a year of cash runway based on current free cash flow trends. Recent operational progress includes successful testing of new wells at the Two Rivers East Project, which exceeded expectations in oil production rates, enhancing future potential output capabilities.

- Click here to discover the nuances of Coelacanth Energy with our detailed analytical financial health report.

- Gain insights into Coelacanth Energy's past trends and performance with our report on the company's historical track record.

Thor Explorations (TSXV:THX)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Thor Explorations Ltd., along with its subsidiaries, operates as a gold producer and explorer, with a market capitalization of CA$226.69 million.

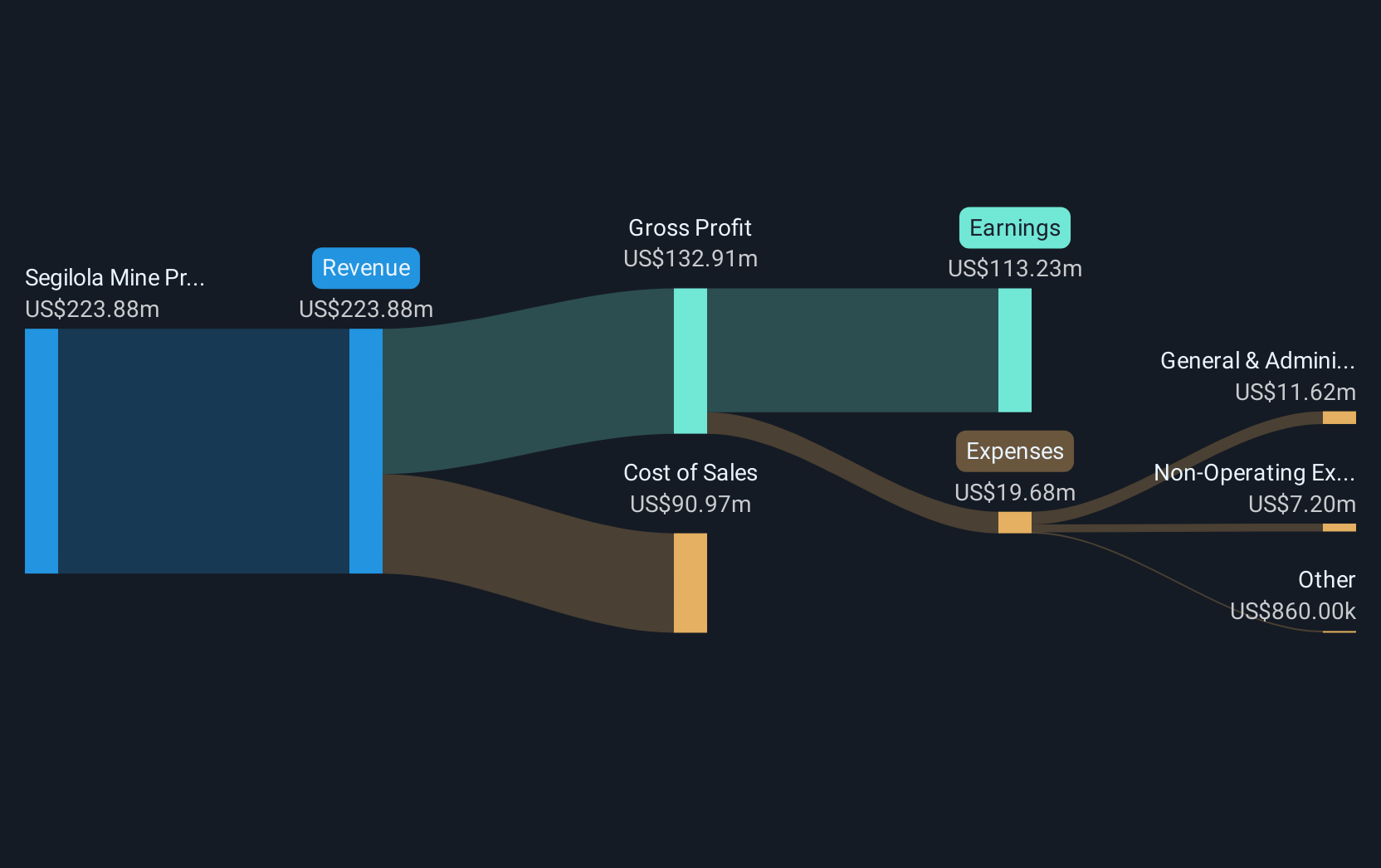

Operations: The company's revenue is primarily generated from the Segilola Mine Project, which contributed $150.41 million.

Market Cap: CA$226.69M

Thor Explorations Ltd., with a market cap of CA$226.69 million, has shown robust financial performance, primarily driven by its Segilola Mine Project, generating US$150.41 million in revenue. The company has reported strong earnings growth over the past five years and maintains high-quality earnings with a net profit margin of 33.2%. Despite short-term liabilities exceeding short-term assets, Thor's debt is well-covered by operating cash flow. Recent drilling results at Segilola have been promising, indicating potential resource expansion and supporting continued exploration efforts to extend the mine's life and production capacity further.

- Get an in-depth perspective on Thor Explorations' performance by reading our balance sheet health report here.

- Gain insights into Thor Explorations' outlook and expected performance with our report on the company's earnings estimates.

Next Steps

- Investigate our full lineup of 935 TSX Penny Stocks right here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade NanoXplore, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if NanoXplore might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:GRA

NanoXplore

A graphene company, manufactures and supplies graphene powder for use in industrial markets in Australia.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives