- Canada

- /

- Oil and Gas

- /

- TSXV:AXL

TSX Penny Stocks To Watch In December 2024

Reviewed by Simply Wall St

As the Canadian market navigates through a complex landscape of economic trends and strategic portfolio developments, investors are increasingly seeking opportunities that align with their long-term financial goals. Penny stocks, though often seen as an outdated term, continue to hold relevance for those interested in smaller or newer companies offering a blend of affordability and potential growth. In this context, we will explore several penny stocks that exhibit financial strength and could offer intriguing prospects for investors.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Financial Health Rating |

| Alvopetro Energy (TSXV:ALV) | CA$4.96 | CA$184.25M | ★★★★★★ |

| Pulse Seismic (TSX:PSD) | CA$2.26 | CA$113.98M | ★★★★★★ |

| PetroTal (TSX:TAL) | CA$0.55 | CA$538.09M | ★★★★★★ |

| Findev (TSXV:FDI) | CA$0.54 | CA$15.47M | ★★★★★★ |

| Silvercorp Metals (TSX:SVM) | CA$4.37 | CA$939.87M | ★★★★★★ |

| Foraco International (TSX:FAR) | CA$2.25 | CA$221.48M | ★★★★★☆ |

| NamSys (TSXV:CTZ) | CA$1.20 | CA$32.24M | ★★★★★★ |

| East West Petroleum (TSXV:EW) | CA$0.04 | CA$3.17M | ★★★★★★ |

| Hemisphere Energy (TSXV:HME) | CA$1.87 | CA$182.38M | ★★★★★☆ |

| Enterprise Group (TSX:E) | CA$1.85 | CA$118.19M | ★★★★☆☆ |

Click here to see the full list of 942 stocks from our TSX Penny Stocks screener.

We're going to check out a few of the best picks from our screener tool.

Sol Strategies (CNSX:HODL)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Sol Strategies Inc. is a company that invests in cryptocurrencies and blockchain technologies, with a market cap of CA$391.91 million.

Operations: The company generates revenue from its investment activities in cryptocurrencies and blockchain technology, amounting to -CA$0.73 million.

Market Cap: CA$391.91M

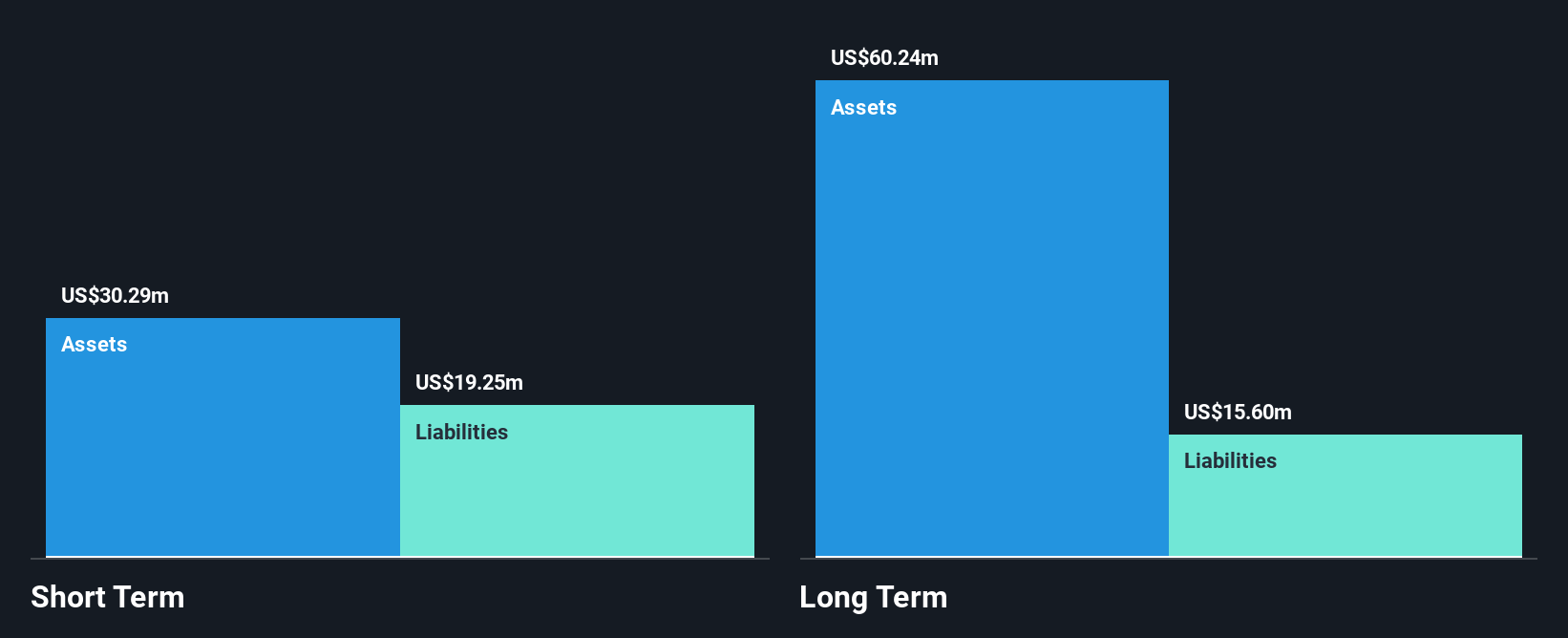

Sol Strategies Inc., with a market cap of CA$391.91 million, is pre-revenue, generating less than US$1 million from its cryptocurrency and blockchain investments. The company is debt-free, which alleviates concerns about interest payments or long-term liabilities. However, it remains unprofitable with declining earnings over the past five years and a negative return on equity of -5.55%. Despite this, there has been no significant shareholder dilution recently. The stock's volatility has increased significantly over the past year, compounded by substantial insider selling in recent months. Notably, Antanas Guoga acquired nearly 4 million shares in November 2024 through private placements.

- Click here and access our complete financial health analysis report to understand the dynamics of Sol Strategies.

- Explore historical data to track Sol Strategies' performance over time in our past results report.

Trilogy Metals (TSX:TMQ)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Trilogy Metals Inc. is a base metals exploration company focused on the exploration and development of mineral properties in the United States, with a market cap of CA$260.73 million.

Operations: Trilogy Metals Inc. currently does not report any revenue segments.

Market Cap: CA$260.73M

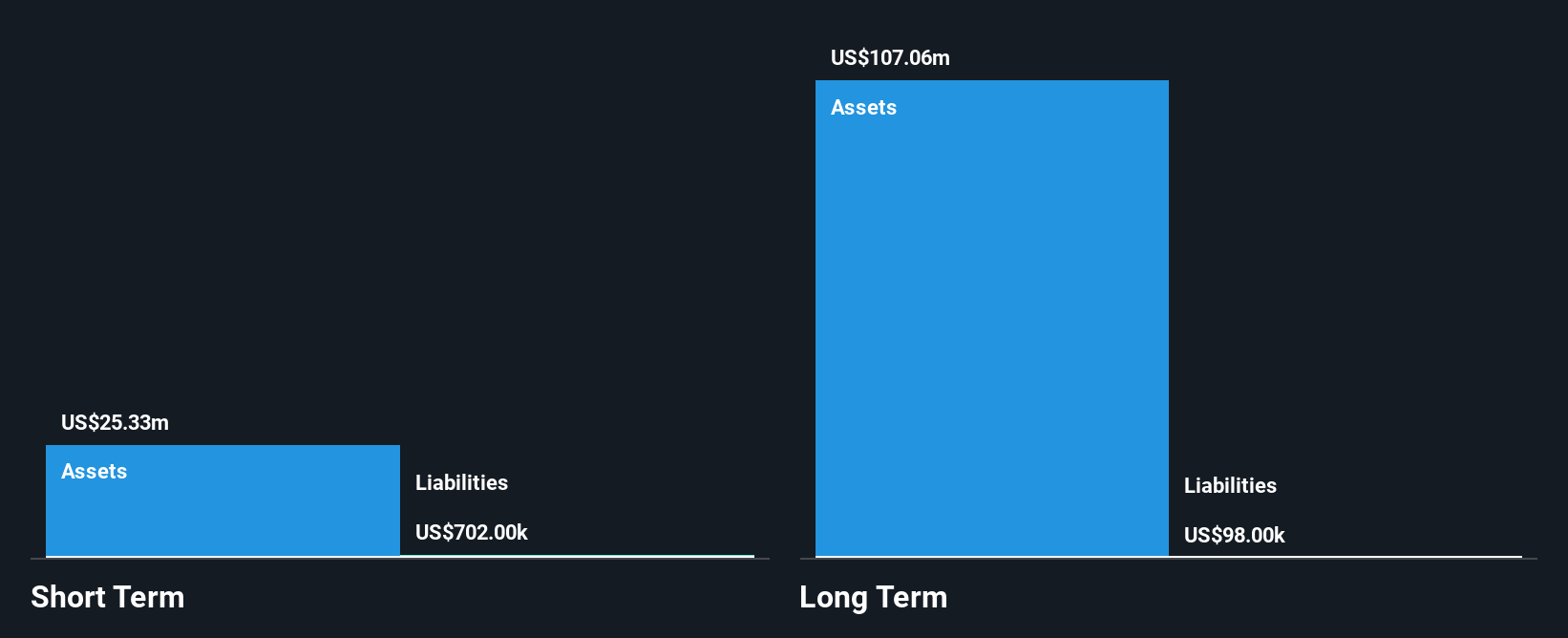

Trilogy Metals Inc., with a market cap of CA$260.73 million, is pre-revenue, generating less than US$1 million. The company remains unprofitable but benefits from being debt-free and having sufficient cash runway for over three years based on current free cash flow. Recent filings include a shelf registration for $6.98 million in common shares related to an Employee Stock Ownership Plan (ESOP). Despite increased shareholder dilution by 3.2% this year, the experienced management and board teams provide stability amidst high share price volatility and improved net loss figures compared to the previous year’s results.

- Unlock comprehensive insights into our analysis of Trilogy Metals stock in this financial health report.

- Gain insights into Trilogy Metals' historical outcomes by reviewing our past performance report.

Arrow Exploration (TSXV:AXL)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Arrow Exploration Corp. is a junior oil and gas company focused on acquiring, exploring, developing, and producing oil and gas properties in Colombia and Western Canada, with a market cap of CA$114.35 million.

Operations: The company generates revenue of $64.26 million from its oil and gas exploration and production activities.

Market Cap: CA$114.35M

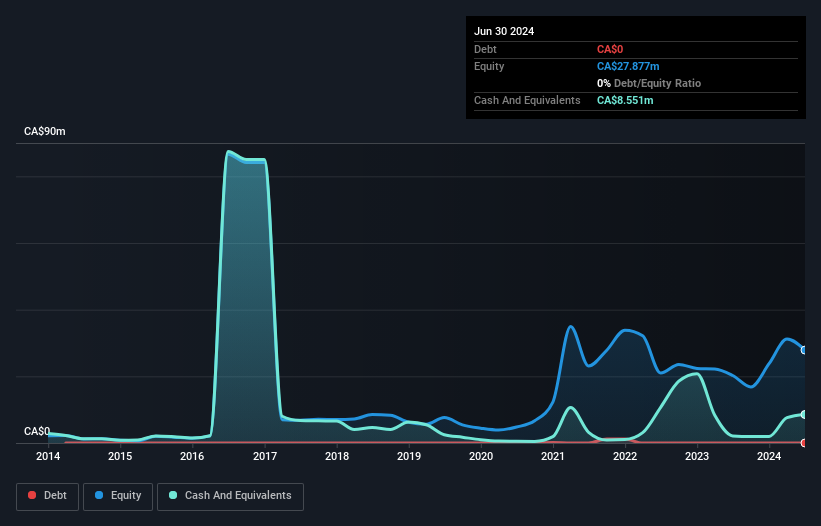

Arrow Exploration Corp., with a market cap of CA$114.35 million, has shown significant operational progress in its oil and gas activities, notably increasing production rates and maintaining a debt-free balance sheet. Recent updates highlight improved production from wells like CNB HZ-6, which contributes to the company's current net corporate production exceeding 5,305 BOE/D. Despite low return on equity at 1.1% and declining profit margins to 0.9%, Arrow has reported revenue growth with USD 50.85 million for the first nine months of 2024 compared to USD 31.26 million last year, indicating robust operational performance amidst industry challenges.

- Take a closer look at Arrow Exploration's potential here in our financial health report.

- Review our growth performance report to gain insights into Arrow Exploration's future.

Taking Advantage

- Navigate through the entire inventory of 942 TSX Penny Stocks here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSXV:AXL

Arrow Exploration

A junior oil and gas company, engages in the acquisition, exploration, development, and production of oil and gas properties in Colombia and Western Canada.

Flawless balance sheet and slightly overvalued.

Market Insights

Community Narratives