- Canada

- /

- Energy Services

- /

- TSX:WRG

Take Care Before Diving Into The Deep End On Western Energy Services Corp. (TSE:WRG)

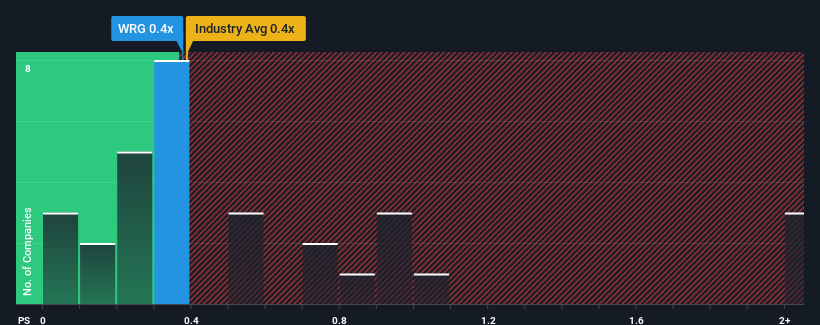

With a median price-to-sales (or "P/S") ratio of close to 0.4x in the Energy Services industry in Canada, you could be forgiven for feeling indifferent about Western Energy Services Corp.'s (TSE:WRG) P/S ratio, which comes in at about the same. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

See our latest analysis for Western Energy Services

How Has Western Energy Services Performed Recently?

There hasn't been much to differentiate Western Energy Services' and the industry's revenue growth lately. It seems that many are expecting the mediocre revenue performance to persist, which has held the P/S ratio back. If you like the company, you'd be hoping this can at least be maintained so that you could pick up some stock while it's not quite in favour.

Want the full picture on analyst estimates for the company? Then our free report on Western Energy Services will help you uncover what's on the horizon.How Is Western Energy Services' Revenue Growth Trending?

Western Energy Services' P/S ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the industry.

Taking a look back first, we see that the company grew revenue by an impressive 32% last year. The latest three year period has also seen an excellent 95% overall rise in revenue, aided by its short-term performance. So we can start by confirming that the company has done a great job of growing revenue over that time.

Looking ahead now, revenue is anticipated to remain somewhat buoyant, growing by 3.8% during the coming year according to the dual analysts following the company. Meanwhile, the broader industry is forecast to contract by 14%, which would indicate the company is doing better than the majority of its peers.

Despite the marginal growth, we find it odd that Western Energy Services is trading at a fairly similar P/S to the industry. It looks like most investors aren't convinced the company can achieve positive future growth in the face of a shrinking broader industry.

The Final Word

Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

We've established that Western Energy Services currently trades on a lower than expected P/S since its growth forecasts are potentially beating a struggling industry. We assume that investors are attributing some risk to the company's future revenues, keeping it from trading at a higher P/S. Perhaps there is some hesitation about the company's ability to keep swimming against the current of the broader industry turmoil. However, if you agree with the analysts' forecasts, you may be able to pick up the stock at an attractive price.

You should always think about risks. Case in point, we've spotted 1 warning sign for Western Energy Services you should be aware of.

If these risks are making you reconsider your opinion on Western Energy Services, explore our interactive list of high quality stocks to get an idea of what else is out there.

Valuation is complex, but we're here to simplify it.

Discover if Western Energy Services might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSX:WRG

Western Energy Services

Operates as an oilfield service company in Canada and the United States.

Undervalued with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives