- Canada

- /

- Oil and Gas

- /

- TSX:VET

Vermilion Energy Inc. (TSE:VET) Analysts Just Trimmed Their Revenue Forecasts By 11%

Market forces rained on the parade of Vermilion Energy Inc. (TSE:VET) shareholders today, when the analysts downgraded their forecasts for this year. Revenue estimates were cut sharply as analysts signalled a weaker outlook - perhaps a sign that investors should temper their expectations as well.

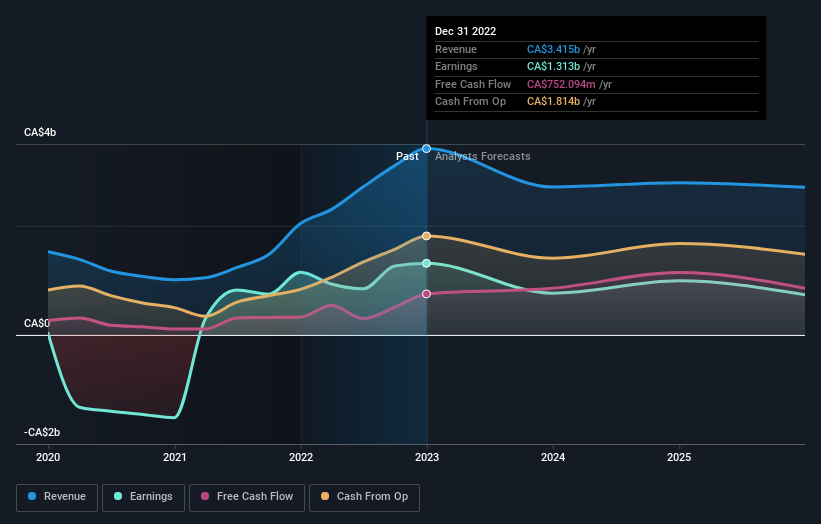

Following the latest downgrade, the current consensus, from the five analysts covering Vermilion Energy, is for revenues of CA$2.7b in 2023, which would reflect a sizeable 21% reduction in Vermilion Energy's sales over the past 12 months. Before the latest update, the analysts were foreseeing CA$3.0b of revenue in 2023. It looks like forecasts have become a fair bit less optimistic on Vermilion Energy, given the measurable cut to revenue estimates.

See our latest analysis for Vermilion Energy

The consensus price target fell 5.6% to CA$30.89, with the analysts clearly less optimistic about Vermilion Energy's valuation following this update. That's not the only conclusion we can draw from this data however, as some investors also like to consider the spread in estimates when evaluating analyst price targets. The most optimistic Vermilion Energy analyst has a price target of CA$40.50 per share, while the most pessimistic values it at CA$23.00. This shows there is still some diversity in estimates, but analysts don't appear to be totally split on the stock as though it might be a success or failure situation.

One way to get more context on these forecasts is to look at how they compare to both past performance, and how other companies in the same industry are performing. We would highlight that sales are expected to reverse, with a forecast 21% annualised revenue decline to the end of 2023. That is a notable change from historical growth of 18% over the last five years. Yet aggregate analyst estimates for other companies in the industry suggest that industry revenues are forecast to decline 1.5% per year. So it's pretty clear that Vermilion Energy's revenues are expected to shrink faster than the wider industry.

The Bottom Line

The clear low-light was that analysts slashing their revenue forecasts for Vermilion Energy this year. Analysts also expect revenues to shrink faster than the wider market. Furthermore, there was a cut to the price target, suggesting that the latest news has led to more pessimism about the intrinsic value of the business. Overall, given the drastic downgrade to this year's forecasts, we'd be feeling a little more wary of Vermilion Energy going forwards.

As you can see, the analysts clearly aren't bullish, and there might be good reason for that. We've identified some potential issues with Vermilion Energy's financials, such as its declining profit margins. Learn more, and discover the 2 other flags we've identified, for free on our platform here.

Of course, seeing company management invest large sums of money in a stock can be just as useful as knowing whether analysts are downgrading their estimates. So you may also wish to search this free list of stocks that insiders are buying.

If you're looking to trade Vermilion Energy, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSX:VET

Vermilion Energy

An oil and gas producer, focuses on the acquisition, exploration, development, and optimization of producing properties in North America, Europe, and Australia.

Very undervalued with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives