- Canada

- /

- Oil and Gas

- /

- TSX:VET

Assessing Vermilion Energy (TSX:VET)’s Valuation After Its Recent Share Price Rebound

Reviewed by Simply Wall St

Vermilion Energy (TSX:VET) has been grinding through a mixed year in the market, but its recent share performance and improving earnings trend are starting to draw fresh attention from value focused energy investors.

See our latest analysis for Vermilion Energy.

Over the past few months, Vermilion’s 21.44% 3 month share price return stands in sharp contrast to its weaker year to date share price performance and modest 1 year total shareholder return. This hints at momentum rebuilding as earnings stabilize.

If Vermilion has caught your eye but you want more ideas in the space, this could be a smart moment to explore aerospace and defense stocks as another hunting ground for opportunities.

With Vermilion trading below analyst targets yet showing only modest growth, investors face a key question: is this a mispriced turnaround with more upside to come, or is the market already discounting its future recovery?

Most Popular Narrative: 7.7% Undervalued

With Vermilion Energy last closing at CA$12.46 against a most popular narrative fair value of CA$13.50, the valuation case leans toward moderate upside built on future operational gains.

Vermilion's discovery and development of German deep gas exploration wells, particularly with successful wells like Wisselshorst, are expected to more than double current European 2P gas reserves. This could significantly boost revenue and increase earnings over the coming years through higher production and premium European gas prices.

Want to see what kind of revenue lift, margin expansion, and earnings power this play is banking on? The narrative leans on ambitious profit rebuilding and a punchy future earnings multiple that would not look out of place in a high growth sector. Curious which projections have to land perfectly for that price to make sense? Read on to uncover the full blueprint behind this valuation call.

Result: Fair Value of $13.50 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, meaningful execution missteps on Westbrick integration, or disappointing returns from capital intensive European gas projects, could quickly undermine this upbeat valuation narrative.

Find out about the key risks to this Vermilion Energy narrative.

Another Angle on Valuation

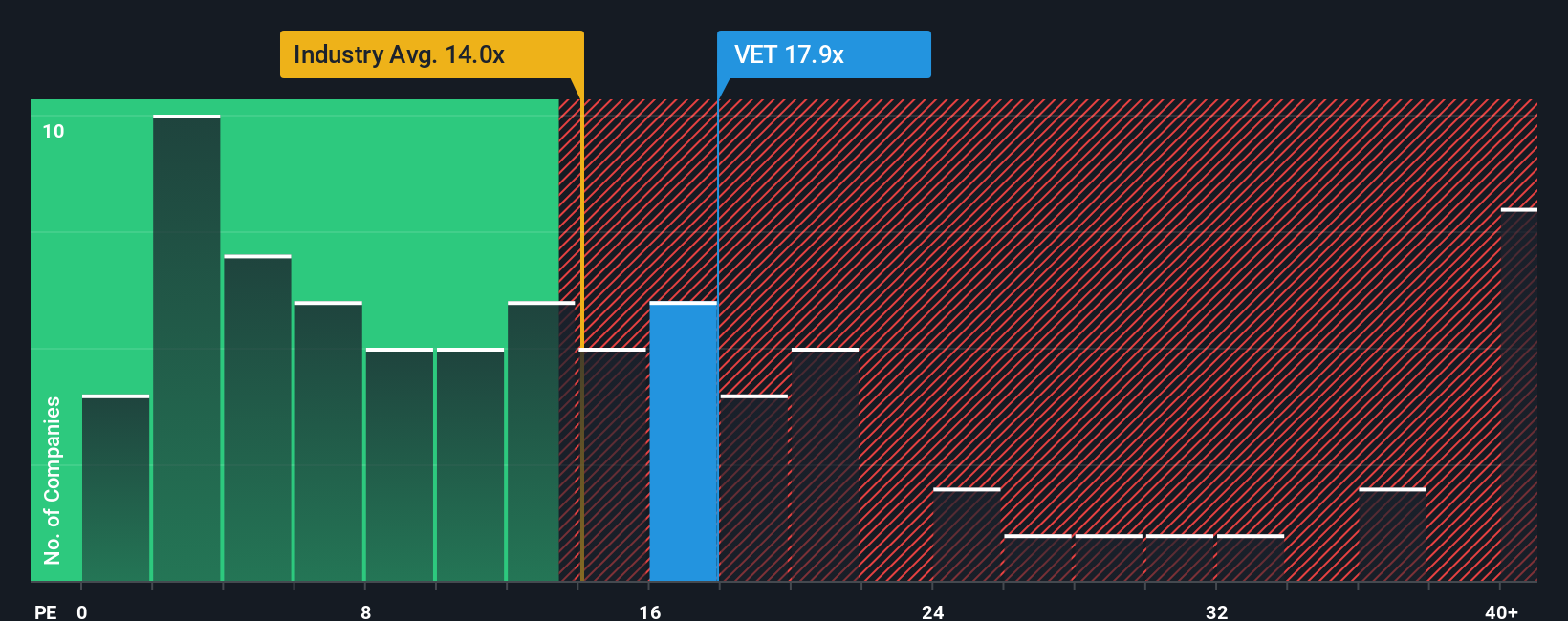

While the narrative sees Vermilion as 7.7% undervalued, a simple price to earnings check tells a tighter story. VET trades at 18.3 times earnings, richer than the Canadian oil and gas average of 15 times and above a fair ratio of 16 times, implying limited margin for error.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Vermilion Energy Narrative

If this view does not quite fit your thinking or you would rather dig into the numbers yourself, you can craft a custom take in just a few minutes, Do it your way.

A great starting point for your Vermilion Energy research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Ready for more high conviction ideas?

Do not stop at a single opportunity when the market is full of potential, use the Simply Wall Street Screener now before others spot the same setups.

- Capitalize on mispriced potential by targeting value rich companies using these 903 undervalued stocks based on cash flows that align solid fundamentals with attractive entry points.

- Ride the momentum of innovation by zeroing in on transformational names through these 27 AI penny stocks at the forefront of intelligent technology.

- Lock in dependable income streams by focusing on cash generating businesses with reliable payouts via these 15 dividend stocks with yields > 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:VET

Vermilion Energy

An oil and gas producer, focuses on the acquisition, exploration, development, and optimization of producing properties in North America, Europe, and Australia.

Fair value with moderate growth potential.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

SLI is share to watch next 5 years

The "Molecular Pencil": Why Beam's Technology is Built to Win

PRME remains a long shot but publication in the New England Journal of Medicine helps.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026