- Canada

- /

- Oil and Gas

- /

- TSX:URE

Will Ur-Energy’s (TSX:URE) Leadership Succession Reinforce Its Long-Term Project Execution Strategy?

Reviewed by Sasha Jovanovic

- Ur-Energy Inc. has announced that President Matthew D. Gili will become CEO on December 13, 2025, succeeding John W. Cash as part of the company's planned leadership succession, with Cash remaining as Chairman of the Board and a strategic advisor.

- This transition places a leader with extensive mining sector executive experience at the helm during a period of growth focused on operational development at Lost Creek and the upcoming Shirley Basin project.

- We'll examine how the planned leadership transition to Matthew Gili in December may shape Ur-Energy's investment narrative and project execution.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

What Is Ur-Energy's Investment Narrative?

For anyone considering Ur-Energy as an investment, the key story centers around its ambition to ramp up uranium production and execution at both Lost Creek and the upcoming Shirley Basin project, all while navigating ongoing losses and operational spending. The transition to Matthew D. Gili as CEO in December 2025 brings a seasoned mining executive into the main leadership role, and with John Cash remaining as Chairman and advisor, the company looks set for management continuity. Near-term catalysts remain unchanged: production milestones at Lost Creek and progress at Shirley Basin, underpinned by sales contracts stretching to 2033, all hinge on smooth project execution and uranium market demand. The recent leadership news isn’t likely to shift catalysts for the coming quarters but it may help reduce execution risk, given Gili’s sector background. That said, the biggest risk continues to be Ur-Energy’s financial position, with less than one year of cash runway and persistent net losses despite revenue growth. Yet, with that growth story, the risk of cash burn remains a key watch point for shareholders.

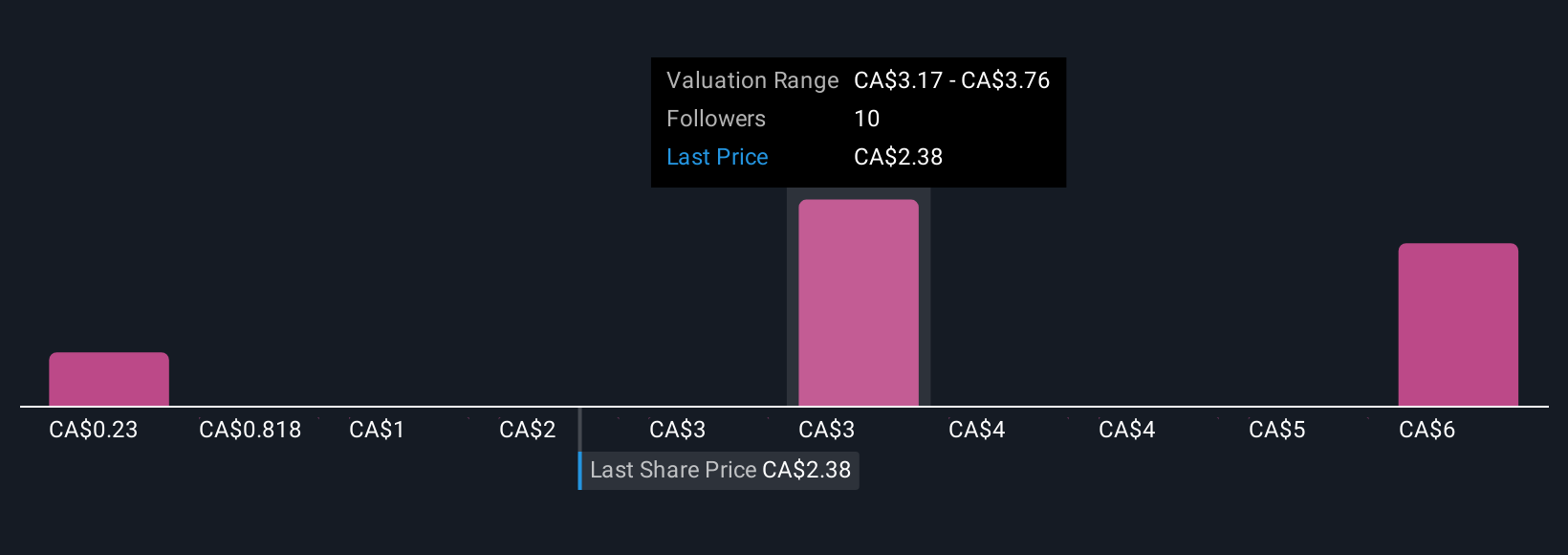

Despite retreating, Ur-Energy's shares might still be trading above their fair value and there could be some more downside. Discover how much.Exploring Other Perspectives

Explore 7 other fair value estimates on Ur-Energy - why the stock might be worth less than half the current price!

Build Your Own Ur-Energy Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Ur-Energy research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Ur-Energy research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Ur-Energy's overall financial health at a glance.

Contemplating Other Strategies?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

- These 10 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:URE

Ur-Energy

Engages in the acquisition, exploration, development, and operation of uranium mineral properties in the United States.

Adequate balance sheet with low risk.

Similar Companies

Market Insights

Community Narratives