- Canada

- /

- Oil and Gas

- /

- TSX:URE

Why Are Ur-Energy's Expanding Operations Not Translating Into Stronger Financial Health for TSX:URE?

Reviewed by Simply Wall St

- Ur-Energy reported real operational progress in Q2 2025 with revenues supported by increased uranium production at its Lost Creek project and on-schedule development at Shirley Basin.

- While these advancements occurred amid a favorable US policy environment for uranium, financial risks such as ongoing losses and derivative obligations remain a concern for the company.

- We'll explore how ongoing production gains at Lost Creek shape Ur-Energy's broader investment story and operational outlook.

Find companies with promising cash flow potential yet trading below their fair value.

What Is Ur-Energy's Investment Narrative?

For shareholders of Ur-Energy, the big picture rests on faith in the company’s ability to convert operational progress into financial strength, despite persistent losses and a relatively short cash runway. The latest news, highlighting real gains in uranium output at Lost Creek and on-schedule work at Shirley Basin, lands at a time when uranium policy signals from Washington remain supportive, arguably bolstering the near-term production story. These updates build on earlier reports of rising sales and higher-priced off-take agreements, which suggest Ur-Energy is starting to show tangible improvement on key short-term catalysts like revenue growth and operational scale. However, with net losses deepening (from US$6.58 million to US$20.96 million year-on-year), the ability of these operational wins to sustainably shift the company’s risk profile is still in question. While the news boosts optimism on execution, financial risks, especially cash burn and derivative obligations, remain front and center for investors watching this turnaround effort. But with financial risks still looming, the future may hinge on more than just higher uranium output.

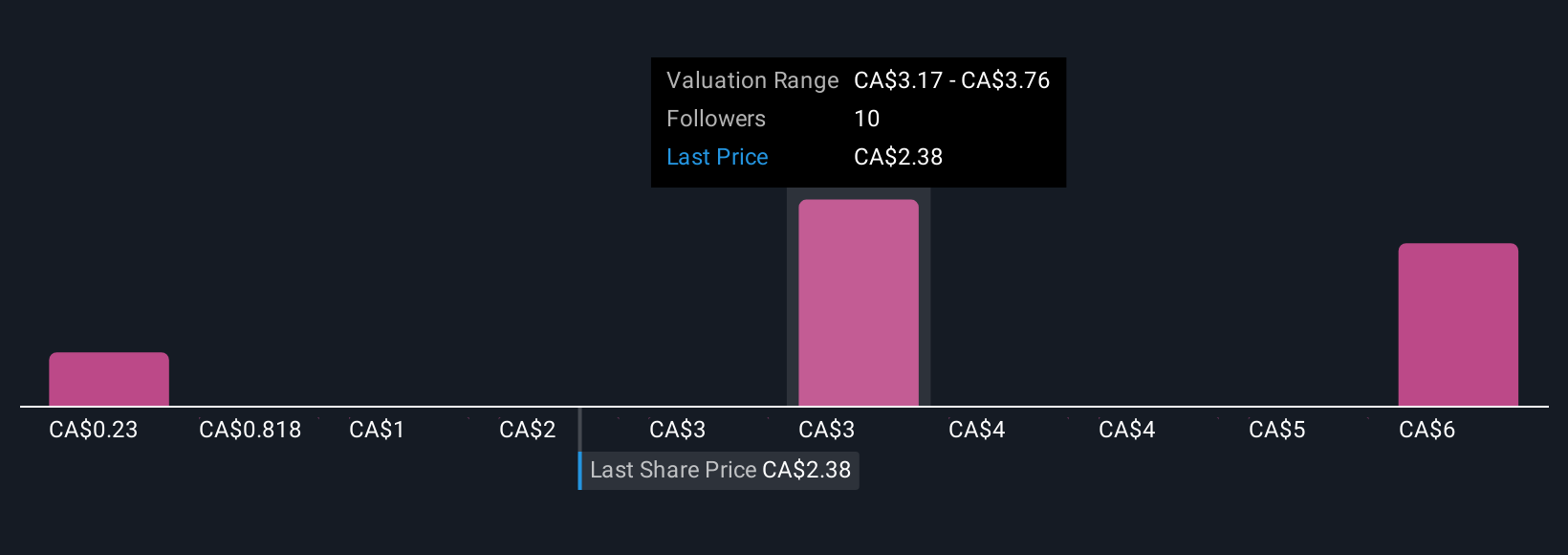

Ur-Energy's shares have been on the rise but are still potentially undervalued. Find out how large the opportunity might be.Exploring Other Perspectives

Explore 6 other fair value estimates on Ur-Energy - why the stock might be worth over 2x more than the current price!

Build Your Own Ur-Energy Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Ur-Energy research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Ur-Energy research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Ur-Energy's overall financial health at a glance.

Seeking Other Investments?

Our top stock finds are flying under the radar-for now. Get in early:

- These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:URE

Ur-Energy

Engages in the acquisition, exploration, development, and operation of uranium mineral properties in the United States.

Adequate balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives