- Canada

- /

- Oil and Gas

- /

- TSX:URE

The Ur-Energy (TSE:URE) Share Price Has Gained 64% And Shareholders Are Hoping For More

The Ur-Energy Inc. (TSE:URE) share price has had a bad week, falling 13%. But that doesn't change the fact that the returns over the last year have been pleasing. To wit, it had solidly beat the market, up 64%.

View our latest analysis for Ur-Energy

Because Ur-Energy made a loss in the last twelve months, we think the market is probably more focussed on revenue and revenue growth, at least for now. When a company doesn't make profits, we'd generally expect to see good revenue growth. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

In the last year Ur-Energy saw its revenue shrink by 11%. The stock is up 64% in that time, a fine performance given the revenue drop. We can correlate the share price rise with revenue or profit growth, but it seems the market had previously expected weaker results, and sentiment around the stock is improving.

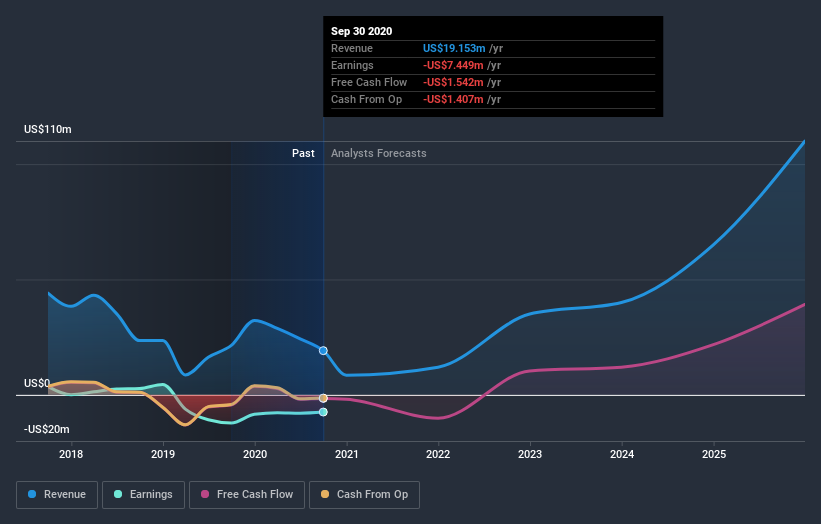

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

If you are thinking of buying or selling Ur-Energy stock, you should check out this FREE detailed report on its balance sheet.

A Different Perspective

It's nice to see that Ur-Energy shareholders have received a total shareholder return of 64% over the last year. That gain is better than the annual TSR over five years, which is 9%. Therefore it seems like sentiment around the company has been positive lately. Given the share price momentum remains strong, it might be worth taking a closer look at the stock, lest you miss an opportunity. It's always interesting to track share price performance over the longer term. But to understand Ur-Energy better, we need to consider many other factors. Case in point: We've spotted 4 warning signs for Ur-Energy you should be aware of, and 2 of them are a bit concerning.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on CA exchanges.

If you decide to trade Ur-Energy, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TSX:URE

Ur-Energy

Engages in the acquisition, exploration, development, and operation of uranium mineral properties in the United States.

Adequate balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Fiducian: Compliance Clouds or Value Opportunity?

Q3 Outlook modestly optimistic

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.