- Canada

- /

- Oil and Gas

- /

- TSX:URE

A Look at Ur-Energy (TSX:URE) Valuation Following Leadership Transition Plans

Reviewed by Kshitija Bhandaru

Ur-Energy (TSX:URE) just outlined its next chapter, unveiling a carefully crafted CEO succession plan. John W. Cash will step down and pass leadership to President Matthew D. Gili in December, with both executives bringing longstanding experience to the transition.

See our latest analysis for Ur-Energy.

Ur-Energy's thoughtful succession plan comes at a moment of renewed investor attention. Momentum has been building, with a 22.4% year-to-date share price gain and a robust 23.8% total shareholder return over the past year. Although the stock recently pulled back, the long-term total return of 261% over five years suggests that optimism about both leadership continuity and project growth continues to shape the broader valuation story.

If this kind of leadership-driven momentum inspires you, now’s a great time to broaden your search and discover fast growing stocks with high insider ownership

Given the impressive performance and strategic leadership transition, the real question is whether Ur-Energy’s current share price still leaves room for upside or if the market has already factored in all future growth potential.

Price-to-Sales of 14.8x: Is it justified?

Ur-Energy currently trades at a price-to-sales ratio of 14.8x, which places its valuation well above both peer and industry benchmarks, despite a last close of CA$2.24.

The price-to-sales ratio helps investors assess how much they are paying for each dollar of company revenue. For a uranium developer with high top-line growth but no profits, this metric captures market optimism about future sales potential more than earnings power.

This premium is tough to ignore. The sector average sits at 2.4x, and Ur-Energy’s multiple is nearly double that of its direct peers, who average 7.5x. According to our estimates, the fair price-to-sales ratio should be closer to zero based on the current financial picture. This suggests the market is pricing in aggressive revenue expansion or future profitability not yet visible in results.

Explore the SWS fair ratio for Ur-Energy

Result: Price-to-Sales of 14.8x (OVERVALUED)

However, slow revenue growth or ongoing net losses could challenge the bullish outlook, particularly if industry sentiment or uranium prices become negative.

Find out about the key risks to this Ur-Energy narrative.

Another View: Discounted Cash Flow Perspective

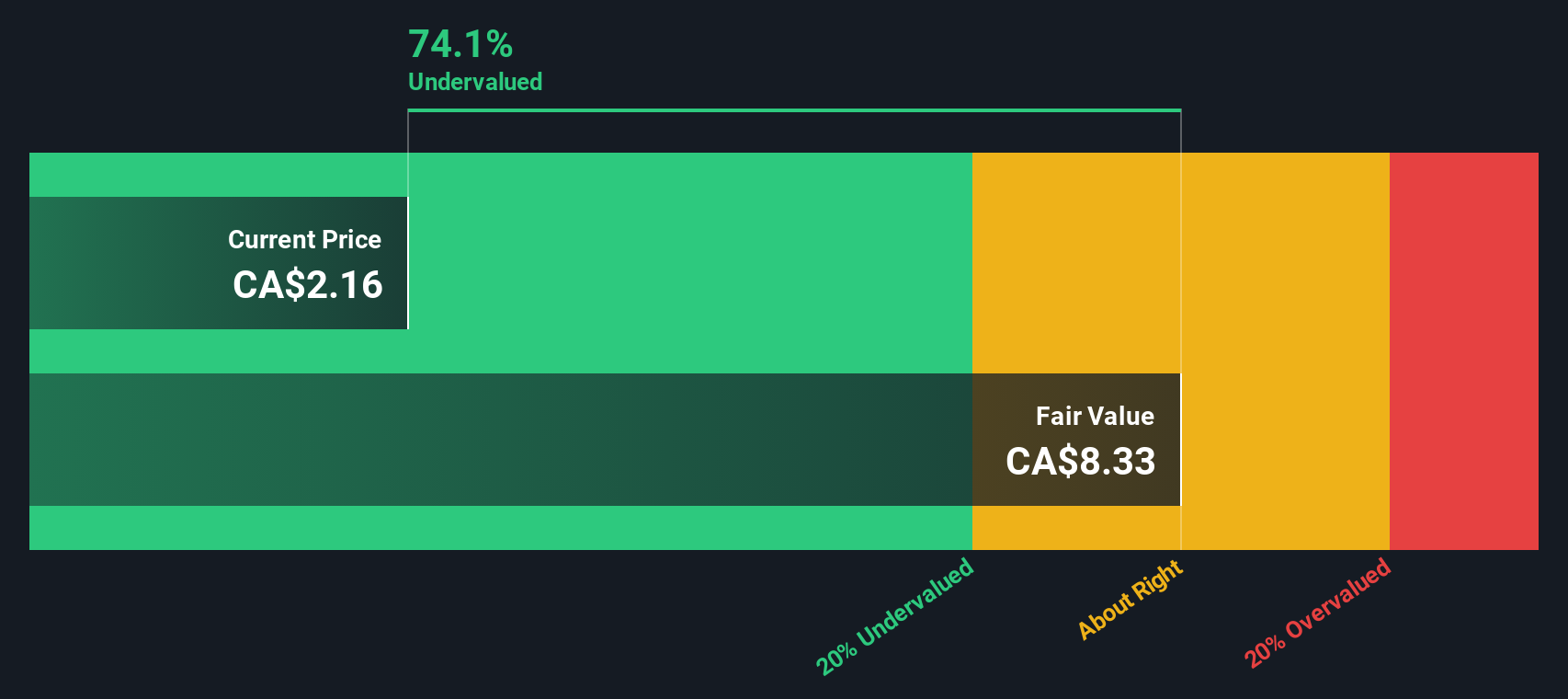

Looking at Ur-Energy through our SWS DCF model, the picture shifts. The shares trade at CA$2.24, which is well below our calculated fair value of CA$8.35. This suggests the company is undervalued based on future cash flows. Could market pessimism be missing the long-term upside?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Ur-Energy for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Ur-Energy Narrative

If you have a different perspective or want to delve into the numbers yourself, it takes just a few minutes to build your own story and see where the evidence leads. Do it your way

A great starting point for your Ur-Energy research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Smart investors never stop at just one stock opportunity. Use the Simply Wall Street Screener to find strategies others are missing and take control of your portfolio now.

- Grow your income by targeting high yield returns and stability through these 18 dividend stocks with yields > 3%. These can consistently outperform low-interest alternatives.

- Uncover the potential of tomorrow’s tech as you scan for innovation leaders using these 24 AI penny stocks in artificial intelligence.

- Secure a head start on market value by spotting bargain opportunities in these 878 undervalued stocks based on cash flows before they are priced in by the crowd.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:URE

Ur-Energy

Engages in the acquisition, exploration, development, and operation of uranium mineral properties in the United States.

Adequate balance sheet with low risk.

Similar Companies

Market Insights

Community Narratives