- Canada

- /

- Oil and Gas

- /

- TSX:URC

Undiscovered Gems in Canada Three Promising Stocks for December 2024

Reviewed by Simply Wall St

As the Canadian market navigates a landscape marked by fluctuating indices and shifting economic indicators, particularly affecting small-cap stocks, investors are keenly observing opportunities that may arise from these dynamic conditions. In this context, identifying promising stocks involves looking for companies with strong fundamentals and growth potential amidst broader market sentiment.

Top 10 Undiscovered Gems With Strong Fundamentals In Canada

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Reconnaissance Energy Africa | NA | 9.16% | 15.11% | ★★★★★★ |

| Lithium Chile | NA | nan | 42.01% | ★★★★★★ |

| Amerigo Resources | 14.04% | 7.04% | 11.73% | ★★★★★☆ |

| Maxim Power | 25.01% | 12.79% | 17.14% | ★★★★★☆ |

| Mako Mining | 10.21% | 38.44% | 58.78% | ★★★★★☆ |

| Grown Rogue International | 24.92% | 43.35% | 67.95% | ★★★★★☆ |

| Corby Spirit and Wine | 65.79% | 7.46% | -5.76% | ★★★★☆☆ |

| Petrus Resources | 19.44% | 17.20% | 46.03% | ★★★★☆☆ |

| DIRTT Environmental Solutions | 58.73% | -5.34% | -5.43% | ★★★★☆☆ |

| Dundee | 3.76% | -37.57% | 44.64% | ★★★★☆☆ |

Let's review some notable picks from our screened stocks.

High Liner Foods (TSX:HLF)

Simply Wall St Value Rating: ★★★★★☆

Overview: High Liner Foods Incorporated is a company that processes and markets frozen seafood products in North America, with a market cap of CA$467.84 million.

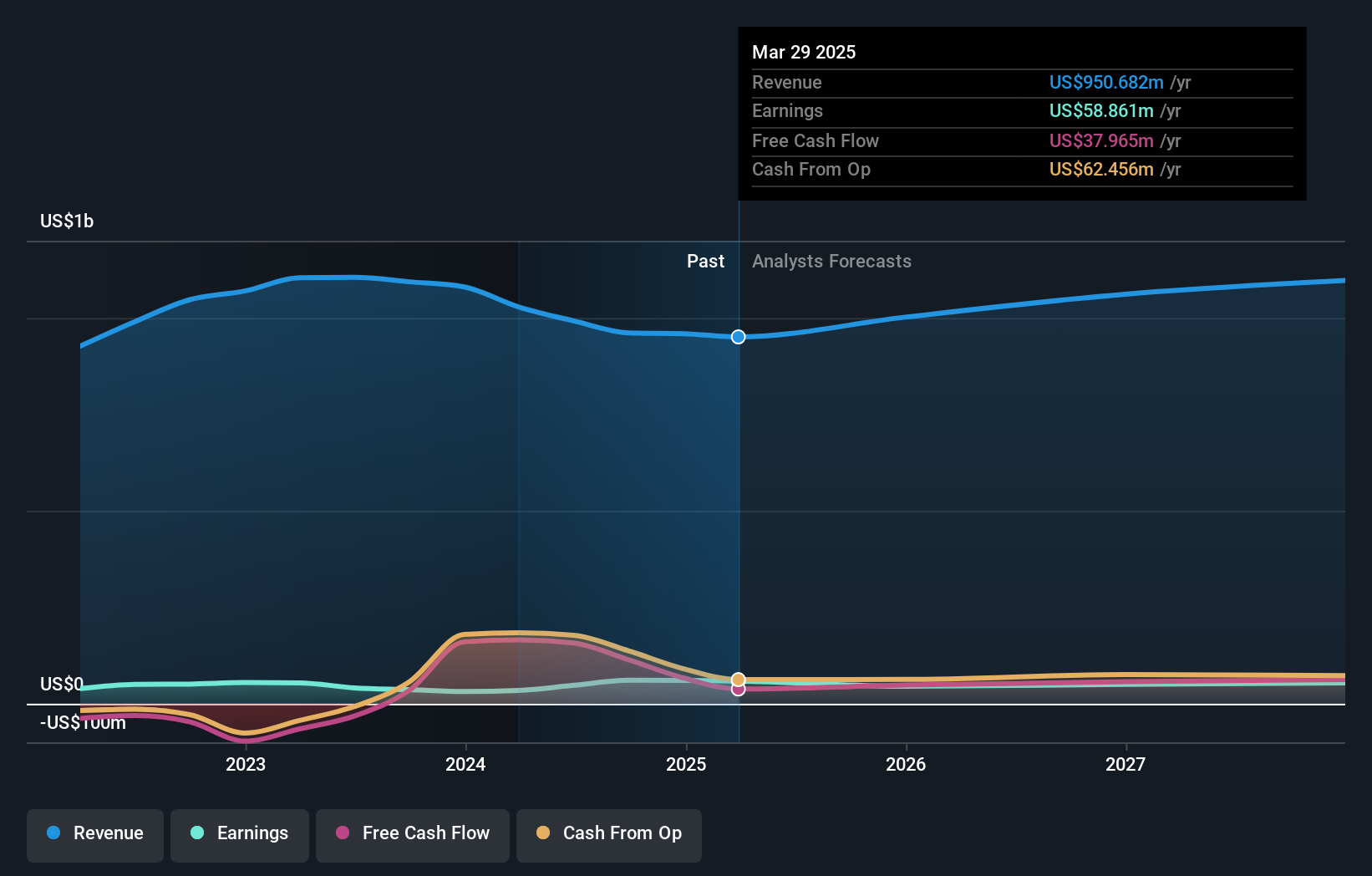

Operations: High Liner Foods generates revenue primarily from the manufacturing and marketing of prepared and packaged frozen seafood, amounting to $961.30 million.

High Liner Foods, a Canadian company, has seen its earnings grow by 66% over the past year, outpacing the food industry's growth of 6.3%. Despite a high net debt to equity ratio of 50.9%, its interest payments are well covered with EBIT at 3.3x coverage. The firm recently reported a net income increase to US$18 million for Q3 2024 from US$5 million the previous year, alongside an increased quarterly dividend of C$0.17 per share and repurchased shares worth C$2.65 million this year, indicating confidence in its operations and value proposition.

Mandalay Resources (TSX:MND)

Simply Wall St Value Rating: ★★★★★★

Overview: Mandalay Resources Corporation, along with its subsidiaries, focuses on the acquisition, exploration, extraction, processing, and reclamation of mineral properties across Canada, Australia, Sweden, and Chile with a market cap of CA$413.23 million.

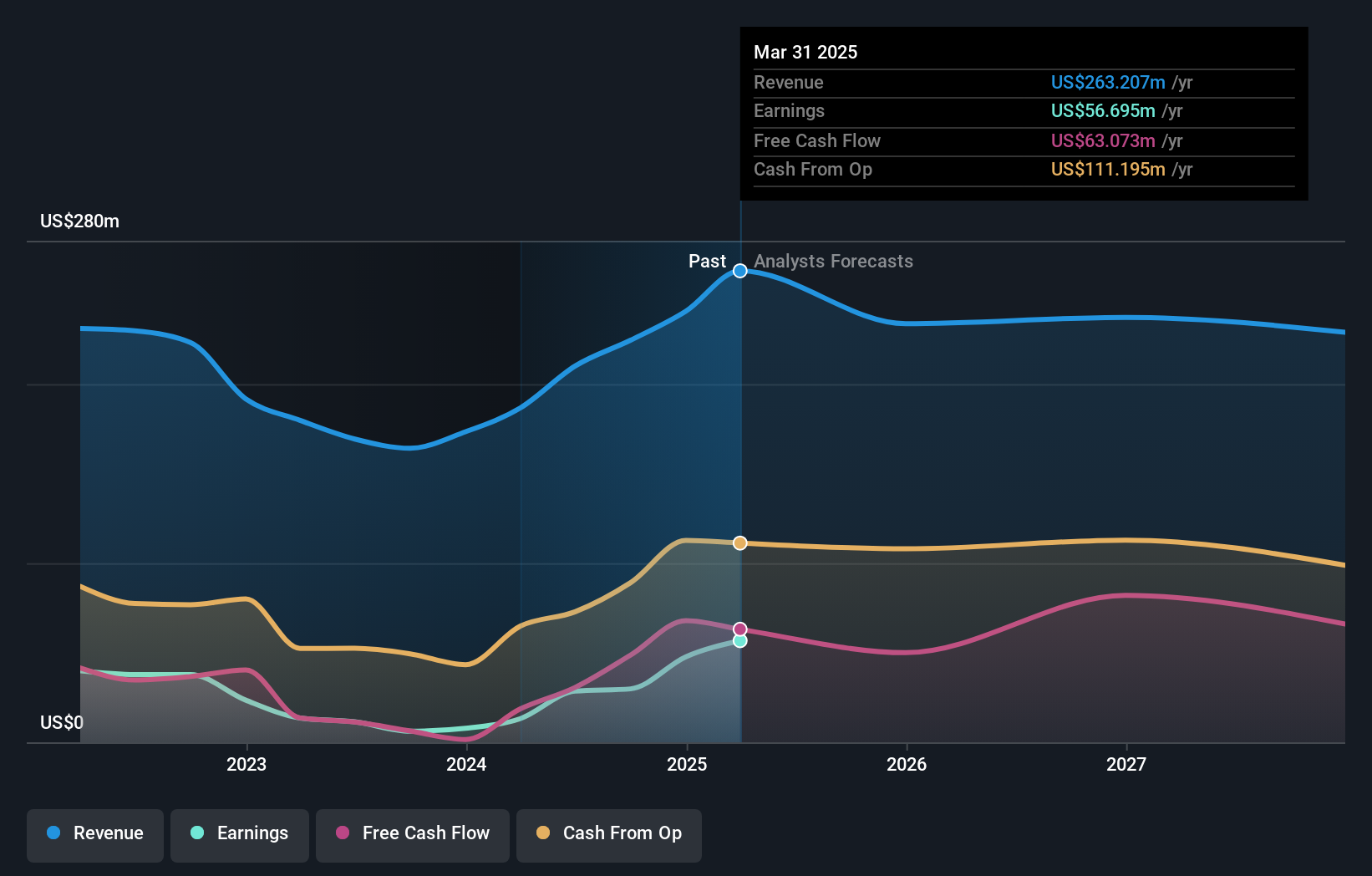

Operations: Mandalay generates revenue primarily from its metals and mining segment, focusing on gold and other precious metals, with reported revenues of $224.44 million.

Mandalay Resources, a small-cap player in the mining sector, has shown impressive financial strides. Over the past year, earnings surged by 382%, outpacing industry growth of 27%. The company's debt to equity ratio saw a significant reduction from 56.1% to just 2.7% over five years, indicating improved financial health. Recent earnings for Q3 revealed sales of US$55.29 million and net income of US$5.35 million, up from last year's figures. Despite some insider selling recently, Mandalay's strategic repurchase of shares worth CAD 0.18 million highlights its confidence in future performance and value proposition.

- Get an in-depth perspective on Mandalay Resources' performance by reading our health report here.

Assess Mandalay Resources' past performance with our detailed historical performance reports.

Uranium Royalty (TSX:URC)

Simply Wall St Value Rating: ★★★★★★

Overview: Uranium Royalty Corp. is a pure-play uranium royalty company with a market capitalization of CA$442.19 million.

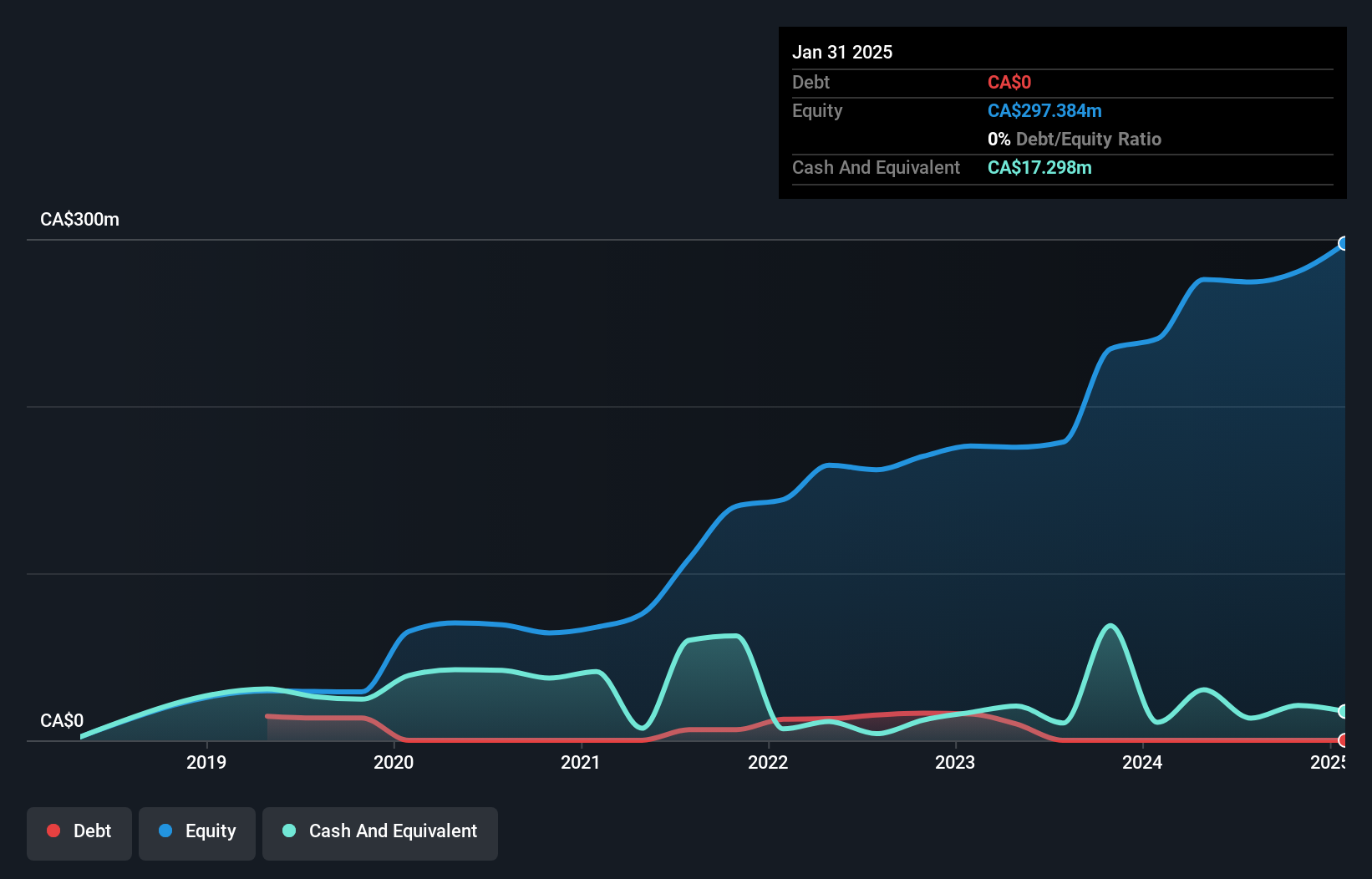

Operations: The company generates revenue primarily through acquiring and assembling a portfolio of royalties and investing, with reported revenues of CA$38.29 million.

Uranium Royalty Corp. offers an intriguing opportunity with its debt-free status and impressive earnings growth of 259% over the past year, outpacing the Oil and Gas industry's -21%. Despite trading at 61.8% below estimated fair value, recent financials show a CAD 0.428 million net loss for Q2 compared to CAD 3.49 million net income a year prior, indicating challenges in profitability. The acquisition of royalties on major uranium projects in Saskatchewan expands its asset base significantly, while board changes bring seasoned expertise to steer future strategies effectively, suggesting potential for long-term value creation despite current hurdles.

- Take a closer look at Uranium Royalty's potential here in our health report.

Explore historical data to track Uranium Royalty's performance over time in our Past section.

Seize The Opportunity

- Navigate through the entire inventory of 44 TSX Undiscovered Gems With Strong Fundamentals here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:URC

Flawless balance sheet with questionable track record.

Market Insights

Community Narratives