- Canada

- /

- Energy Services

- /

- TSX:TVK

Earnings Not Telling The Story For TerraVest Industries Inc. (TSE:TVK)

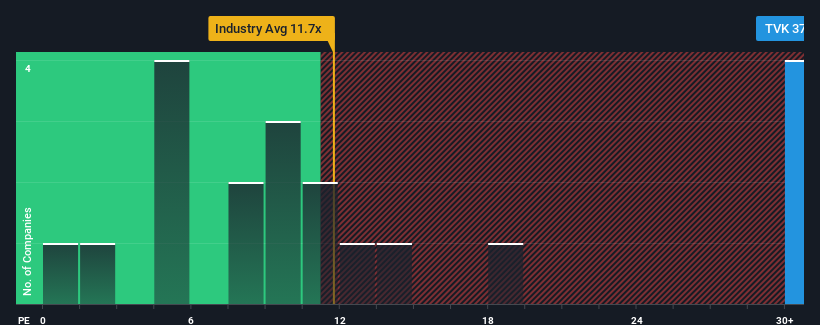

With a price-to-earnings (or "P/E") ratio of 37.8x TerraVest Industries Inc. (TSE:TVK) may be sending very bearish signals at the moment, given that almost half of all companies in Canada have P/E ratios under 14x and even P/E's lower than 8x are not unusual. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/E.

With earnings growth that's superior to most other companies of late, TerraVest Industries has been doing relatively well. The P/E is probably high because investors think this strong earnings performance will continue. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Check out our latest analysis for TerraVest Industries

How Is TerraVest Industries' Growth Trending?

In order to justify its P/E ratio, TerraVest Industries would need to produce outstanding growth well in excess of the market.

Retrospectively, the last year delivered an exceptional 45% gain to the company's bottom line. The strong recent performance means it was also able to grow EPS by 61% in total over the last three years. Therefore, it's fair to say the earnings growth recently has been superb for the company.

Shifting to the future, estimates from the four analysts covering the company suggest earnings should grow by 19% over the next year. With the market predicted to deliver 22% growth , the company is positioned for a weaker earnings result.

With this information, we find it concerning that TerraVest Industries is trading at a P/E higher than the market. Apparently many investors in the company are way more bullish than analysts indicate and aren't willing to let go of their stock at any price. There's a good chance these shareholders are setting themselves up for future disappointment if the P/E falls to levels more in line with the growth outlook.

The Final Word

It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Our examination of TerraVest Industries' analyst forecasts revealed that its inferior earnings outlook isn't impacting its high P/E anywhere near as much as we would have predicted. Right now we are increasingly uncomfortable with the high P/E as the predicted future earnings aren't likely to support such positive sentiment for long. Unless these conditions improve markedly, it's very challenging to accept these prices as being reasonable.

Having said that, be aware TerraVest Industries is showing 2 warning signs in our investment analysis, you should know about.

If these risks are making you reconsider your opinion on TerraVest Industries, explore our interactive list of high quality stocks to get an idea of what else is out there.

Valuation is complex, but we're here to simplify it.

Discover if TerraVest Industries might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSX:TVK

TerraVest Industries

Manufactures and sells goods and services to agriculture, mining, energy production and distribution, chemical, utilities, transportation and construction, and other markets in Canada, the United States, and internationally.

Proven track record and fair value.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Positioned globally, partnered locally

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026