- Canada

- /

- Energy Services

- /

- TSX:TVK

3 TSX Stocks That Investors Might Be Undervaluing

Reviewed by Simply Wall St

The Canadian stock market has been riding a wave of optimism, reaching all-time highs recently, driven by the U.S. Fed's rate cut and enthusiasm around AI. As the market continues to focus on prevailing economic trends rather than political uncertainties, investors might find opportunities in stocks that are currently undervalued but have strong fundamentals.

Top 10 Undervalued Stocks Based On Cash Flows In Canada

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Computer Modelling Group (TSX:CMG) | CA$11.37 | CA$22.01 | 48.3% |

| goeasy (TSX:GSY) | CA$180.94 | CA$361.68 | 50% |

| Endeavour Mining (TSX:EDV) | CA$32.14 | CA$62.37 | 48.5% |

| Real Matters (TSX:REAL) | CA$9.15 | CA$17.50 | 47.7% |

| Viemed Healthcare (TSX:VMD) | CA$10.45 | CA$20.08 | 48% |

| Kinaxis (TSX:KXS) | CA$160.67 | CA$279.76 | 42.6% |

| Bragg Gaming Group (TSX:BRAG) | CA$6.86 | CA$10.69 | 35.8% |

| Blackline Safety (TSX:BLN) | CA$5.59 | CA$10.99 | 49.1% |

| Boyd Group Services (TSX:BYD) | CA$204.96 | CA$336.47 | 39.1% |

| Opsens (TSX:OPS) | CA$2.90 | CA$4.64 | 37.5% |

We're going to check out a few of the best picks from our screener tool.

AtkinsRéalis Group (TSX:ATRL)

Overview: AtkinsRéalis Group (TSX:ATRL) is an integrated professional services and project management company with a market cap of CA$9.47 billion.

Operations: AtkinsRéalis generates revenue from four primary segments: Capital (CA$127.40 million), Nuclear (CA$1.20 billion), LSTK Projects (CA$318.44 million), and Segment Adjustment (CA$7.46 billion).

Estimated Discount To Fair Value: 28.1%

AtkinsRéalis Group appears undervalued based on discounted cash flow analysis, trading at CA$54.95 against an estimated fair value of CA$76.48. The company has shown strong earnings growth, with a 290.9% increase over the past year and is forecasted to grow earnings by 26.3% annually, outpacing the Canadian market's average growth rate of 14.9%. Recent significant contract wins and strategic executive appointments further bolster its financial position and future growth prospects.

- Our expertly prepared growth report on AtkinsRéalis Group implies its future financial outlook may be stronger than recent results.

- Navigate through the intricacies of AtkinsRéalis Group with our comprehensive financial health report here.

Ivanhoe Mines (TSX:IVN)

Overview: Ivanhoe Mines Ltd. is involved in the mining, development, and exploration of minerals and precious metals primarily in Africa, with a market cap of CA$27.77 billion.

Operations: Ivanhoe Mines Ltd. generates revenue through the mining, development, and exploration of minerals and precious metals in Africa.

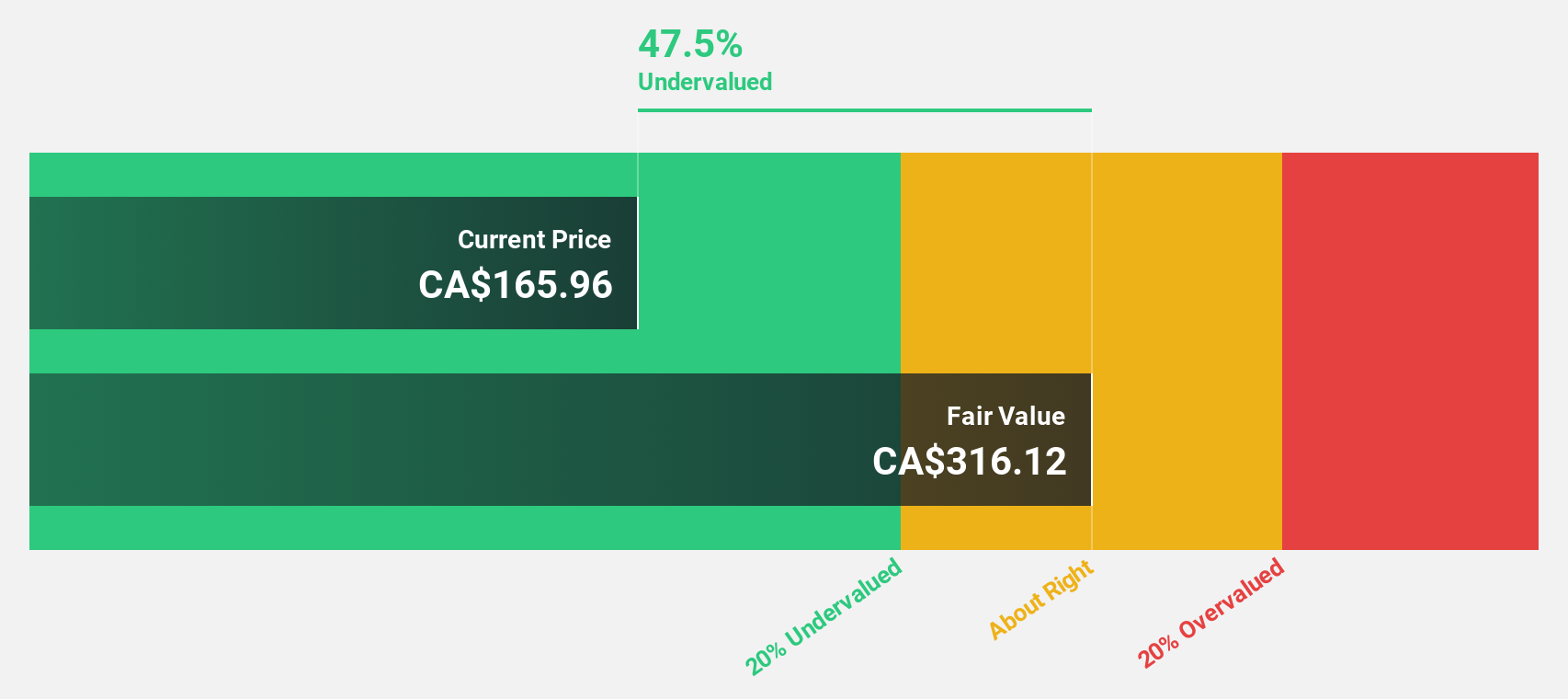

Estimated Discount To Fair Value: 14.2%

Ivanhoe Mines is trading at CA$20.12, below its estimated fair value of CA$23.45, suggesting it may be undervalued based on cash flows. Recent milestones include a record monthly copper production and a strategic MOU with Zambia's Ministry of Mines to expand exploration activities. Despite past shareholder dilution and low current revenue, Ivanhoe's earnings are forecasted to grow significantly at 68.27% annually, outpacing the broader Canadian market growth rate of 14.9%.

- The analysis detailed in our Ivanhoe Mines growth report hints at robust future financial performance.

- Click here to discover the nuances of Ivanhoe Mines with our detailed financial health report.

TerraVest Industries (TSX:TVK)

Overview: TerraVest Industries Inc. manufactures and sells goods and services to energy, agriculture, mining, transportation, and other markets in Canada and the United States with a market cap of CA$1.86 billion.

Operations: TerraVest Industries' revenue segments include Service (CA$201.78 million), Processing Equipment (CA$117.58 million), Compressed Gas Equipment (CA$243.77 million), and HVAC and Containment Equipment (CA$292.90 million).

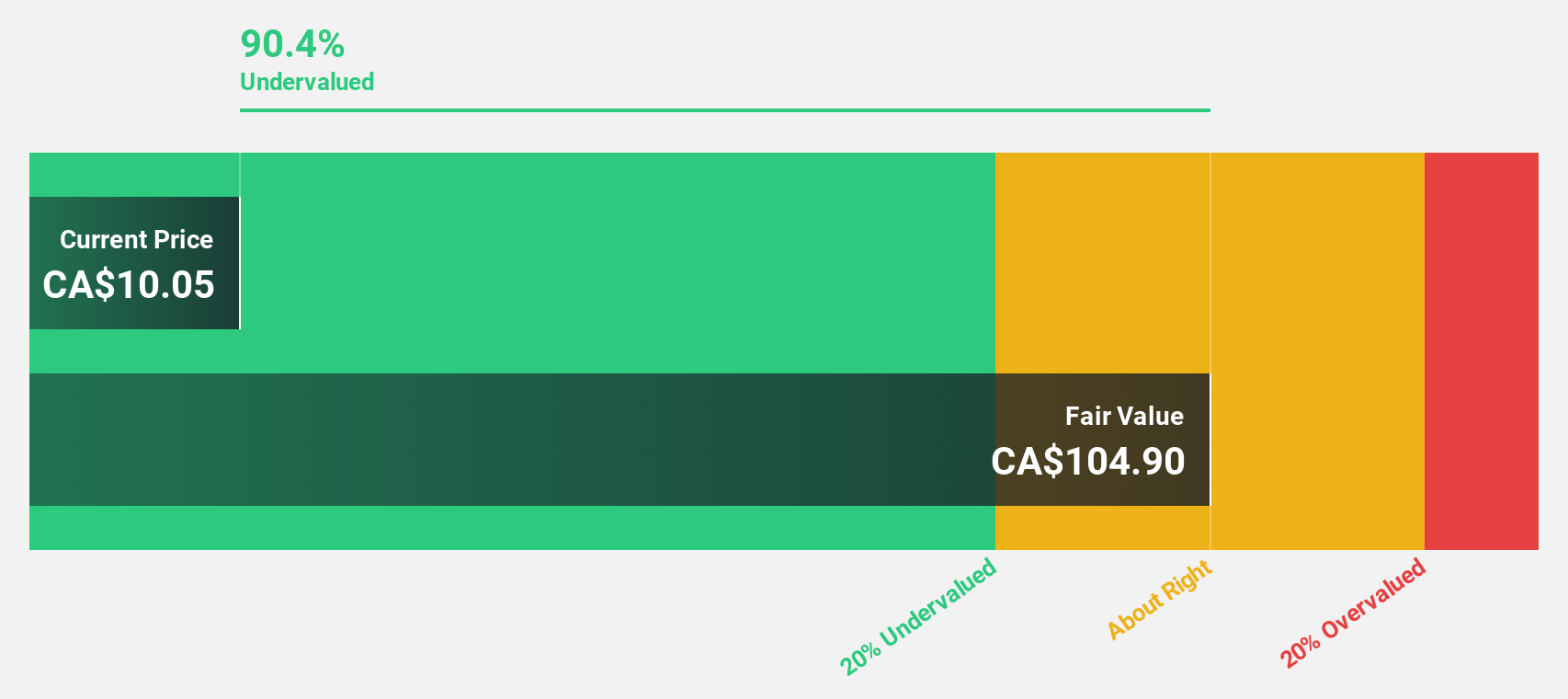

Estimated Discount To Fair Value: 26.2%

TerraVest Industries, trading at CA$96.11, is significantly undervalued with a fair value estimate of CA$130.25. Earnings are forecast to grow 21.1% annually, outpacing the Canadian market's 14.9%. Despite high debt and recent insider selling, TerraVest reported strong Q3 earnings with revenue of CA$238.13 million and net income of CA$11.92 million, both up from last year. Recent inclusion in the S&P Global BMI Index enhances its market visibility.

- Our comprehensive growth report raises the possibility that TerraVest Industries is poised for substantial financial growth.

- Delve into the full analysis health report here for a deeper understanding of TerraVest Industries.

Where To Now?

- Investigate our full lineup of 23 Undervalued TSX Stocks Based On Cash Flows right here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if TerraVest Industries might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:TVK

TerraVest Industries

Manufactures and sells goods and services to agriculture, mining, energy production and distribution, chemical, utilities, transportation and construction, and other markets in Canada, the United States, and internationally.

Solid track record with excellent balance sheet.

Market Insights

Community Narratives