- Canada

- /

- Oil and Gas

- /

- TSX:TRP

TC Energy (TSX:TRP) Reports Record Earnings and Announces Strategic Spin-Off of South Bow in Late 2024

Reviewed by Simply Wall St

TC Energy (TSX:TRP) is currently navigating a dynamic environment characterized by both growth prospects and financial hurdles. Key developments include a successful asset divestiture program and a strong dividend yield, offset by rising interest expenses and valuation concerns. In the discussion that follows, we will explore TC Energy's core strengths, financial challenges, growth opportunities, and potential risks to provide a comprehensive overview of the company's current business situation.

Navigate through the intricacies of TC Energy with our comprehensive report here.

Strengths: Core Advantages Driving Sustained Success For TC Energy

TC Energy has demonstrated strong financial health, with record earnings and comparable EBITDA growth of 11% year-over-year, as noted by President and CEO Francois Poirier. The company's operational excellence is evident from high availability and utilization across its asset base, achieving multiple first-quarter all-time records. Additionally, TC Energy's strategic asset divestiture program has been successful, with the recent sale of PNGTS yielding CAD 1.1 billion in pretax proceeds. The company's dividend yield of 5.95% is among the top 25% of dividend payers in the Canadian market, showcasing its commitment to shareholder returns. Notably, TC Energy is trading below its estimated fair value of CA$73.75, providing a 12.5% discount, which underscores its attractiveness relative to peers.

Learn about TC Energy's dividend strategy and how it impacts shareholder returns and financial stability.Weaknesses: Critical Issues Affecting TC Energy's Performance and Areas For Growth

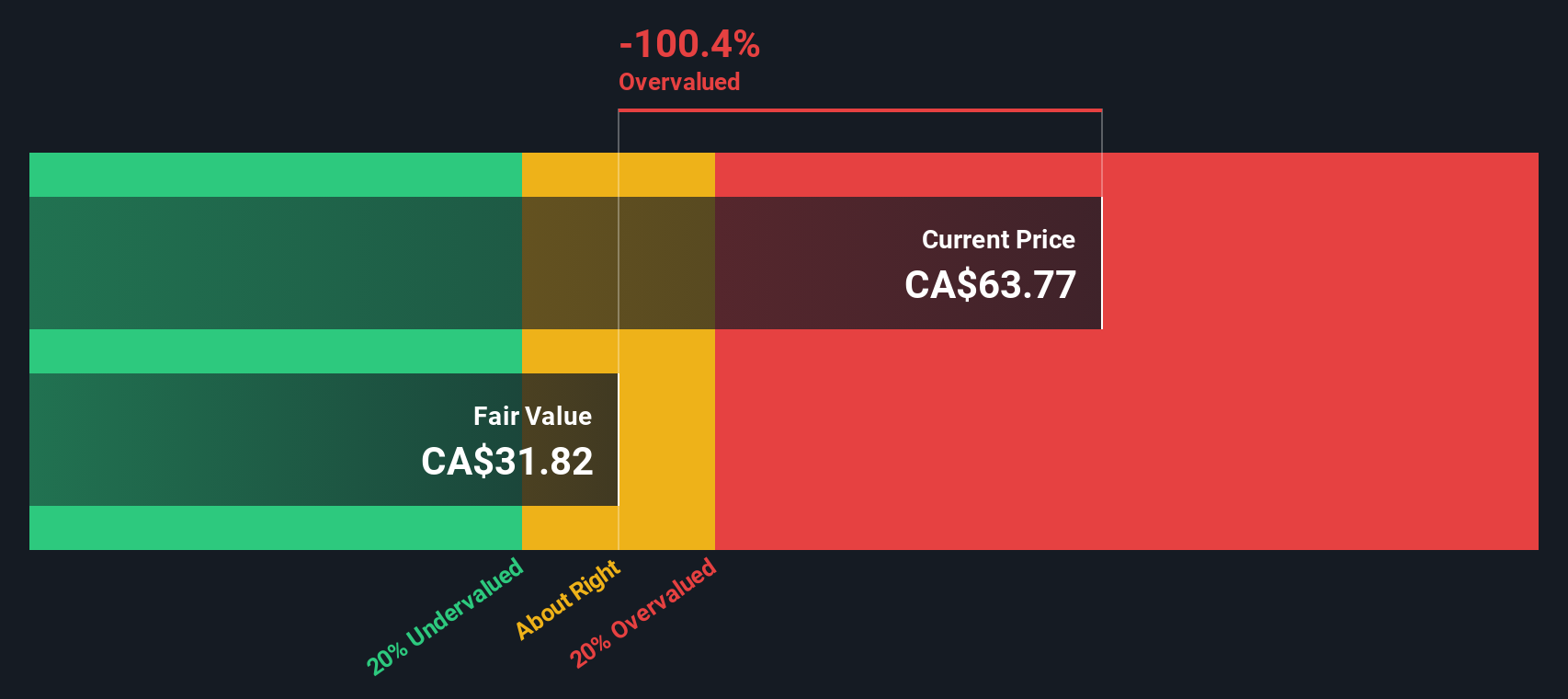

TC Energy faces several financial challenges. The company's higher interest expenses, primarily due to long-term debt issuances, have impacted its net income, as highlighted by Executive Vice President and CFO Joel Hunter. Additionally, the company's Price-To-Earnings Ratio (19.5x) is higher than the Canadian Oil and Gas industry average of 11.5x, indicating a relatively expensive valuation. The dividend payout ratio of 114.2% suggests that dividend payments are not well covered by earnings, raising concerns about sustainability. Furthermore, the company's Return on Equity (9.8%) is considered low, reflecting potential inefficiencies in generating returns on shareholder investments.

To dive deeper into how TC Energy's valuation metrics are shaping its market position, check out our detailed analysis of TC Energy's Valuation.Opportunities: Potential Strategies for Leveraging Growth and Competitive Advantage

TC Energy has several growth opportunities on the horizon. The expansion in natural gas demand, particularly from data centers, presents a meaningful load and growth opportunity. The company expects to place approximately $7 billion of new projects into service this year, which could significantly boost its EBITDA, forecasted to be between $11.2 billion and $11.5 billion. The strategic spin-off of South Bow, expected in late Q3 or Q4, is anticipated to unlock further value and streamline operations. Additionally, TC Energy's forecasted earnings growth of 11.9% per year, although slower than the Canadian market average, still represents a solid growth trajectory.

Threats: Key Risks and Challenges That Could Impact TC Energy's Success

TC Energy faces several external risks that could impact its long-term success. Market volatility remains a concern, although the company's strong financial foundation provides some insulation. Regulatory risks are also significant, with the company emphasizing the need for a cost recovery increase commercial framework before continuing capital investments. Competition is another challenge, particularly in the data center load segment, where much of the demand is likely to materialize behind Local Distribution Companies (LDCs) rather than directly connected to TC Energy's mainline pipes. Additionally, the dividend of 5.95% is not well covered by earnings or free cash flows, posing a risk to its sustainability.

Conclusion

TC Energy's strong financial health, demonstrated by record earnings and a high dividend yield, positions it as an attractive investment, especially given its current trading price of CA$64.55, which is below its estimated fair value of CA$73.75. However, the company faces significant challenges, including high interest expenses and a dividend payout ratio of 114.2%, which raises concerns about the sustainability of its dividends. While growth opportunities such as the expansion in natural gas demand and new projects coming online are promising, external risks like market volatility and regulatory hurdles could impact future performance. Despite trading at a higher Price-To-Earnings Ratio compared to the industry average, TC Energy's strategic initiatives and financial resilience make it a compelling option for investors willing to navigate these complexities.

Seize The Opportunity

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

Valuation is complex, but we're here to simplify it.

Discover if TC Energy might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Simply Wall St and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

About TSX:TRP

Proven track record slight.

Similar Companies

Market Insights

Community Narratives