- Canada

- /

- Oil and Gas

- /

- TSX:TPZ

We Ran A Stock Scan For Earnings Growth And Topaz Energy (TSE:TPZ) Passed With Ease

For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it currently lacks a track record of revenue and profit. Sometimes these stories can cloud the minds of investors, leading them to invest with their emotions rather than on the merit of good company fundamentals. Loss-making companies are always racing against time to reach financial sustainability, so investors in these companies may be taking on more risk than they should.

If this kind of company isn't your style, you like companies that generate revenue, and even earn profits, then you may well be interested in Topaz Energy (TSE:TPZ). While this doesn't necessarily speak to whether it's undervalued, the profitability of the business is enough to warrant some appreciation - especially if its growing.

View our latest analysis for Topaz Energy

How Quickly Is Topaz Energy Increasing Earnings Per Share?

If a company can keep growing earnings per share (EPS) long enough, its share price should eventually follow. That makes EPS growth an attractive quality for any company. Impressively, Topaz Energy has grown EPS by 33% per year, compound, in the last three years. So it's not surprising to see the company trades on a very high multiple of (past) earnings.

It's often helpful to take a look at earnings before interest and tax (EBIT) margins, as well as revenue growth, to get another take on the quality of the company's growth. It's noted that Topaz Energy's revenue from operations was lower than its revenue in the last twelve months, so that could distort our analysis of its margins. We note that while EBIT margins have improved from 28% to 38%, the company has actually reported a fall in revenue by 6.4%. While not disastrous, these figures could be better.

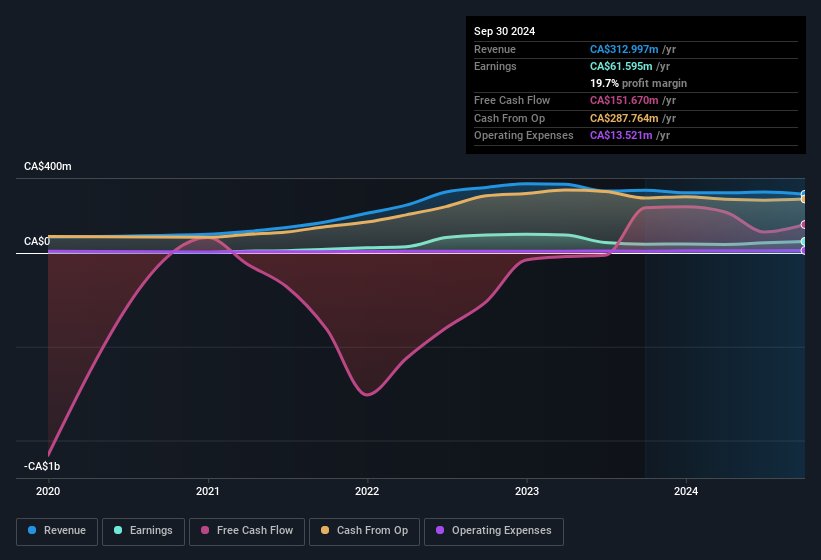

In the chart below, you can see how the company has grown earnings and revenue, over time. Click on the chart to see the exact numbers.

Of course the knack is to find stocks that have their best days in the future, not in the past. You could base your opinion on past performance, of course, but you may also want to check this interactive graph of professional analyst EPS forecasts for Topaz Energy.

Are Topaz Energy Insiders Aligned With All Shareholders?

Investors are always searching for a vote of confidence in the companies they hold and insider buying is one of the key indicators for optimism on the market. This view is based on the possibility that stock purchases signal bullishness on behalf of the buyer. Of course, we can never be sure what insiders are thinking, we can only judge their actions.

The real kicker here is that Topaz Energy insiders spent a staggering CA$4.4m on acquiring shares in just one year, without single share being sold in the meantime. Buying like that is a fantastic look for the company and should rouse the market in anticipation for the future. It is also worth noting that it was Chairman Michael Rose who made the biggest single purchase, worth CA$2.0m, paying CA$25.05 per share.

On top of the insider buying, it's good to see that Topaz Energy insiders have a valuable investment in the business. Notably, they have an enviable stake in the company, worth CA$190m. Investors will appreciate management having this amount of skin in the game as it shows their commitment to the company's future.

Shareholders have more to smile about than just insiders adding more shares to their already sizeable holdings. That's because Topaz Energy's CEO, Marty Staples, is paid at a relatively modest level when compared to other CEOs for companies of this size. The median total compensation for CEOs of companies similar in size to Topaz Energy, with market caps between CA$2.9b and CA$9.2b, is around CA$4.5m.

Topaz Energy's CEO took home a total compensation package worth CA$3.7m in the year leading up to December 2023. That seems pretty reasonable, especially given it's below the median for similar sized companies. CEO remuneration levels are not the most important metric for investors, but when the pay is modest, that does support enhanced alignment between the CEO and the ordinary shareholders. It can also be a sign of good governance, more generally.

Is Topaz Energy Worth Keeping An Eye On?

For growth investors, Topaz Energy's raw rate of earnings growth is a beacon in the night. On top of that, insiders own a significant stake in the company and have been buying more shares. So it's fair to say that this stock may well deserve a spot on your watchlist. We don't want to rain on the parade too much, but we did also find 2 warning signs for Topaz Energy (1 doesn't sit too well with us!) that you need to be mindful of.

There are plenty of other companies that have insiders buying up shares. So if you like the sound of Topaz Energy, you'll probably love this curated collection of companies in CA that have an attractive valuation alongside insider buying in the last three months.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Valuation is complex, but we're here to simplify it.

Discover if Topaz Energy might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSX:TPZ

Topaz Energy

Operates as a royalty and infrastructure energy company in Canada.

Reasonable growth potential and slightly overvalued.

Market Insights

Community Narratives