The board of Topaz Energy Corp. (TSE:TPZ) has announced that it will be paying its dividend of CA$0.30 on the 31st of March, an increased payment from last year's comparable dividend. This will take the dividend yield to an attractive 6.1%, providing a nice boost to shareholder returns.

See our latest analysis for Topaz Energy

Topaz Energy Doesn't Earn Enough To Cover Its Payments

Impressive dividend yields are good, but this doesn't matter much if the payments can't be sustained. Before this announcement, Topaz Energy was paying out 158% of what it was earning, and not generating any free cash flows either. Paying out such a large dividend compared to earnings while also not generating any free cash flow would definitely be difficult to keep up.

Over the next year, EPS is forecast to expand by 30.6%. If the dividend continues on its recent course, the payout ratio in 12 months could be 127%, which is a bit high and could start applying pressure to the balance sheet.

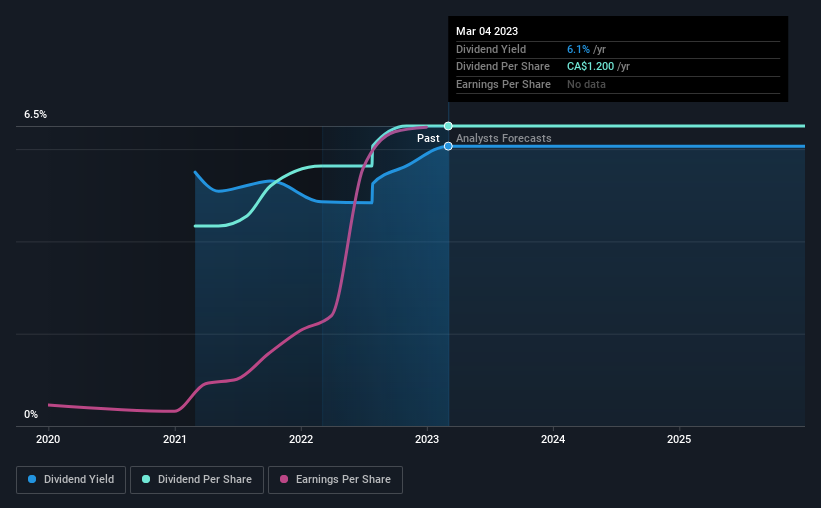

Topaz Energy Doesn't Have A Long Payment History

Looking back, the dividend has been stable, but the company hasn't been paying a dividend for very long so we can't be confident that the dividend will remain stable through all economic environments. Since 2021, the dividend has gone from CA$0.80 total annually to CA$1.20. This implies that the company grew its distributions at a yearly rate of about 22% over that duration. It is always nice to see strong dividend growth, but with such a short payment history we wouldn't be inclined to rely on it until a longer track record can be developed.

Topaz Energy's Dividend Might Lack Growth

Investors who have held shares in the company for the past few years will be happy with the dividend income they have received. Topaz Energy has impressed us by growing EPS at 70% per year over the past five years. Strong earnings is nice to see, but unless this can be sustained on minimal reinvestment of profits, we would question whether dividends will follow suit.

Topaz Energy's Dividend Doesn't Look Sustainable

Overall, we always like to see the dividend being raised, but we don't think Topaz Energy will make a great income stock. In general, the distributions are a little bit higher than we would like, but we can't ignore the fact the quickly growing earnings gives this stock great potential in the future. Overall, we don't think this company has the makings of a good income stock.

It's important to note that companies having a consistent dividend policy will generate greater investor confidence than those having an erratic one. Still, investors need to consider a host of other factors, apart from dividend payments, when analysing a company. Case in point: We've spotted 3 warning signs for Topaz Energy (of which 2 are a bit unpleasant!) you should know about. Looking for more high-yielding dividend ideas? Try our collection of strong dividend payers.

If you're looking to trade Topaz Energy, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Topaz Energy might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSX:TPZ

Topaz Energy

Operates as a royalty and infrastructure energy company in Canada.

Reasonable growth potential with proven track record.

Market Insights

Community Narratives