- Canada

- /

- Oil and Gas

- /

- TSX:TOU

Tourmaline Oil (TSX:TOU): Exploring Valuation as Analyst Targets Signal Possible Upside

Reviewed by Kshitija Bhandaru

Tourmaline Oil (TSX:TOU) has seen its stock price move modestly over the past week, as investors keep an eye on recent performance and upcoming developments in the Canadian energy sector. Shares closed at CA$60.28 yesterday.

See our latest analysis for Tourmaline Oil.

Tourmaline Oil’s latest share price moves come after a year of fading momentum, with a 1-year total shareholder return of -0.02% and a 5-year total return of just over 4%. Despite modest revenue and earnings growth, ongoing sector headwinds appear to overshadow near-term optimism.

If you’re scanning the market for more growth stories, this could be an ideal moment to discover fast growing stocks with high insider ownership.

With Tourmaline Oil’s fundamentals holding steady yet its stock lagging the sector, investors are left to wonder: Is the current share price undervaluing future growth, or has the market already factored in all the upside?

Most Popular Narrative: 19% Undervalued

Tourmaline Oil’s consensus price target stands nearly 19% above the recent closing price, a gap drawing attention as analysts weigh future growth. The stage is set for evidence behind this optimism, especially as sector challenges persist and strategic shifts begin to unfold.

Increasing international demand for lower-carbon energy is creating new export opportunities for Canadian natural gas. Tourmaline's long-term LNG supply agreement with Uniper and secured firm transportation to the U.S. Gulf Coast will provide direct access to premium global markets and pricing, increasing future revenues and cash flow.

What financial engine powers this bullish view? The narrative hinges on a big jump in future revenue, with payout multiples usually reserved for top-tier growth stocks. Want to see which assumptions drive this price target and the wildcards that could send estimates soaring? Dive in to uncover the audacious forecasts and the numbers that matter most to this scenario.

Result: Fair Value of $74.42 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, lingering volatility in natural gas prices and mounting capital commitments could quickly undermine expectations for Tourmaline’s future revenue and profit growth.

Find out about the key risks to this Tourmaline Oil narrative.

Another View: Earnings Multiple Tells a Different Story

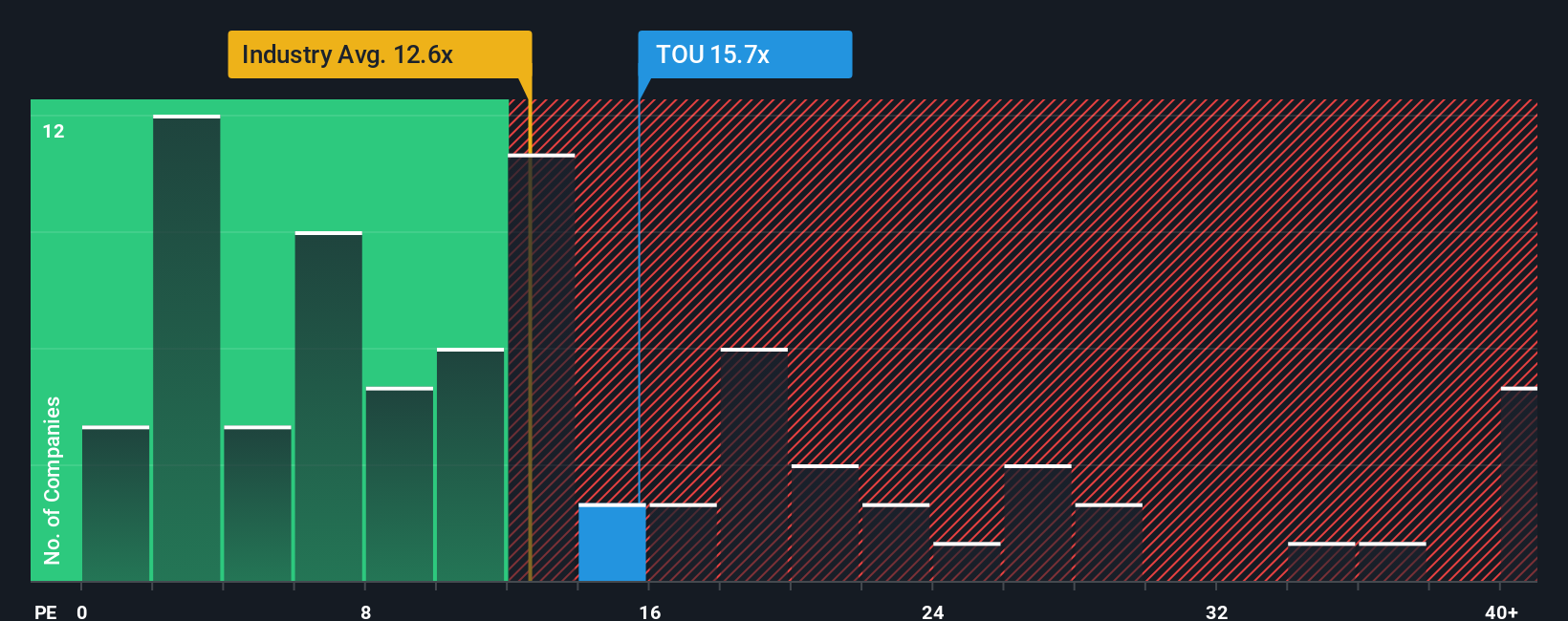

While the fair value estimate suggests Tourmaline Oil is undervalued, looking at the current price-to-earnings ratio offers a contrasting perspective. The company trades at 15.7 times earnings, which is higher than both industry (12.3x) and peer (12x) averages, but below the market’s fair ratio of 18.3x. Does this premium reflect future growth or introduce new valuation risks?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Tourmaline Oil Narrative

If you prefer your own conclusions or want to test the data yourself, it only takes a few minutes to craft a unique perspective. Do it your way.

A great starting point for your Tourmaline Oil research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Step ahead of the crowd by checking out investment opportunities that could deliver exceptional performance and align with your financial goals. Don’t wait for the market to move. Get inspired by these timely ideas today:

- Capture growth potential by targeting market leaders using these 24 AI penny stocks shaping the future of artificial intelligence innovation.

- Maximize your income stream by reviewing these 19 dividend stocks with yields > 3% featuring strong yields and consistent payouts for reliable returns.

- Be an early mover into emerging technologies by tapping into these 26 quantum computing stocks, where the next breakthroughs in computing are taking off.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Tourmaline Oil might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:TOU

Tourmaline Oil

Engages in the acquisition, exploration, development, and production of petroleum and natural gas properties in the Western Canadian Sedimentary Basin.

Good value with reasonable growth potential.

Market Insights

Community Narratives