- Canada

- /

- Oil and Gas

- /

- TSX:TOU

Tourmaline Oil (TSX:TOU): Assessing Valuation as Investors Eye Key Updates at Calgary Conference

Reviewed by Kshitija Bhandaru

Tourmaline Oil (TSX:TOU) is set to present at the Schachter Catch the Energy Conference on October 18 in Calgary. This event often draws investor attention as the company outlines its outlook and strategic direction.

See our latest analysis for Tourmaline Oil.

Tourmaline Oil has seen its share price taper off this year, with a year-to-date decline of 12.3 percent. However, the total shareholder return over the past twelve months is just above break-even. Despite some recent volatility, long-term investors have still enjoyed a remarkable 351 percent gain over five years. This suggests that earlier momentum is giving way to a more cautious market mood as investors weigh upcoming updates at the conference.

If this shift in sentiment has you curious about other opportunities, now’s a great time to broaden your investing horizons and discover fast growing stocks with high insider ownership

With shares trading at a 25 percent discount to analyst targets and strong underlying growth, investors must ask if Tourmaline Oil is an undervalued pick right now or if the market has already accounted for its future potential.

Most Popular Narrative: 20.1% Undervalued

Tourmaline Oil’s widely-followed narrative signals a notable pricing gap, with its fair value estimate standing well above the latest closing share price. Expectations for future growth underpin this optimism, even as analysts debate how much upside remains.

Strategic build-out of low-cost, high-margin inventory in the Northeast BC Montney, with associated infrastructure owned by Tourmaline, positions the company for meaningful production growth to 850,000 BOE/d by early next decade. At flat pricing, this will more than double annual free cash flow, supporting higher future dividend payments and potential buybacks.

Curious why analysts see room for such a valuation jump? The narrative hinges on aggressive production targets and bold profit projections few energy companies can match. Find out what’s fueling these high expectations and how they factor into the fair value estimate.

Result: Fair Value of $73.95 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent weakness in North American gas prices and major capital spending obligations could create significant challenges for Tourmaline’s future earnings and valuation.

Find out about the key risks to this Tourmaline Oil narrative.

Another View: What Do Market Ratios Suggest?

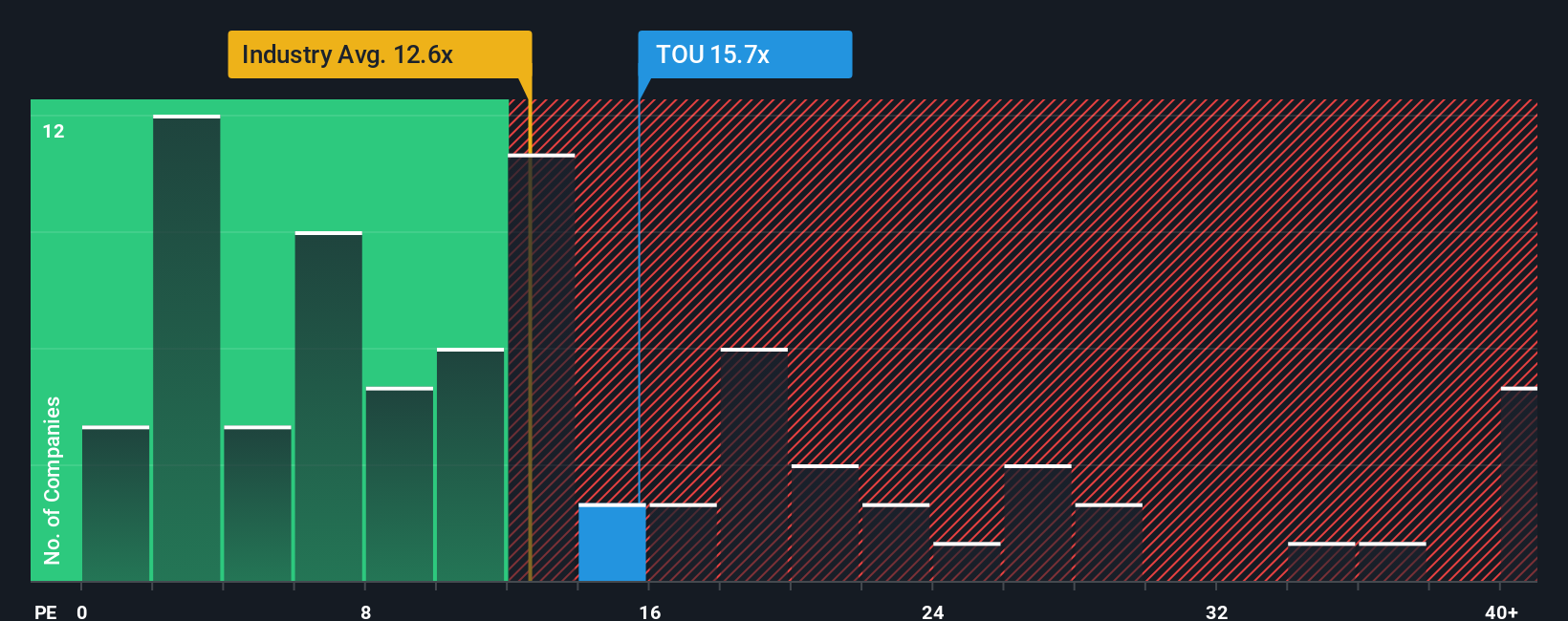

Looking at Tourmaline Oil through the lens of price-to-earnings, the shares trade at 15.3x earnings, which is higher than both the Canadian oil and gas industry average of 12x and the peer average of 12x. However, this remains below the fair ratio of 17.5x that the market could move towards. This gap raises a question: is the market being too cautious, or are investors already pricing in execution risks?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Tourmaline Oil Narrative

If you have a different perspective or want to dive deeper into the numbers yourself, you can craft your own analysis in just minutes. Do it your way

A great starting point for your Tourmaline Oil research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Get ahead of the curve and supercharge your portfolio by checking out fast-moving opportunities beyond Tourmaline Oil. Don’t wait for the crowd. Lead your investment journey now:

- Tap into tomorrow’s industry leaders and seize early-mover advantages with these 24 AI penny stocks focused on artificial intelligence innovation and disruption.

- Collect powerful yields and steady cashflow with these 18 dividend stocks with yields > 3%, highlighting top companies delivering impressive dividend payouts.

- Unlock access to untapped value by targeting these 877 undervalued stocks based on cash flows where strong fundamentals meet attractive prices.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Tourmaline Oil might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:TOU

Tourmaline Oil

Engages in the acquisition, exploration, development, and production of petroleum and natural gas properties in the Western Canadian Sedimentary Basin.

Good value with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives