- Canada

- /

- Energy Services

- /

- TSX:TOT

Top TSX Dividend Stocks To Consider In January 2025

Reviewed by Simply Wall St

As we enter 2025, the Canadian market is navigating a landscape marked by rising government bond yields and political shifts, with investors focusing on fundamentals rather than political headlines. In this environment, dividend stocks can offer stability and income potential, making them an attractive option for those looking to diversify their portfolios amidst uncertainty.

Top 10 Dividend Stocks In Canada

| Name | Dividend Yield | Dividend Rating |

| Whitecap Resources (TSX:WCP) | 7.08% | ★★★★★★ |

| Acadian Timber (TSX:ADN) | 6.74% | ★★★★★★ |

| Olympia Financial Group (TSX:OLY) | 6.71% | ★★★★★☆ |

| Russel Metals (TSX:RUS) | 4.17% | ★★★★★☆ |

| Power Corporation of Canada (TSX:POW) | 5.29% | ★★★★★☆ |

| Royal Bank of Canada (TSX:RY) | 3.45% | ★★★★★☆ |

| Canadian Natural Resources (TSX:CNQ) | 4.65% | ★★★★★☆ |

| Firm Capital Mortgage Investment (TSX:FC) | 8.39% | ★★★★★☆ |

| Richards Packaging Income Fund (TSX:RPI.UN) | 5.63% | ★★★★★☆ |

| Sun Life Financial (TSX:SLF) | 3.98% | ★★★★★☆ |

Click here to see the full list of 27 stocks from our Top TSX Dividend Stocks screener.

Let's review some notable picks from our screened stocks.

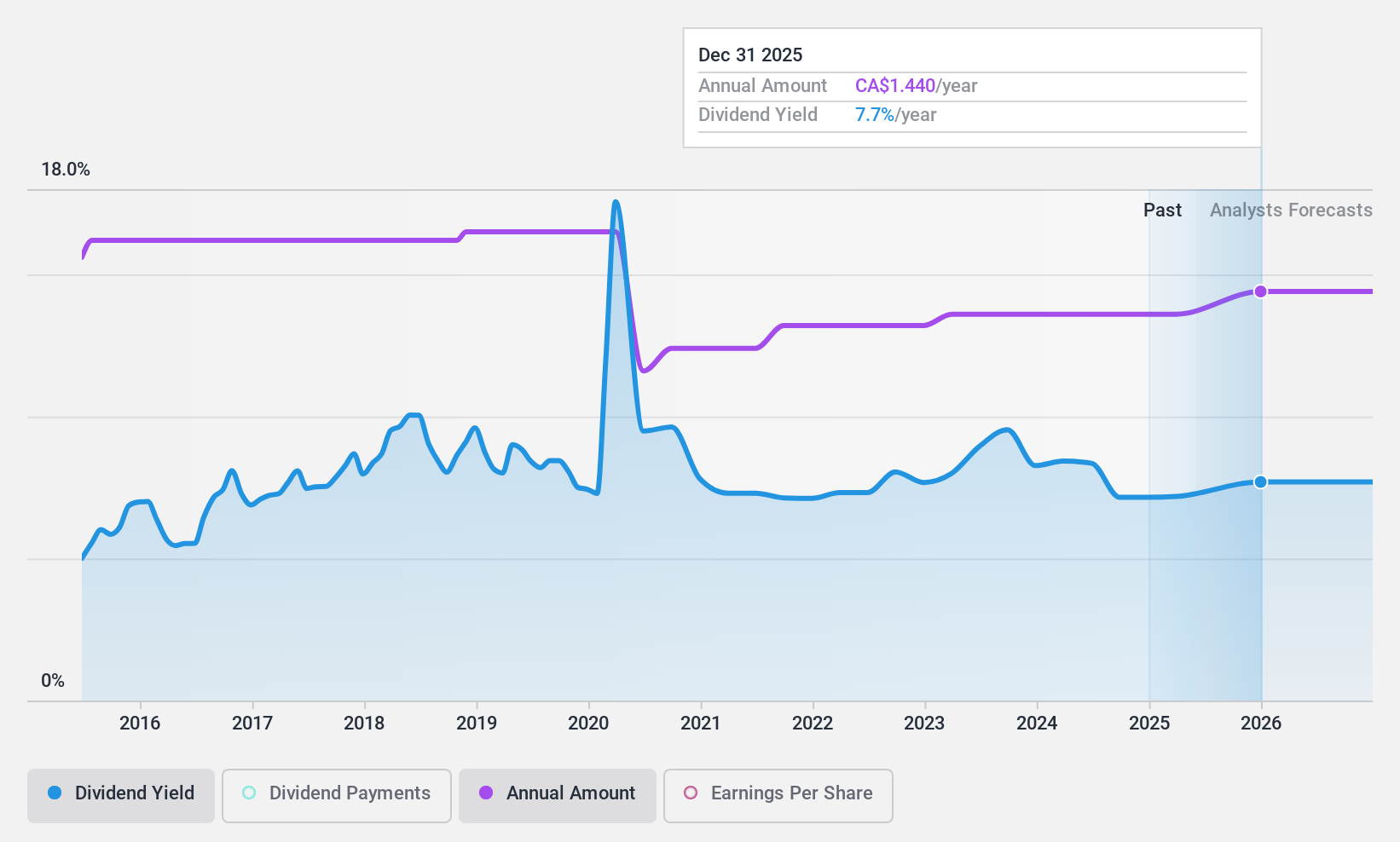

Alaris Equity Partners Income Trust (TSX:AD.UN)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Alaris Equity Partners Income Trust is a private equity firm focused on management buyouts, growth capital, and mature investments in the lower and middle market, with a market cap of CA$815.33 million.

Operations: Alaris Equity Partners Income Trust generates revenue of CA$198.46 million from its unclassified services segment.

Dividend Yield: 7.3%

Alaris Equity Partners Income Trust offers a compelling dividend yield, ranking in the top 25% of Canadian dividend payers. Recent financials reveal a solid earnings coverage with a payout ratio of 31.4%, although cash flow coverage is tighter at 83.8%. Despite past volatility and declining dividends over the last decade, recent affirmations maintain stability with an annualized distribution of C$1.36 per unit. The stock trades below analyst price targets, suggesting potential value upside.

- Get an in-depth perspective on Alaris Equity Partners Income Trust's performance by reading our dividend report here.

- Upon reviewing our latest valuation report, Alaris Equity Partners Income Trust's share price might be too pessimistic.

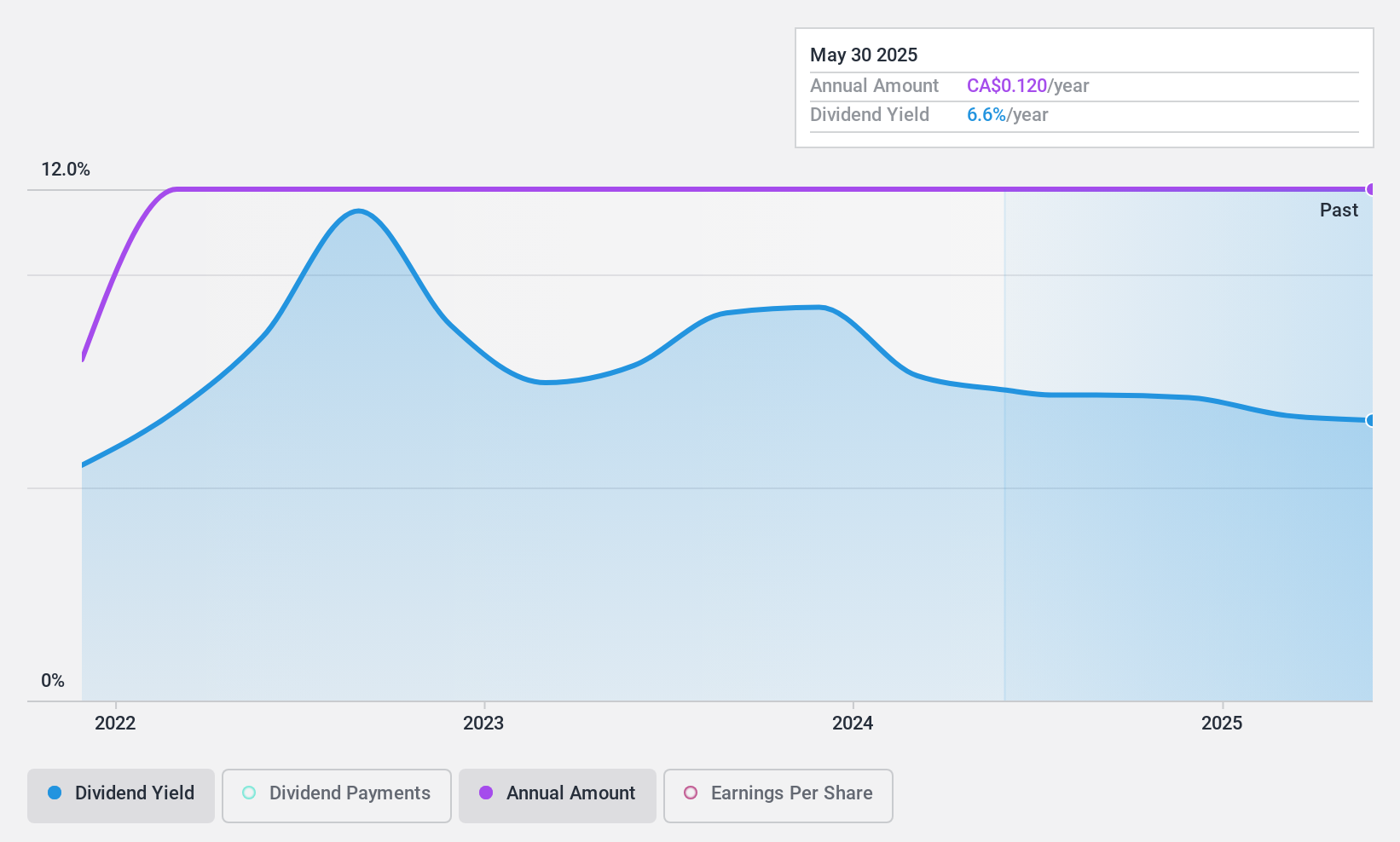

Amerigo Resources (TSX:ARG)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Amerigo Resources Ltd., via its subsidiary Minera Valle Central S.A., produces and sells copper and molybdenum concentrates from Codelco’s El Teniente underground mine in Chile, with a market cap of CA$266.54 million.

Operations: Amerigo Resources Ltd. generates revenue primarily from the production of copper concentrates under a tolling agreement with DET, amounting to $184.41 million.

Dividend Yield: 7.3%

Amerigo Resources has demonstrated strong dividend coverage with a payout ratio of 72.7% and cash payout ratio of 35.6%, supported by recent profitability. However, its dividend history is short and marked by volatility, raising concerns about long-term stability. The company recently declared a C$0.03 per share dividend, reflecting a yield in the top 25% of Canadian payers. Despite trading below estimated fair value, investors should weigh the risks associated with its inconsistent dividend track record.

- Click to explore a detailed breakdown of our findings in Amerigo Resources' dividend report.

- Our comprehensive valuation report raises the possibility that Amerigo Resources is priced lower than what may be justified by its financials.

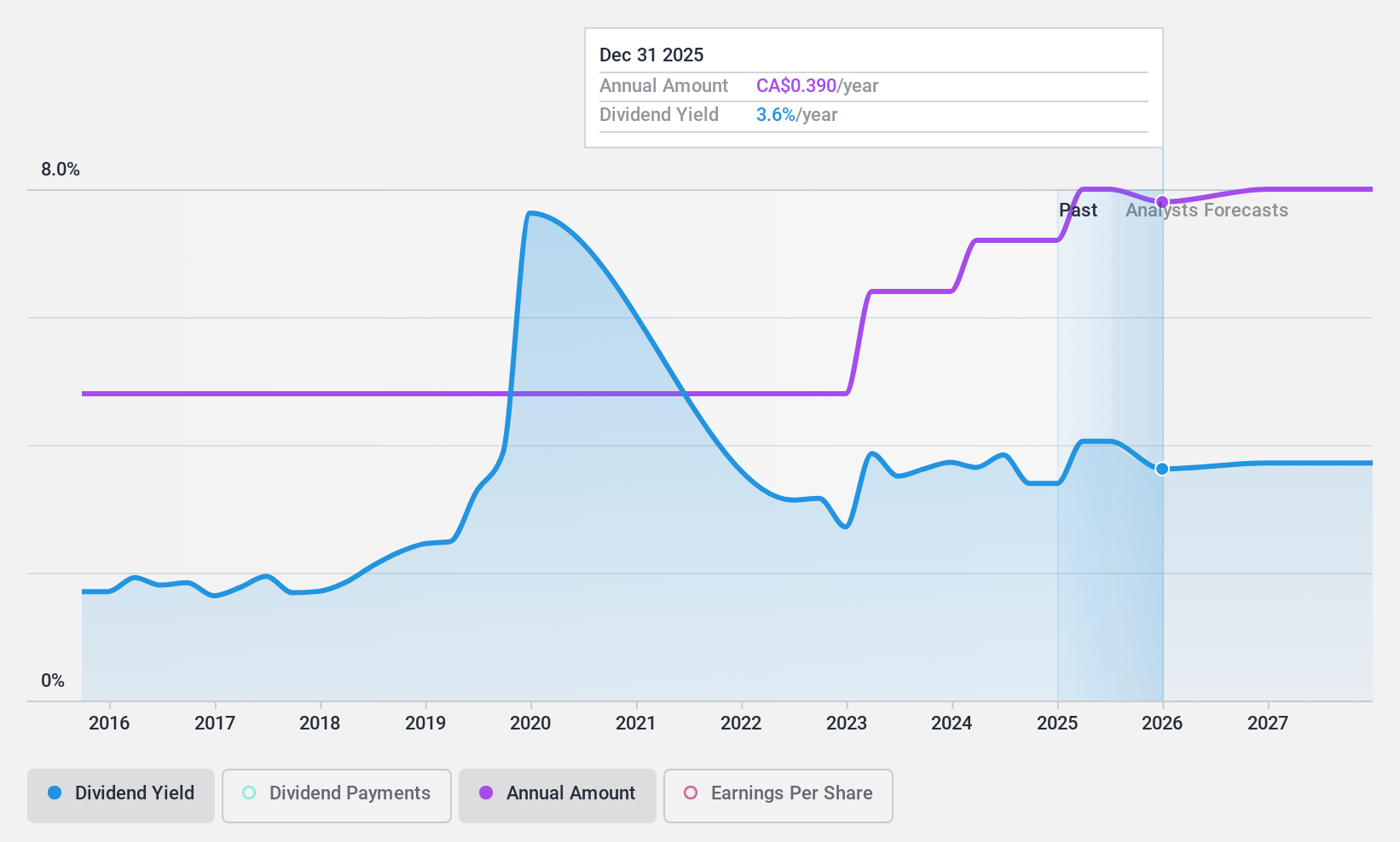

Total Energy Services (TSX:TOT)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Total Energy Services Inc. is an energy services company operating mainly in Canada, the United States, and Australia with a market cap of CA$459.86 million.

Operations: Total Energy Services Inc. generates revenue through four main segments: Well Servicing (CA$91.14 million), Contract Drilling Services (CA$310.43 million), Compression and Process Services (CA$392.99 million), and Rentals and Transportation Services (CA$79.16 million).

Dividend Yield: 3%

Total Energy Services offers a quarterly dividend of C$0.09 per share, with coverage supported by a low payout ratio of 32.3% and cash payout ratio of 14.2%. Despite recent earnings growth, its dividend history is marked by volatility and unreliability over the past decade. The company is actively pursuing acquisitions in the U.S., which could impact future dividends. Its dividend yield is relatively low compared to top Canadian payers, but shares are trading below estimated fair value.

- Take a closer look at Total Energy Services' potential here in our dividend report.

- Our valuation report unveils the possibility Total Energy Services' shares may be trading at a discount.

Key Takeaways

- Click this link to deep-dive into the 27 companies within our Top TSX Dividend Stocks screener.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Total Energy Services might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:TOT

Total Energy Services

Operates as an energy services company primarily in Canada, the United States, and Australia.

Flawless balance sheet average dividend payer.