- Canada

- /

- Specialty Stores

- /

- TSX:LNF

3 TSX Dividend Stocks With Yields Up To 4.2%

Reviewed by Simply Wall St

In recent times, the Canadian market has shown resilience amidst global economic fluctuations, with particular attention on stable dividend-yielding stocks as a potential harbor for investors seeking consistent returns. As market conditions continue to evolve, understanding the characteristics of strong dividend stocks—such as robust financial health and a history of reliable payouts—becomes crucial for those looking to fortify their investment portfolios against uncertainty.

Top 10 Dividend Stocks In Canada

| Name | Dividend Yield | Dividend Rating |

| Bank of Nova Scotia (TSX:BNS) | 6.59% | ★★★★★★ |

| Whitecap Resources (TSX:WCP) | 7.21% | ★★★★★★ |

| Power Corporation of Canada (TSX:POW) | 5.69% | ★★★★★☆ |

| Enghouse Systems (TSX:ENGH) | 3.78% | ★★★★★☆ |

| Secure Energy Services (TSX:SES) | 3.51% | ★★★★★☆ |

| Boston Pizza Royalties Income Fund (TSX:BPF.UN) | 8.61% | ★★★★★☆ |

| Canadian Western Bank (TSX:CWB) | 5.38% | ★★★★★☆ |

| Russel Metals (TSX:RUS) | 4.62% | ★★★★★☆ |

| Canadian Natural Resources (TSX:CNQ) | 4.20% | ★★★★★☆ |

| Royal Bank of Canada (TSX:RY) | 3.73% | ★★★★★☆ |

Click here to see the full list of 32 stocks from our Top TSX Dividend Stocks screener.

Let's review some notable picks from our screened stocks.

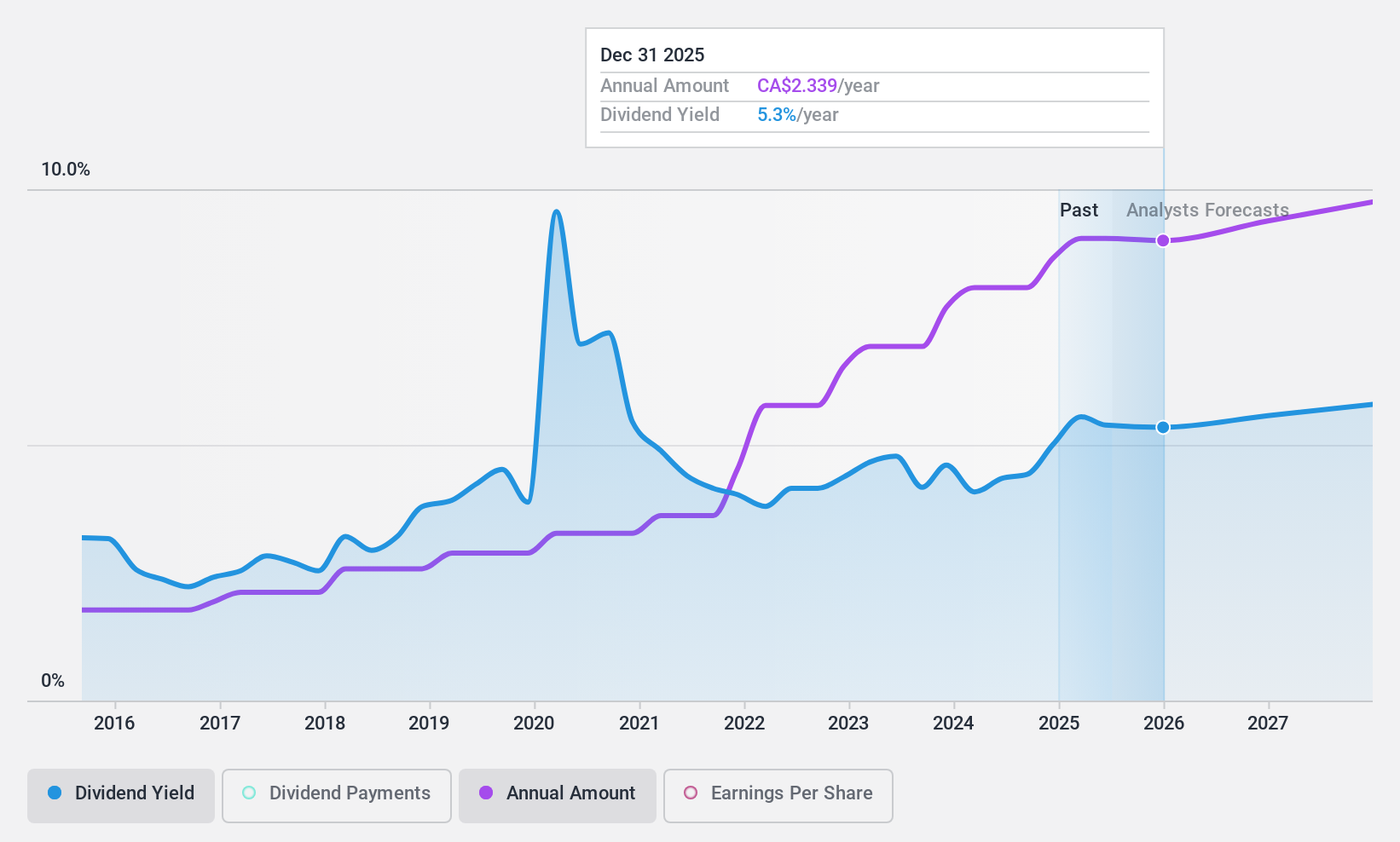

Canadian Natural Resources (TSX:CNQ)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Canadian Natural Resources Limited, operating in the energy sector, engages in the acquisition, exploration, development, production, marketing, and sale of crude oil, natural gas, and NGLs with a market cap of approximately CA$111.83 billion.

Operations: Canadian Natural Resources Limited generates revenue primarily through its segments: Midstream and Refining (CA$0.97 billion), Oil Sands Mining and Upgrading (CA$15.80 billion), Exploration and Production in the North Sea (CA$0.58 billion), North America (CA$17.43 billion), and Offshore Africa (CA$0.57 billion).

Dividend Yield: 4.2%

Canadian Natural Resources Limited (CNQ) offers a modest dividend yield of 4.2%, which is below the top quartile in the Canadian market. Despite this, dividends appear sustainable with a payout ratio of 56.2% and cash payout ratio at 49%. Recent financials show a decline in net income from CAD 1.8 billion to CAD 987 million year-over-year, but the firm maintains its dividend commitment, recently declaring a quarterly dividend post-stock split and actively repurchasing shares, signaling confidence in its financial health.

- Delve into the full analysis dividend report here for a deeper understanding of Canadian Natural Resources.

- Insights from our recent valuation report point to the potential undervaluation of Canadian Natural Resources shares in the market.

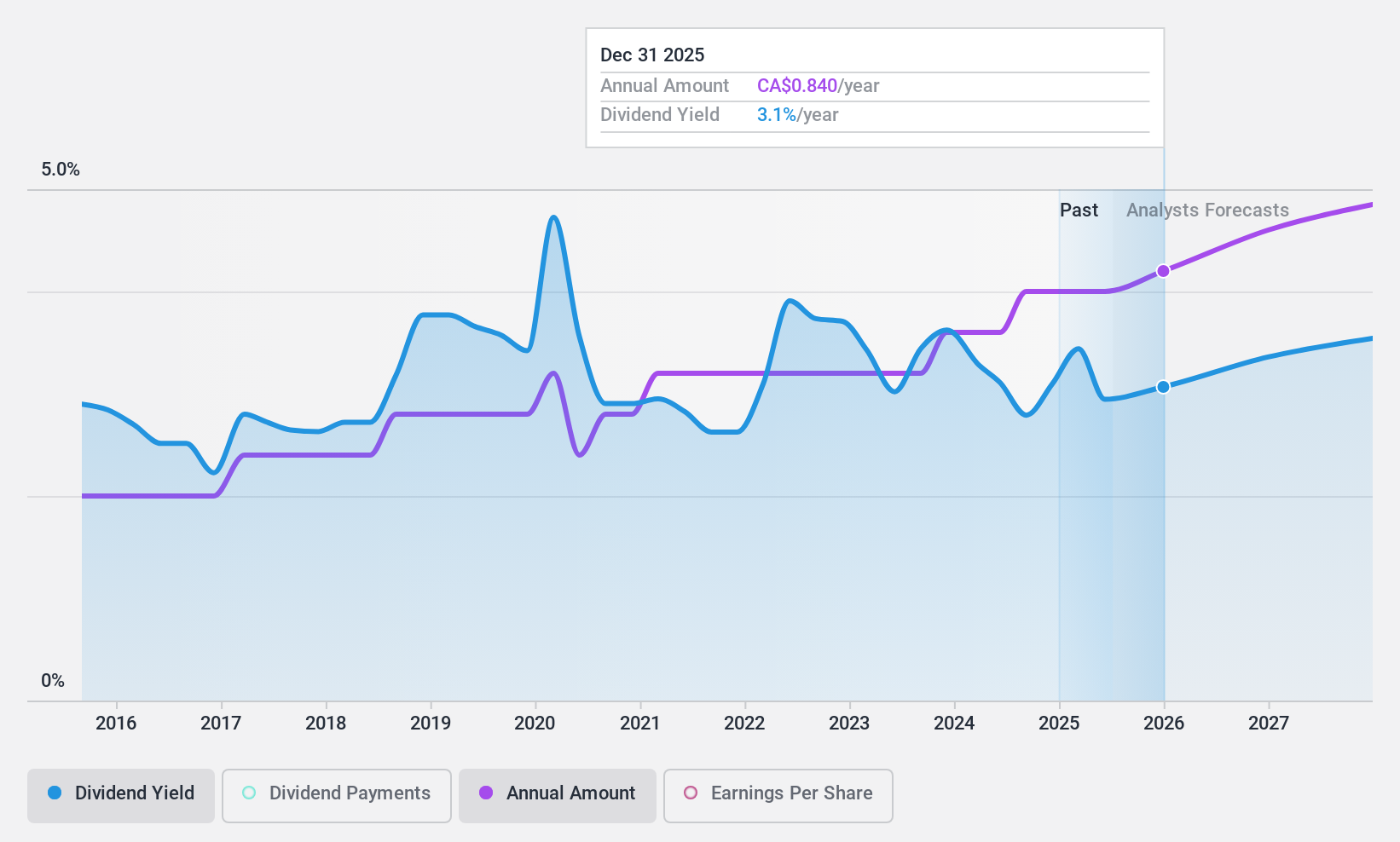

Leon's Furniture (TSX:LNF)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Leon's Furniture Limited, a Canadian retailer, specializes in selling home furnishings, mattresses, appliances, and electronics with a market capitalization of CA$1.49 billion.

Operations: Leon's Furniture Limited generates CA$2.50 billion in revenue primarily from its sales of home furnishings, mattresses, appliances, and electronics.

Dividend Yield: 3.3%

Leon's Furniture reported a strong Q1 in 2024, with sales rising to CA$562.25 million and net income increasing to CA$18.82 million. The company declared a quarterly dividend of $0.18 per share, maintaining its payout amidst executive transitions, including a new interim CFO from April 2024. Despite a decade of fluctuating dividends, recent earnings and cash flow coverage ratios (31.9% and 25.1%, respectively) suggest improved stability in dividend payments, though the yield remains modest at 3.25%.

- Click here to discover the nuances of Leon's Furniture with our detailed analytical dividend report.

- The valuation report we've compiled suggests that Leon's Furniture's current price could be quite moderate.

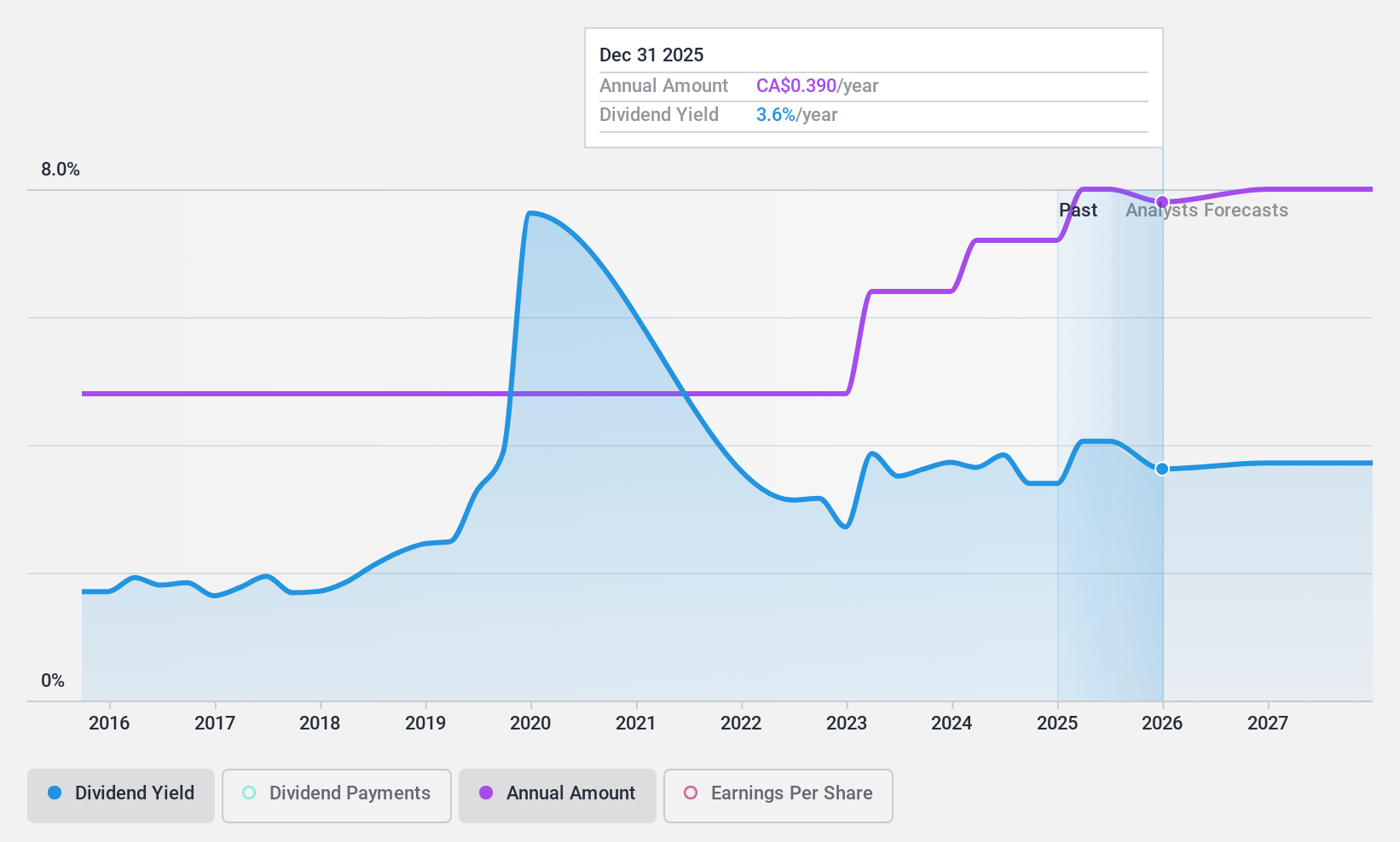

Total Energy Services (TSX:TOT)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Total Energy Services Inc. is an energy services company with operations mainly in Canada, the United States, and Australia, boasting a market capitalization of approximately CA$377.35 million.

Operations: Total Energy Services Inc. generates revenue through four primary segments: Well Servicing (CA$93.37 million), Contract Drilling Services (CA$286.01 million), Compression and Process Services (CA$397.05 million), and Rentals and Transportation Services (CA$82.87 million).

Dividend Yield: 3.9%

Total Energy Services has seen a decrease in profit margins from 7.1% to 3.8% over the past year, reflecting challenges in maintaining profitability. Despite this, dividends have grown over the last decade but with significant volatility, including annual drops exceeding 20%. The dividend yield stands at 3.86%, lower than the top quartile of Canadian dividend stocks at 6.39%. However, both earnings and cash flows substantiate current dividend levels with payout ratios of 40% and 18.1%, respectively, suggesting a foundation for ongoing payments despite an unstable track record. Recent affirmations include a quarterly dividend declaration of CAD$0.09 per share as of May 31, 2024.

- Navigate through the intricacies of Total Energy Services with our comprehensive dividend report here.

- In light of our recent valuation report, it seems possible that Total Energy Services is trading behind its estimated value.

Taking Advantage

- Unlock our comprehensive list of 32 Top TSX Dividend Stocks by clicking here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:LNF

Leon's Furniture

Operates as a retailer of home furnishings, mattresses, appliances, and electronics in Canada.

Flawless balance sheet, undervalued and pays a dividend.

Similar Companies

Market Insights

Community Narratives