- Canada

- /

- Energy Services

- /

- TSX:TCW

Trican Well Service (TSE:TCW) Shareholders Have Enjoyed An Impressive 113% Share Price Gain

Unfortunately, investing is risky - companies can and do go bankrupt. But if you pick the right stock, you can make a lot more than 100%. For example, the Trican Well Service Ltd. (TSE:TCW) share price has soared 113% return in just a single year. Also pleasing for shareholders was the 44% gain in the last three months. This could be related to the recent financial results, released recently - you can catch up on the most recent data by reading our company report. Zooming out, the stock is actually down 44% in the last three years.

Check out our latest analysis for Trican Well Service

Because Trican Well Service made a loss in the last twelve months, we think the market is probably more focussed on revenue and revenue growth, at least for now. When a company doesn't make profits, we'd generally expect to see good revenue growth. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

Trican Well Service actually shrunk its revenue over the last year, with a reduction of 38%. So we would not have expected the share price to rise 113%. It just goes to show the market doesn't always pay attention to the reported numbers. Of course, it could be that the market expected this revenue drop.

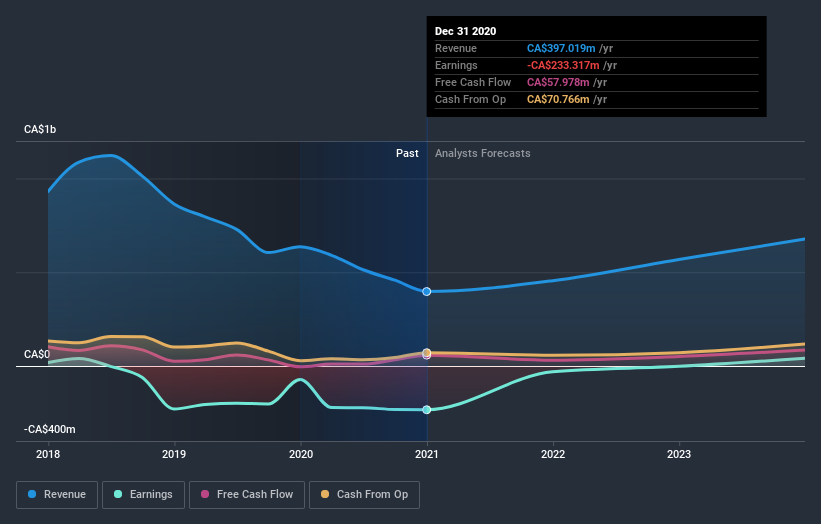

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

We're pleased to report that the CEO is remunerated more modestly than most CEOs at similarly capitalized companies. It's always worth keeping an eye on CEO pay, but a more important question is whether the company will grow earnings throughout the years. So we recommend checking out this free report showing consensus forecasts

A Different Perspective

It's nice to see that Trican Well Service shareholders have received a total shareholder return of 113% over the last year. Since the one-year TSR is better than the five-year TSR (the latter coming in at 4% per year), it would seem that the stock's performance has improved in recent times. Someone with an optimistic perspective could view the recent improvement in TSR as indicating that the business itself is getting better with time. It's always interesting to track share price performance over the longer term. But to understand Trican Well Service better, we need to consider many other factors. Consider for instance, the ever-present spectre of investment risk. We've identified 1 warning sign with Trican Well Service , and understanding them should be part of your investment process.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on CA exchanges.

If you’re looking to trade Trican Well Service, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Trican Well Service might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TSX:TCW

Trican Well Service

An equipment services company, provides various products, equipment, services, and technology for use in the drilling, completion, stimulation, and reworking of oil and gas wells in Canada.

Very undervalued with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives