- Canada

- /

- Diversified Financial

- /

- TSX:FN

Exploring 3 Undervalued Small Caps In Canada With Insider Action

Reviewed by Simply Wall St

As the Canadian market navigates a period of economic transition, marked by cooling labor markets and anticipated rate cuts from the Bank of Canada, investors are keenly observing how these macroeconomic shifts might influence small-cap stocks. In this environment, identifying promising small-cap opportunities involves looking for companies with strong fundamentals and potential growth catalysts that could benefit from easing monetary policies.

Top 10 Undervalued Small Caps With Insider Buying In Canada

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| AutoCanada | NA | 0.1x | 43.64% | ★★★★★★ |

| Rogers Sugar | 15.1x | 0.6x | 49.00% | ★★★★★☆ |

| Nexus Industrial REIT | 3.5x | 3.5x | 20.08% | ★★★★★☆ |

| Trican Well Service | 8.1x | 0.9x | 18.04% | ★★★★★☆ |

| Calfrac Well Services | 2.6x | 0.2x | 17.78% | ★★★★★☆ |

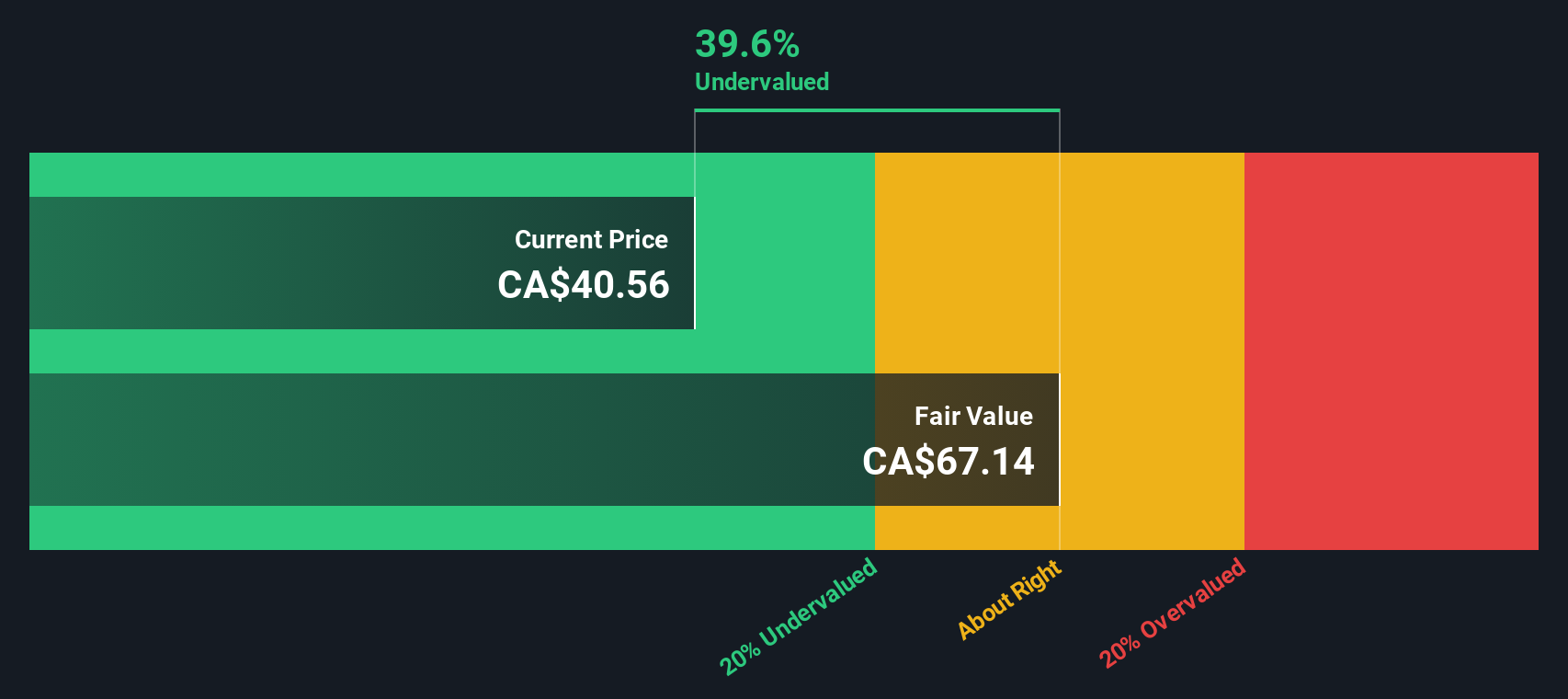

| First National Financial | 13.7x | 3.9x | 42.92% | ★★★★☆☆ |

| Primaris Real Estate Investment Trust | 12.8x | 3.4x | 46.67% | ★★★★☆☆ |

| Sagicor Financial | 1.3x | 0.3x | -35.99% | ★★★★☆☆ |

| Vermilion Energy | NA | 1.1x | -227.46% | ★★★★☆☆ |

| Hemisphere Energy | 6.1x | 2.3x | -221.70% | ★★★☆☆☆ |

Let's explore several standout options from the results in the screener.

First National Financial (TSX:FN)

Simply Wall St Value Rating: ★★★★☆☆

Overview: First National Financial operates as a mortgage lender in Canada, focusing on commercial and residential segments, with a market cap of CA$2.4 billion.

Operations: The company generates revenue primarily from its residential and commercial segments, with the residential segment being the larger contributor. Over recent periods, it has experienced a notable trend in gross profit margin, reaching 86.04% as of September 30, 2024. Operating expenses are significant, with general and administrative expenses forming a substantial part of these costs.

PE: 13.7x

First National Financial, a smaller player in the Canadian market, is drawing attention for its potential value. Despite a dip in net income to C$36.41 million for Q3 2024 from C$83.63 million last year, insider confidence is evident with Stephen J. Smith purchasing 128,614 shares worth over C$4.86 million recently. The company announced a special dividend of $0.50 per share and increased its regular dividend to an annualized rate of $2.50 per share, suggesting shareholder-friendly policies amidst challenging earnings results and higher risk funding reliance on external borrowing sources rather than customer deposits.

- Get an in-depth perspective on First National Financial's performance by reading our valuation report here.

Assess First National Financial's past performance with our detailed historical performance reports.

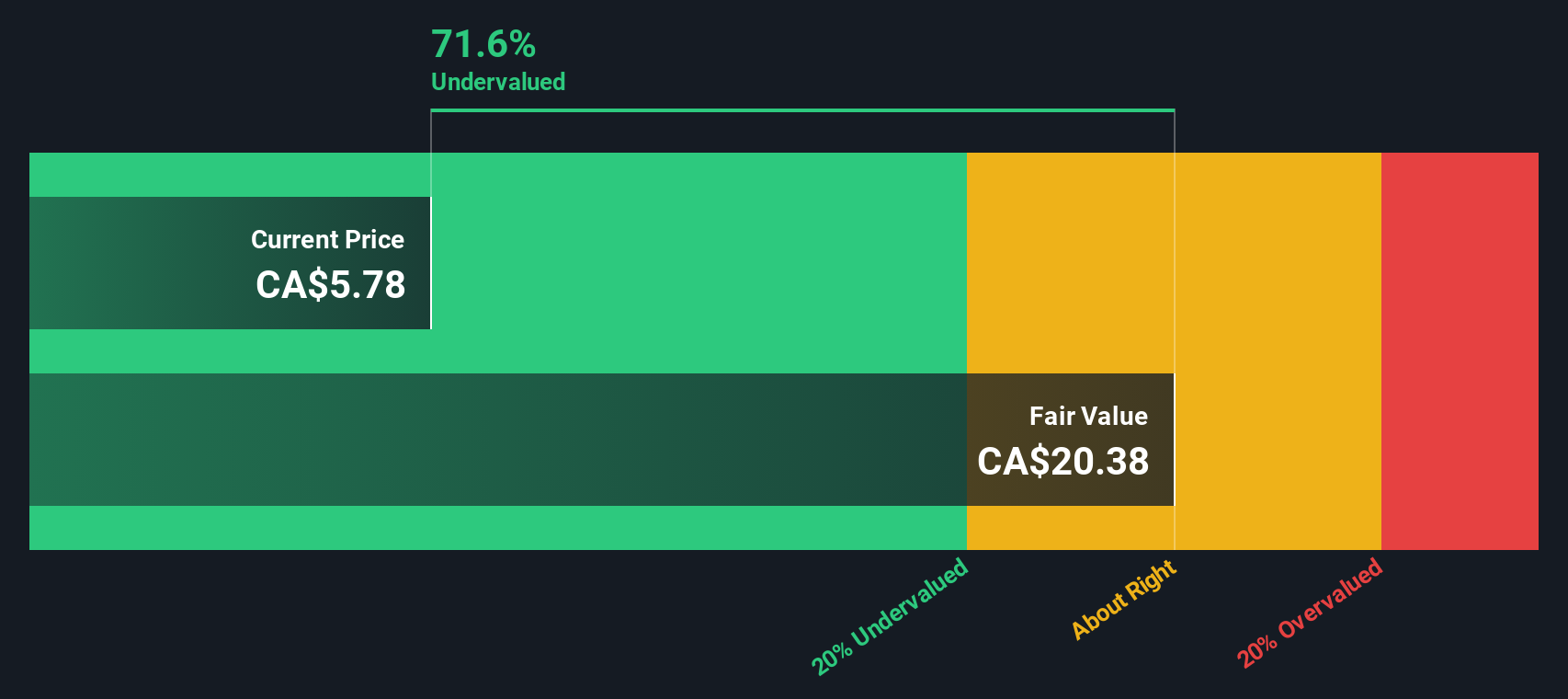

Trican Well Service (TSX:TCW)

Simply Wall St Value Rating: ★★★★★☆

Overview: Trican Well Service is a company that provides oil well equipment and services, with a market capitalization of CA$1.07 billion.

Operations: Trican Well Service generates revenue primarily from oil well equipment and services, with recent figures indicating a revenue of CA$960.24 million. The company has experienced fluctuations in its gross profit margin, which reached 29.22% as of June 2023, reflecting changes in cost management and pricing strategies over time. Operating expenses have consistently included general and administrative costs, contributing to the overall financial performance.

PE: 8.1x

Trican Well Service, a smaller player in the Canadian market, has caught attention with insider confidence shown by Scott Matson's purchase of 27,000 shares for C$130,140 in October 2024. Despite reporting a dip in Q3 sales to C$221.59 million from C$252.5 million last year and earnings per share dropping to C$0.12 from C$0.17, the company completed a significant buyback of over 21 million shares worth C$94.7 million by early October 2024. This strategic move might indicate management’s belief in the company's potential despite forecasted earnings decline and reliance on external borrowing for funding.

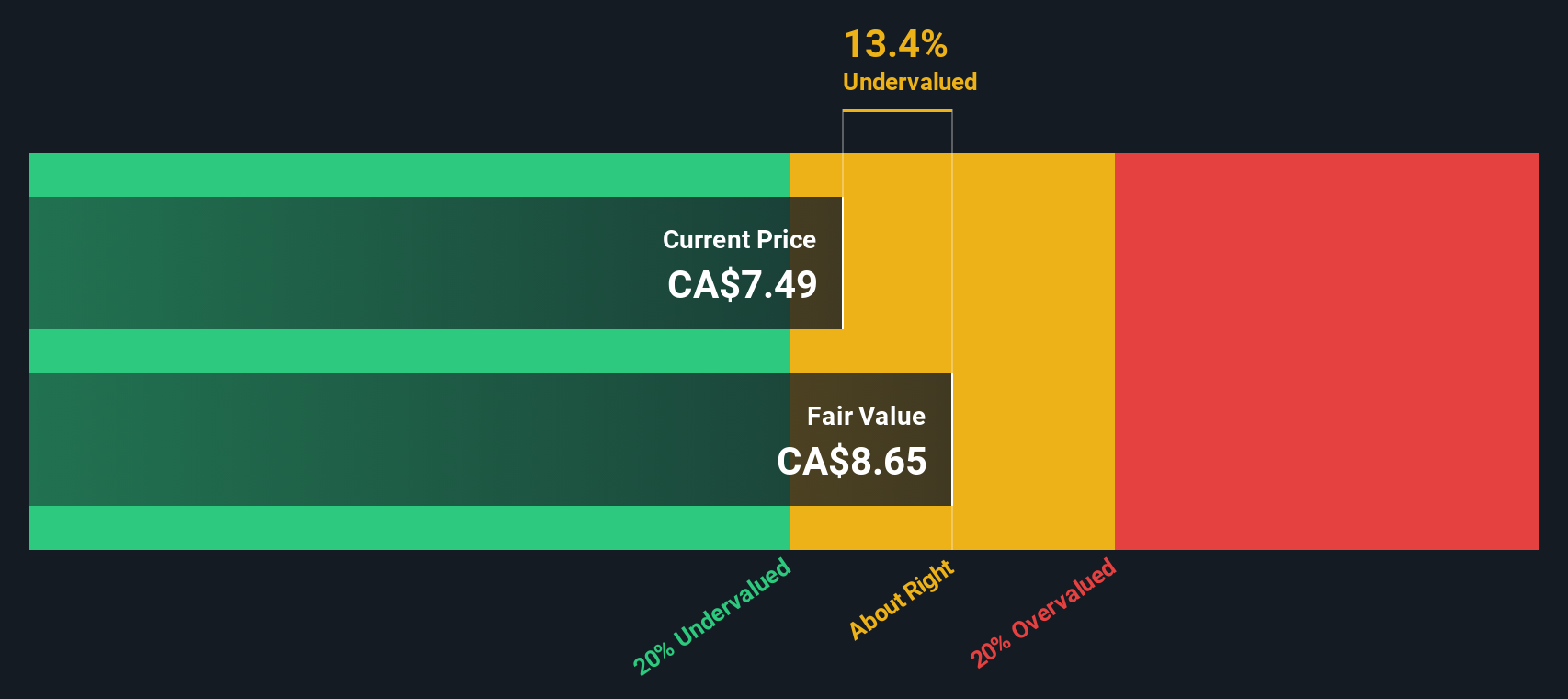

Valeura Energy (TSX:VLE)

Simply Wall St Value Rating: ★★★★★☆

Overview: Valeura Energy is an oil and gas company focused on exploration and production activities, with a market capitalization of approximately $2.50 billion.

Operations: Valeura Energy generates revenue primarily from its oil and gas exploration and production activities, with recent quarterly revenues reaching $564.59 million. The company has seen fluctuations in its gross profit margin, which was 66.63% as of the latest period. Operating expenses and non-operating expenses significantly impact net income, with a notable net income margin of 8.50% in the most recent quarter.

PE: 7.4x

Valeura Energy, a smaller player in the Canadian market, has recently showcased insider confidence through share purchases in 2024. Despite facing a forecasted decline in earnings over the next three years, their recent production achievements are noteworthy. In August 2024, they began oil production from Nong Yao C development offshore Thailand and reported an average daily oil output of 22.2 mbbls/d for Q3 2024. With revenue of US$281 million for the first half of 2024 and improved net income compared to losses last year, Valeura's strategic moves position them as a potentially undervalued opportunity amidst fluctuating profitability margins and external funding risks.

- Click here and access our complete valuation analysis report to understand the dynamics of Valeura Energy.

Gain insights into Valeura Energy's past trends and performance with our Past report.

Taking Advantage

- Take a closer look at our Undervalued TSX Small Caps With Insider Buying list of 22 companies by clicking here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:FN

First National Financial

First National Financial Corporation, together with its subsidiaries, originates, underwrites, and services commercial and residential mortgages in Canada.

Established dividend payer with moderate growth potential.