- Canada

- /

- Oil and Gas

- /

- TSX:SU

Suncor Energy (TSX:SU) Reports Record Refining Throughput and Dividend While Navigating Market Pressures

Suncor Energy (TSX:SU) is navigating a dynamic landscape marked by both opportunities and challenges. Recent highlights include a record-breaking increase in refining throughput and significant improvements in safety performance, juxtaposed against market challenges and projected declines in earnings. In the discussion that follows, we will delve into Suncor's core advantages, critical issues, strategic growth initiatives, and external threats to provide a comprehensive overview of the company's current business situation.

Click to explore a detailed breakdown of our findings on Suncor Energy.

Strengths: Core Advantages Driving Sustained Success For Suncor Energy

Suncor Energy has demonstrated robust growth and operational excellence, particularly in refining throughput, which reached 455,000 barrels a day, marking a 24% increase year-on-year. This achievement is the highest first quarter in the company's history, as highlighted by President and CEO Richard Kruger in the latest earnings call. The company's safety performance has also improved significantly, with lost time incidents down 50% and recordable incidents down 20% year-on-year. Financially, Suncor's net profit margins have improved to 14.9% from 11.5% last year, and the company has maintained stable profitability with a total OS&G of $3.4 billion in the first quarter of 2024. Additionally, Suncor's valuation is attractive, trading at a Price-To-Earnings Ratio of 8.5x, which is favorable compared to the Canadian Oil and Gas industry average of 11.3x and the peer average of 12.4x, indicating it may be undervalued relative to its fair value estimate of CA$108.31.

Weaknesses: Critical Issues Affecting Suncor Energy's Performance and Areas For Growth

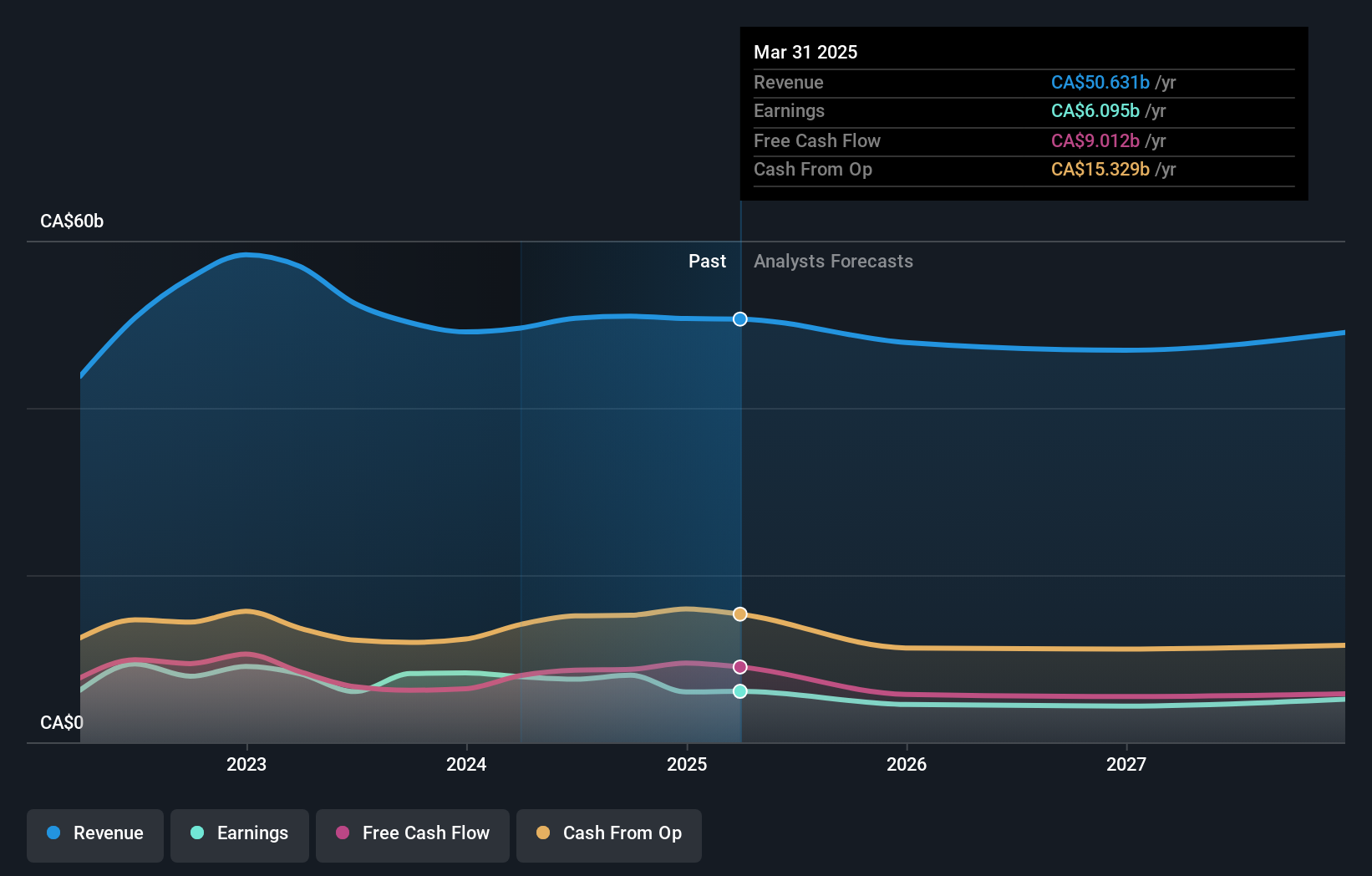

Despite its strengths, Suncor faces several challenges. The company is experiencing market challenges, as evidenced by the weakening of synthetic crude prices in the first quarter, although it remained a strong price and margin environment, according to CFO Kris Smith. Additionally, cost management remains a concern. Richard Kruger noted that the company managed to increase production without additional costs, which might imply underlying issues if costs do not align with production increases. Moreover, Suncor's earnings are forecast to decline by 9% per year over the next three years, and its revenue is expected to decrease by 2.5% annually. These projections indicate potential financial instability in the near future. For a more comprehensive look at how these weaknesses could impact Suncor Energy's financial stability, explore our section on Suncor Energy's Past Performance.

Opportunities: Potential Strategies for Leveraging Growth and Competitive Advantage

Suncor Energy has several strategic opportunities to enhance its market position. The company is exploring technological innovations, particularly in situ technologies, which could significantly improve operational efficiency. Kruger emphasized the potential of these technologies during the latest earnings call. Additionally, the implementation of autonomous operations has improved fleet productivity by 20%, equivalent to generating six free haul trucks, as noted by Peter Zebedee, Executive Vice President of Oil Sands. Market expansion is another key opportunity, with Canadian crude reaching new markets, which Dave Oldreive, Executive Vice President of Downstream, highlighted as crucial for the company's growth. These strategies could help Suncor capitalize on emerging opportunities and strengthen its competitive edge. Learn more about how these opportunities could impact Suncor Energy's future growth by reviewing our analysis of Suncor Energy's Future Performance.

Threats: Key Risks and Challenges That Could Impact Suncor Energy's Success

Suncor faces several external threats that could impact its growth and market share. Economic factors, such as the weakening of synthetic crude oil prices, averaging USD 7 a barrel in Q1, pose a significant risk. Kris Smith highlighted these economic challenges during the earnings call. Market risks are also prevalent, with the company unable to control market movements but striving to find the best customers to capture full value, as stated by Dave Oldreive. Additionally, regulatory issues could pose challenges, although Suncor is well-positioned to take advantage of new markets through its supply trading and optimization organization. These external factors could potentially hinder Suncor's growth and competitive positioning in the market.

Conclusion

In conclusion, Suncor Energy's robust operational performance, marked by a 24% year-on-year increase in refining throughput and significant improvements in safety metrics, underscores its capacity for sustained growth and operational excellence. However, the company faces notable challenges, including weakening synthetic crude prices and forecasted declines in earnings and revenue, which could signal potential financial instability. Despite these concerns, Suncor's strategic focus on technological innovations and market expansion presents significant opportunities for enhancing operational efficiency and capturing new market share. Importantly, Suncor's attractive trading multiple of 8.5x Price-To-Earnings Ratio, compared to the industry average of 11.3x and peer average of 12.4x, suggests that the stock may offer substantial upside potential relative to its fair value estimate of CA$108.31, positioning it favorably for future performance amidst a complex market landscape.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Simply Wall St and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

About TSX:SU

Suncor Energy

Operates as an integrated energy company in Canada, the United States, and internationally.

Undervalued with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Fiducian: Compliance Clouds or Value Opportunity?

Q3 Outlook modestly optimistic

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.