- Canada

- /

- Oil and Gas

- /

- TSX:SOIL

3 Undervalued Small Caps On TSX With Insider Buying In Canada

Reviewed by Simply Wall St

As we move through the year, the Canadian market is navigating a complex landscape of economic indicators and shifting investor sentiment. With inflation stabilizing more effectively in Canada compared to its southern neighbor, there is cautious optimism about growth prospects for small-cap companies on the TSX. In this environment, identifying promising stocks involves looking at those with solid fundamentals and potential for growth, especially where insider buying signals confidence in future performance.

Top 10 Undervalued Small Caps With Insider Buying In Canada

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| First National Financial | 13.6x | 3.8x | 43.03% | ★★★★★☆ |

| Boston Pizza Royalties Income Fund | 12.0x | 7.7x | 31.93% | ★★★★★☆ |

| Nexus Industrial REIT | 11.9x | 3.0x | 23.64% | ★★★★★☆ |

| Primaris Real Estate Investment Trust | 19.8x | 3.1x | 47.38% | ★★★★☆☆ |

| Bragg Gaming Group | NA | 1.3x | -86.22% | ★★★★☆☆ |

| Bonterra Energy | 5.3x | 0.6x | 27.55% | ★★★★☆☆ |

| Parex Resources | 4.1x | 0.9x | -24.26% | ★★★☆☆☆ |

| Calfrac Well Services | 12.0x | 0.2x | -38.66% | ★★★☆☆☆ |

| Saturn Oil & Gas | 2.1x | 0.6x | -79.75% | ★★★☆☆☆ |

| Minto Apartment Real Estate Investment Trust | NA | 5.4x | 13.97% | ★★★☆☆☆ |

We're going to check out a few of the best picks from our screener tool.

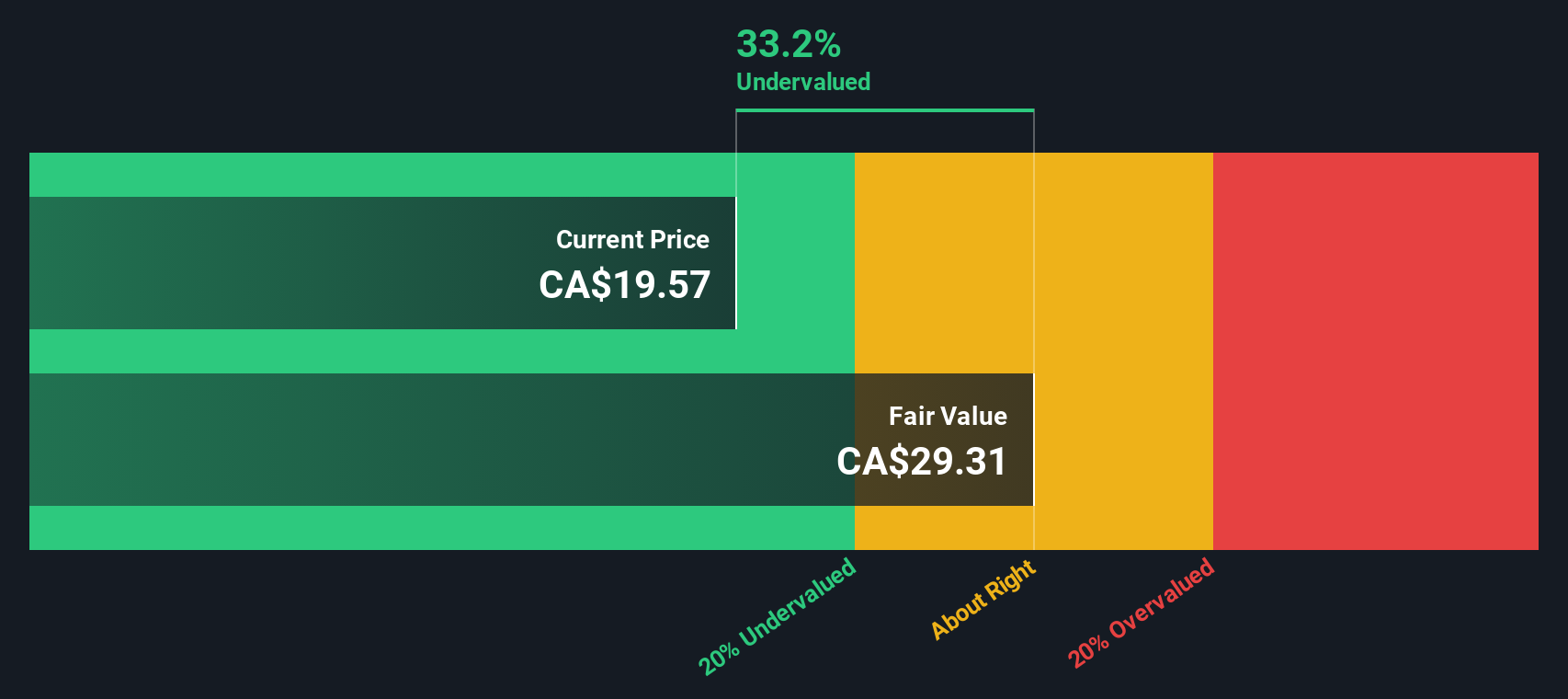

Killam Apartment REIT (TSX:KMP.UN)

Simply Wall St Value Rating: ★★★★★☆

Overview: Killam Apartment REIT is a real estate investment trust focused on owning, managing, and developing residential apartment properties, commercial spaces, and manufactured home communities with a market capitalization of approximately CA$2.32 billion.

Operations: Killam Apartment REIT generates revenue primarily from its apartment segment, contributing CA$321.09 million, with additional income from commercial properties and manufactured home communities. The company reported a gross profit margin of 65.99% as of September 2024, reflecting its ability to manage costs related to property operations effectively.

PE: 2.9x

Killam Apartment REIT, a smaller player in the Canadian market, reported sales of C$364.65 million for 2024, up from C$348.15 million the previous year, with net income soaring to C$667.84 million from C$266.32 million. Despite its high-risk external borrowing structure and earnings not fully covering interest payments, insider confidence is evident through recent share purchases by insiders in early 2025. Regular monthly dividends of C$0.06 per unit continue to attract investors seeking steady income streams.

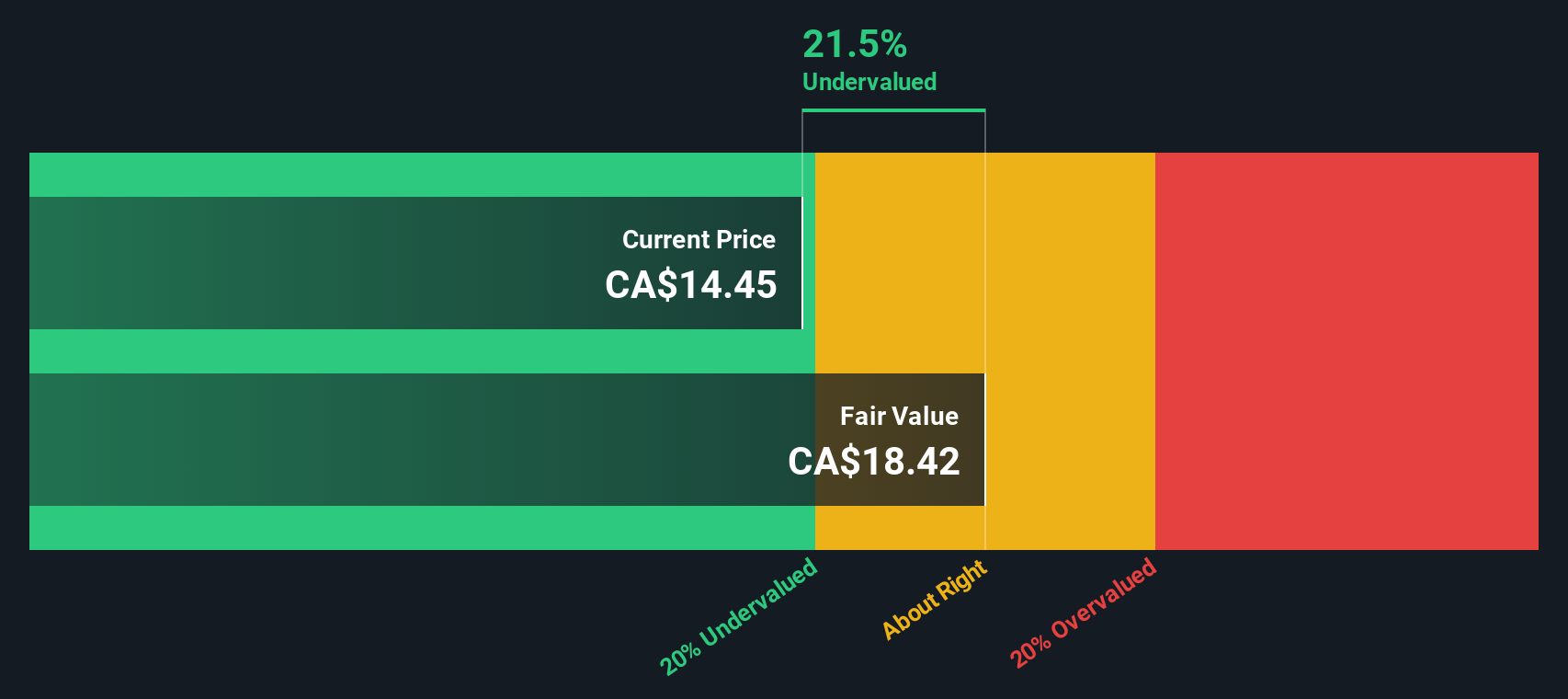

Minto Apartment Real Estate Investment Trust (TSX:MI.UN)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Minto Apartment Real Estate Investment Trust focuses on owning and managing a portfolio of residential rental properties, with operations generating CA$157.94 million in revenue.

Operations: The company generates revenue primarily from its residential real estate investment trust (REIT) operations, with a recent gross profit margin of 64.42%. Operating expenses have shown variability, impacting net income margins, which recently stood at -66.54%.

PE: -8.1x

Minto Apartment Real Estate Investment Trust, a smaller player in the Canadian market, has recently affirmed monthly cash distributions of C$0.04333 per unit, equating to an annualized C$0.52. Despite declining earnings by 32% annually over five years and reliance on external borrowing for funding, insider confidence is evident with recent share purchases. The company maintains a stable financial position but faces challenges covering interest payments with earnings. Investors might find potential value if growth prospects improve amidst these dynamics.

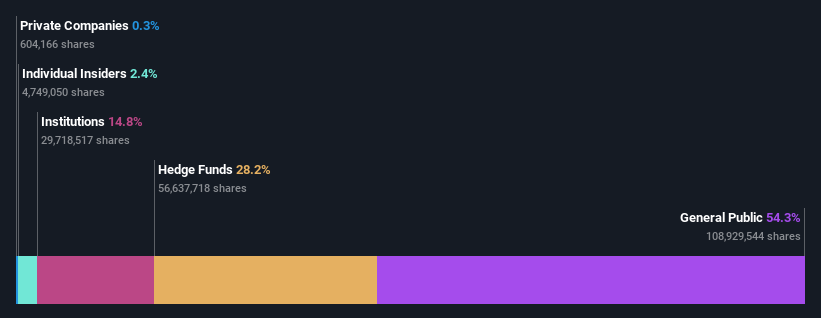

Saturn Oil & Gas (TSX:SOIL)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Saturn Oil & Gas is involved in the acquisition and exploration of resource properties, with a market cap of CA$0.34 billion.

Operations: Saturn Oil & Gas generates revenue primarily from the acquisition and exploration of resource properties, with recent figures showing CA$731.85 million in revenue. The company has a gross profit margin of 69.14%, reflecting its ability to manage costs relative to sales effectively. Operating expenses are significant, including general and administrative expenses which totaled CA$39.87 million in the latest period, impacting overall profitability despite substantial revenue growth over time.

PE: 2.1x

Saturn Oil & Gas, a Canadian energy company, is catching attention as an undervalued player in the market. Recently, insider confidence was demonstrated when Thomas Claugus purchased 308,300 shares for C$693,675. Despite facing a forecasted earnings decline of 18% annually over the next three years and carrying high debt levels with risky external funding sources, Saturn projects strong production growth for 2025 with guidance targeting up to 40,000 boe/d.

- Unlock comprehensive insights into our analysis of Saturn Oil & Gas stock in this valuation report.

Explore historical data to track Saturn Oil & Gas' performance over time in our Past section.

Key Takeaways

- Click here to access our complete index of 26 Undervalued TSX Small Caps With Insider Buying.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:SOIL

Saturn Oil & Gas

Engages in the acquisition, exploration, and development of petroleum and natural gas resource deposits in Canada.

Solid track record and fair value.

Market Insights

Community Narratives