- Canada

- /

- Oil and Gas

- /

- TSX:SES

3 Canadian Dividend Stocks On The TSX With Up To 4.5% Yield

Reviewed by Simply Wall St

The Canadian market has experienced significant volatility recently, with stocks managing to stage an impressive recovery after a 5% pullback in early August. Supported by positive earnings growth and a still-expanding economy, the focus is now shifting toward growth as inflation heads closer to target. In this environment, dividend stocks can offer stability and income, making them attractive options for investors seeking reliable returns amid market fluctuations. Here are three Canadian dividend stocks on the TSX that currently yield up to 4.5%.

Top 10 Dividend Stocks In Canada

| Name | Dividend Yield | Dividend Rating |

| Whitecap Resources (TSX:WCP) | 7.11% | ★★★★★★ |

| Secure Energy Services (TSX:SES) | 3.22% | ★★★★★☆ |

| Power Corporation of Canada (TSX:POW) | 5.44% | ★★★★★☆ |

| Enghouse Systems (TSX:ENGH) | 3.54% | ★★★★★☆ |

| Russel Metals (TSX:RUS) | 4.46% | ★★★★★☆ |

| Sun Life Financial (TSX:SLF) | 4.41% | ★★★★★☆ |

| iA Financial (TSX:IAG) | 3.17% | ★★★★★☆ |

| Firm Capital Mortgage Investment (TSX:FC) | 8.75% | ★★★★★☆ |

| Canadian Natural Resources (TSX:CNQ) | 4.30% | ★★★★★☆ |

| Royal Bank of Canada (TSX:RY) | 3.49% | ★★★★★☆ |

Click here to see the full list of 32 stocks from our Top TSX Dividend Stocks screener.

Let's dive into some prime choices out of the screener.

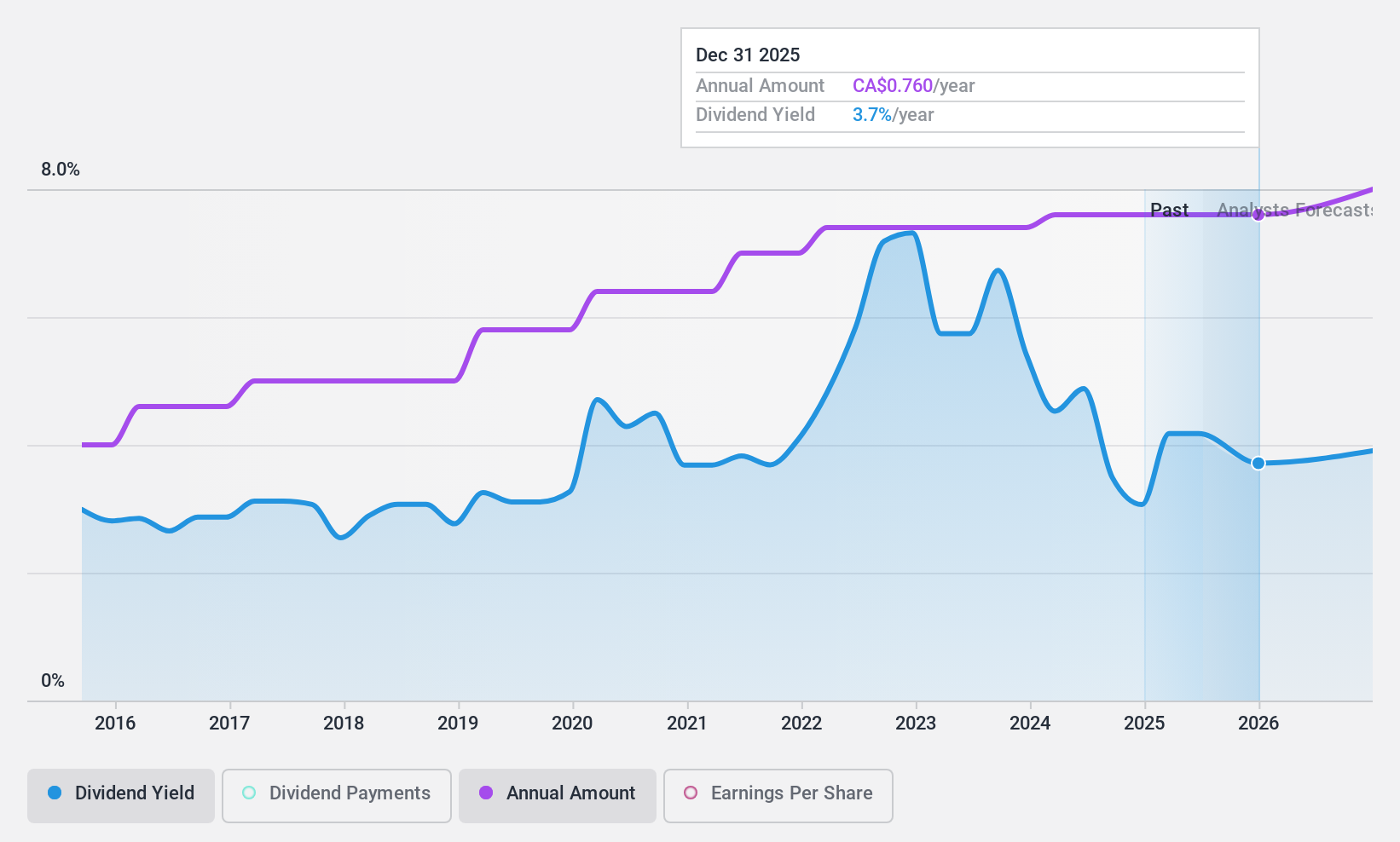

Aecon Group (TSX:ARE)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Aecon Group Inc., with a market cap of CA$1.16 billion, provides construction and infrastructure development services to private and public sector clients in Canada, the United States, and internationally.

Operations: Aecon Group Inc. generates revenue primarily from its Construction segment (CA$4.04 billion) and Concessions segment (CA$34.47 million).

Dividend Yield: 4.1%

Aecon Group Inc. recently secured significant contracts, including a $928 million Surrey Langley SkyTrain project and a $700 million Bruce Power steam generator replacement, bolstering its construction backlog. Despite these wins, Aecon reported a substantial net loss of C$123.89 million for Q2 2024 due to large one-off charges. The board approved a quarterly dividend of C$0.19 per share, though the payout is not well covered by earnings but supported by cash flows and has been stable over the past decade.

- Get an in-depth perspective on Aecon Group's performance by reading our dividend report here.

- According our valuation report, there's an indication that Aecon Group's share price might be on the expensive side.

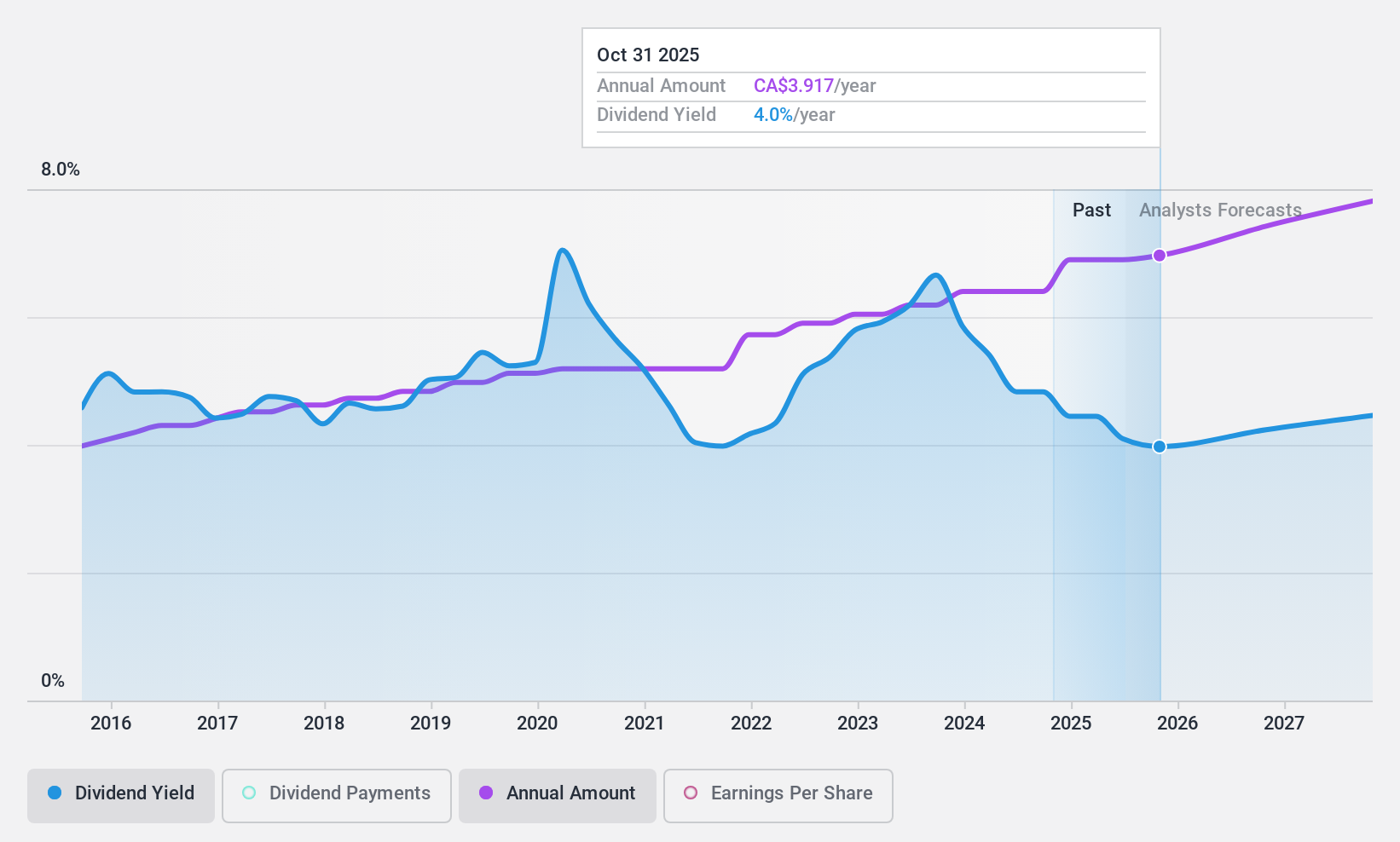

Canadian Imperial Bank of Commerce (TSX:CM)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Canadian Imperial Bank of Commerce, a diversified financial institution with a market cap of CA$74.39 billion, offers a range of financial products and services to personal, business, public sector, and institutional clients in Canada, the United States, and internationally.

Operations: Canadian Imperial Bank of Commerce generates revenue from Canadian Personal and Business Banking (CA$8.80 billion), Capital Markets and Direct Financial Services (CA$5.61 billion), U.S. Commercial Banking and Wealth Management (CA$2.02 billion), and Canadian Commercial Banking and Wealth Management (CA$5.46 billion).

Dividend Yield: 4.6%

Canadian Imperial Bank of Commerce reported strong earnings growth for Q3 2024, with net income rising to C$1.79 billion from C$1.42 billion a year ago. The bank declared a quarterly dividend of C$0.90 per share, supported by its earnings and maintaining a stable payout ratio around 51%. Additionally, the board is considering a share repurchase program for up to 20 million shares, indicating confidence in its financial stability and commitment to returning value to shareholders.

- Delve into the full analysis dividend report here for a deeper understanding of Canadian Imperial Bank of Commerce.

- The analysis detailed in our Canadian Imperial Bank of Commerce valuation report hints at an deflated share price compared to its estimated value.

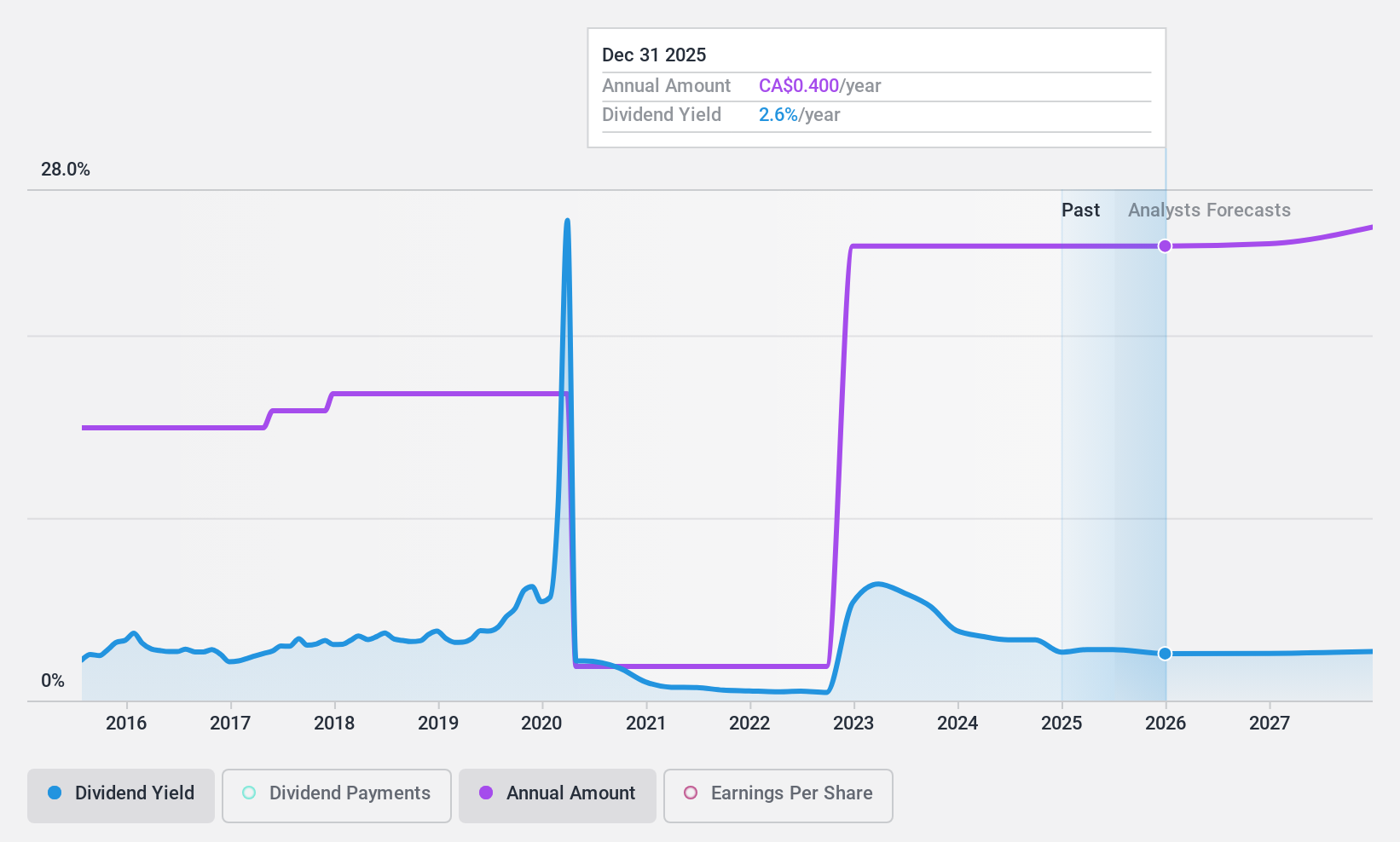

Secure Energy Services (TSX:SES)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Secure Energy Services Inc. operates in the waste management and energy infrastructure sectors across Canada and the United States, with a market cap of CA$2.96 billion.

Operations: Secure Energy Services Inc. generates revenue primarily from its Energy Infrastructure segment (CA$8.61 billion) and Environmental Waste Management (EWM) segment (CA$1.13 billion).

Dividend Yield: 3.2%

Secure Energy Services reported robust revenue growth for Q2 2024, with sales reaching C$2.55 billion, up from C$1.78 billion a year ago. Despite stable net income of C$32 million, the company continues to pay a reliable quarterly dividend of C$0.10 per share, supported by strong earnings and cash flows (payout ratios: 20.1% and 38.4%, respectively). Recent share buybacks and an extended credit facility underscore financial stability and commitment to shareholder returns.

- Navigate through the intricacies of Secure Energy Services with our comprehensive dividend report here.

- Our valuation report here indicates Secure Energy Services may be undervalued.

Make It Happen

- Reveal the 32 hidden gems among our Top TSX Dividend Stocks screener with a single click here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:SES

SECURE Waste Infrastructure

Engages in the waste management and energy infrastructure businesses primarily in Canada and the United States.

Established dividend payer with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives