- Canada

- /

- Metals and Mining

- /

- TSXV:SCZ

TSX Penny Stocks Spotlight: Questerre Energy Among Three Top Picks

Reviewed by Simply Wall St

The Canadian stock market has been experiencing a robust year, with the TSX up over 17%, mirroring the positive trends seen in other major indices like the S&P 500. As investors navigate these buoyant conditions, attention often turns to identifying stocks that can leverage current economic strengths. Penny stocks, though an older term in investment circles, still represent a compelling area for those seeking growth opportunities in smaller or newer companies with strong financial foundations.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Financial Health Rating |

| PetroTal (TSX:TAL) | CA$0.67 | CA$620.84M | ★★★★★★ |

| Findev (TSXV:FDI) | CA$0.42 | CA$11.75M | ★★★★★☆ |

| Winshear Gold (TSXV:WINS) | CA$0.18 | CA$5.18M | ★★★★★★ |

| Mandalay Resources (TSX:MND) | CA$3.34 | CA$304.56M | ★★★★★★ |

| Pulse Seismic (TSX:PSD) | CA$2.37 | CA$116.65M | ★★★★★★ |

| Amerigo Resources (TSX:ARG) | CA$1.80 | CA$298.44M | ★★★★★☆ |

| Foraco International (TSX:FAR) | CA$2.37 | CA$236.62M | ★★★★★☆ |

| East West Petroleum (TSXV:EW) | CA$0.04 | CA$3.17M | ★★★★★★ |

| Newport Exploration (TSXV:NWX) | CA$0.115 | CA$12.14M | ★★★★★★ |

| NamSys (TSXV:CTZ) | CA$1.11 | CA$29.82M | ★★★★★★ |

Click here to see the full list of 948 stocks from our TSX Penny Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

Questerre Energy (TSX:QEC)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Questerre Energy Corporation is an energy technology and innovation company focused on acquiring, exploring, and developing non-conventional oil and gas projects in Canada, with a market cap of CA$117.84 million.

Operations: The company's revenue is generated from its Oil & Gas - Exploration & Production segment, amounting to CA$34.25 million.

Market Cap: CA$117.84M

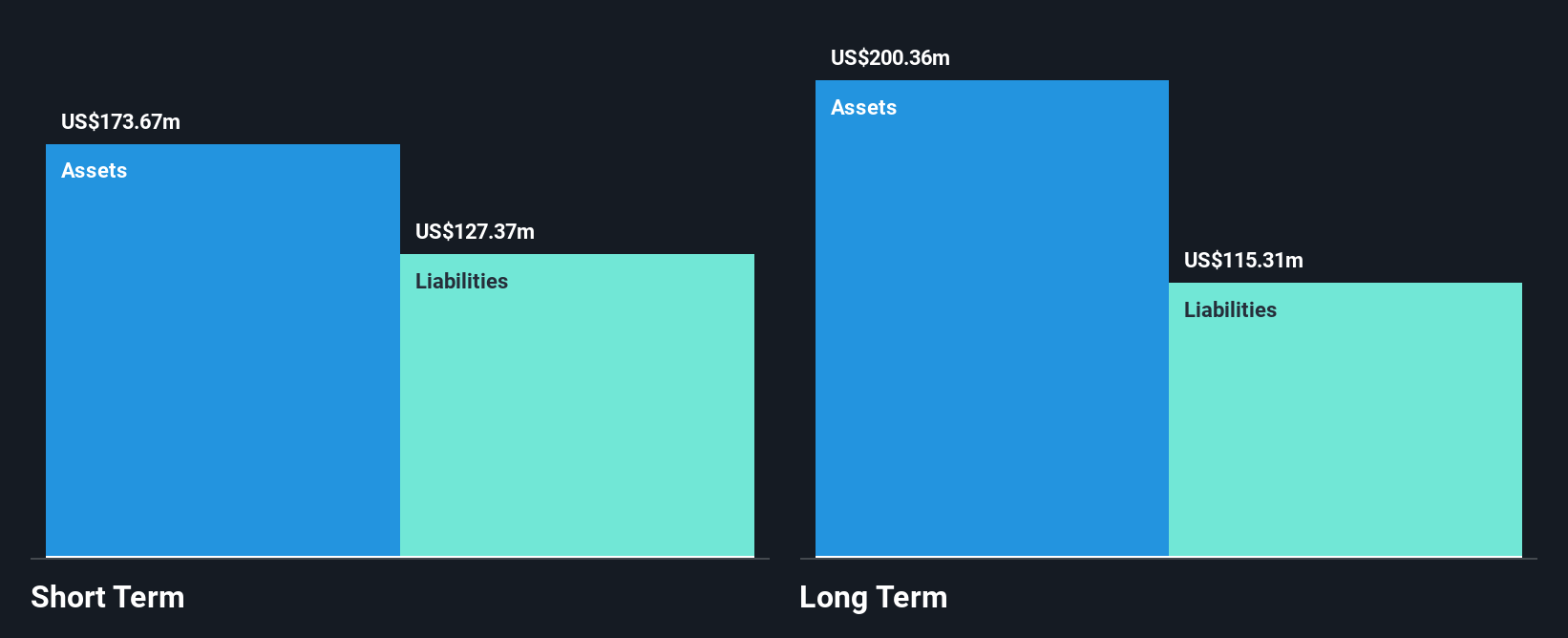

Questerre Energy, with a market cap of CA$117.84 million, is focused on non-conventional oil and gas projects in Canada. Recent developments include the initiation of new drilling programs at Kakwa North and Central, which could impact future production levels. Although currently unprofitable, Questerre has managed to reduce its losses over the past five years by 2.4% annually. The company maintains a strong balance sheet with short-term assets exceeding both short- and long-term liabilities, and it holds more cash than total debt. However, its share price remains highly volatile compared to most Canadian stocks.

- Unlock comprehensive insights into our analysis of Questerre Energy stock in this financial health report.

- Examine Questerre Energy's past performance report to understand how it has performed in prior years.

Santacruz Silver Mining (TSXV:SCZ)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Santacruz Silver Mining Ltd. is involved in the acquisition, exploration, development, and operation of mineral properties in Latin America, with a market cap of CA$140.56 million.

Operations: The company's revenue is derived from its operations at Porco ($31.21 million), Bolivar ($75.81 million), Zimapan ($67.26 million), SAN Lucas ($76.09 million), and the Caballo Blanco Group ($62.69 million).

Market Cap: CA$140.56M

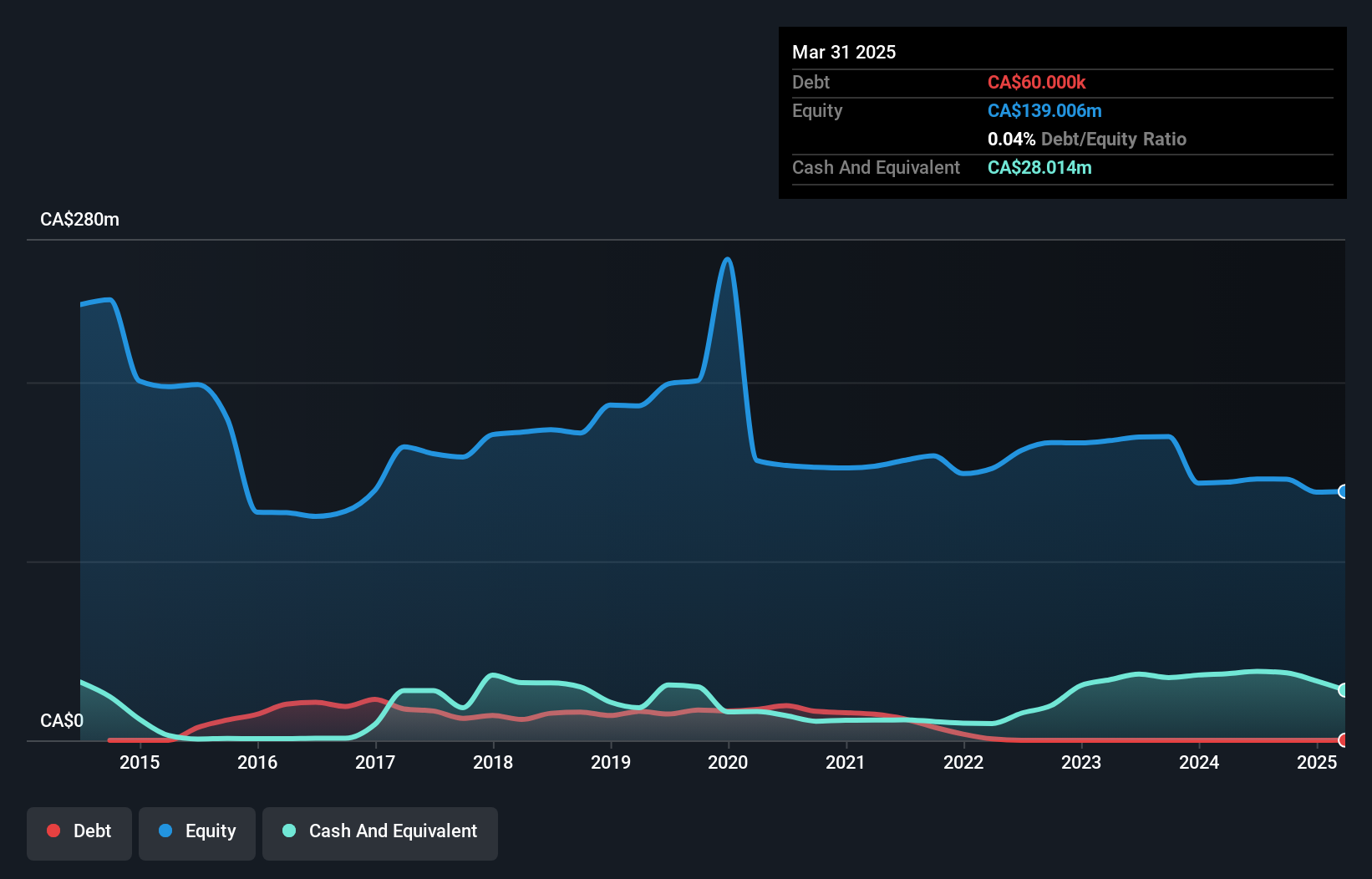

Santacruz Silver Mining, with a market cap of CA$140.56 million, has recently become profitable, supported by operations across several Latin American sites. The company's financial health is bolstered by short-term assets exceeding both short- and long-term liabilities. Despite a large one-off gain impacting recent earnings, Santacruz's return on equity remains outstanding at 101.4%. However, the share price has been highly volatile over recent months. A recent executive change saw Andres Bedregal appointed as interim CFO following Gregg Orr's resignation, potentially influencing future strategic directions and financial management practices within the company.

- Navigate through the intricacies of Santacruz Silver Mining with our comprehensive balance sheet health report here.

- Assess Santacruz Silver Mining's previous results with our detailed historical performance reports.

Taranis Resources (TSXV:TRO)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Taranis Resources Inc. is an exploration stage company focused on acquiring, exploring, and developing precious and base metal deposits in Canada with a market cap of CA$47.82 million.

Operations: Taranis Resources Inc. currently does not report any revenue segments as it is in the exploration stage, focusing on precious and base metal deposits in Canada.

Market Cap: CA$47.82M

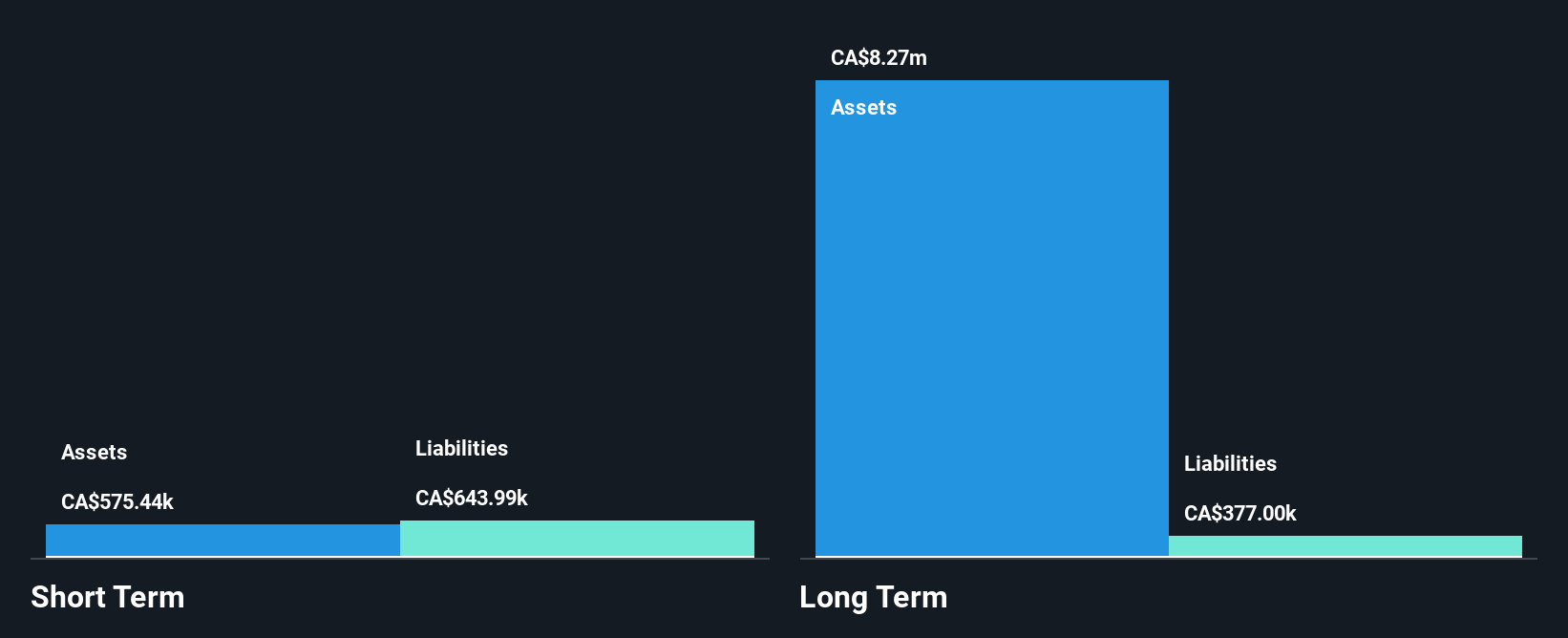

Taranis Resources Inc., with a market cap of CA$47.82 million, remains pre-revenue as it focuses on exploration activities in Canada. The company has strengthened its financial position through recent private placements totaling CA$299,999.9, enhancing its cash runway beyond a year despite being unprofitable. Short-term assets exceed both short- and long-term liabilities, indicating stable financial health. However, shareholder dilution occurred over the past year with shares outstanding increasing by 5.3%. Recent challenges include resuming exploration at the Thor deposit after a wildfire affected operations but left core infrastructure intact and ready for continuation.

- Jump into the full analysis health report here for a deeper understanding of Taranis Resources.

- Review our historical performance report to gain insights into Taranis Resources' track record.

Turning Ideas Into Actions

- Reveal the 948 hidden gems among our TSX Penny Stocks screener with a single click here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSXV:SCZ

Santacruz Silver Mining

Engages in the acquisition, exploration, development, and operation of mineral properties in Latin America.

Flawless balance sheet and good value.