- Canada

- /

- Oil and Gas

- /

- TSX:PXT

Parex Resources (TSX:PXT) Is Up 6.6% After Passing Ex-Dividend Date for C$0.385 Dividend - What's Changed

Reviewed by Simply Wall St

- Parex Resources Inc. recently passed its ex-dividend date for a C$0.385 per share cash dividend, which was scheduled for December 9, 2024.

- This dividend event highlights the company’s ongoing emphasis on shareholder returns through income distributions alongside its broader capital return strategy.

- We'll examine how Parex Resources’ focus on dividend payments may reinforce its investment narrative of prioritizing shareholder value.

Parex Resources Investment Narrative Recap

To own shares in Parex Resources, an investor must have confidence in the company's ability to grow production and reserves from its Colombian oil assets, while effectively managing operational and regulatory risks. The recent ex-dividend date for the C$0.385 per share cash dividend demonstrates Parex Resources’ continued effort to return capital to shareholders, but does not have a material impact on the leading short-term catalyst, which remains the success of key production growth initiatives, or on the main risk around operational reliability of enhanced oil recovery technologies.

Among recent announcements, the company’s Q1 2025 earnings report is closely connected to this dividend event, as earnings growth can underpin dividend sustainability. In this report, Parex Resources posted net income growth year-on-year despite lower revenue, suggesting some resilience, but future dividend capacity still depends on steady production volumes and effective cost management in a relatively uncertain market.

However, investors should not overlook the risk that weaker-than-expected technical performance at assets like Llanos 34 and Cabrestero could...

Read the full narrative on Parex Resources (it's free!)

Parex Resources’ projections indicate $961.7 million in revenue and $261.3 million in earnings by 2028. This scenario assumes a -2.4% annual revenue decline and a $180.1 million earnings increase from the current $81.2 million.

Exploring Other Perspectives

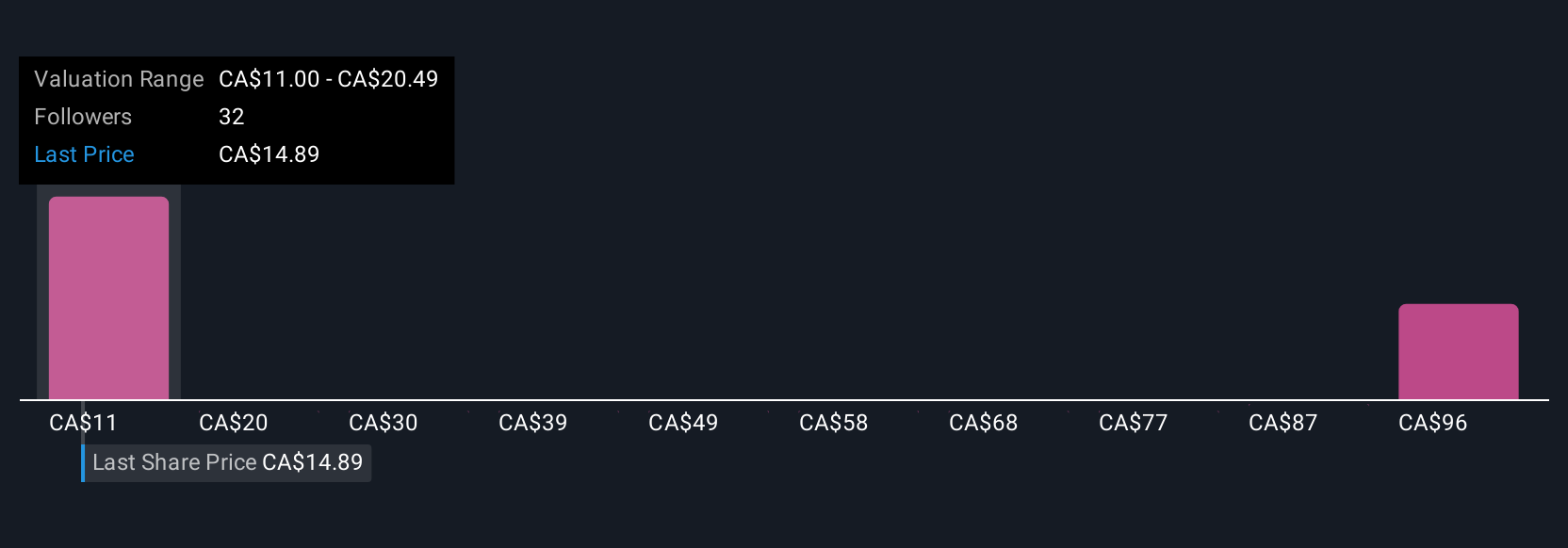

Simply Wall St Community members provided 10 fair value estimates for Parex Resources, ranging widely from C$11.00 to C$105.38 per share. Divergence in these views comes as production success and operational execution remain critical variables for the company's outlook, so consider multiple opinions as you assess the company's next steps.

Build Your Own Parex Resources Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Parex Resources research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Parex Resources research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Parex Resources' overall financial health at a glance.

Curious About Other Options?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- This technology could replace computers: discover the 27 stocks are working to make quantum computing a reality.

- The latest GPUs need a type of rare earth metal called Terbium and there are only 26 companies in the world exploring or producing it. Find the list for free.

- AI is about to change healthcare. These 26 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:PXT

Parex Resources

Engages in the exploration, development, production, and marketing of oil and natural gas in Colombia.

Excellent balance sheet and good value.

Similar Companies

Market Insights

Community Narratives