- Canada

- /

- Oil and Gas

- /

- TSX:PSK

PrairieSky Royalty (TSX:PSK) Margin Outperformance Sharpens Focus on Dividend Sustainability Concerns

Reviewed by Simply Wall St

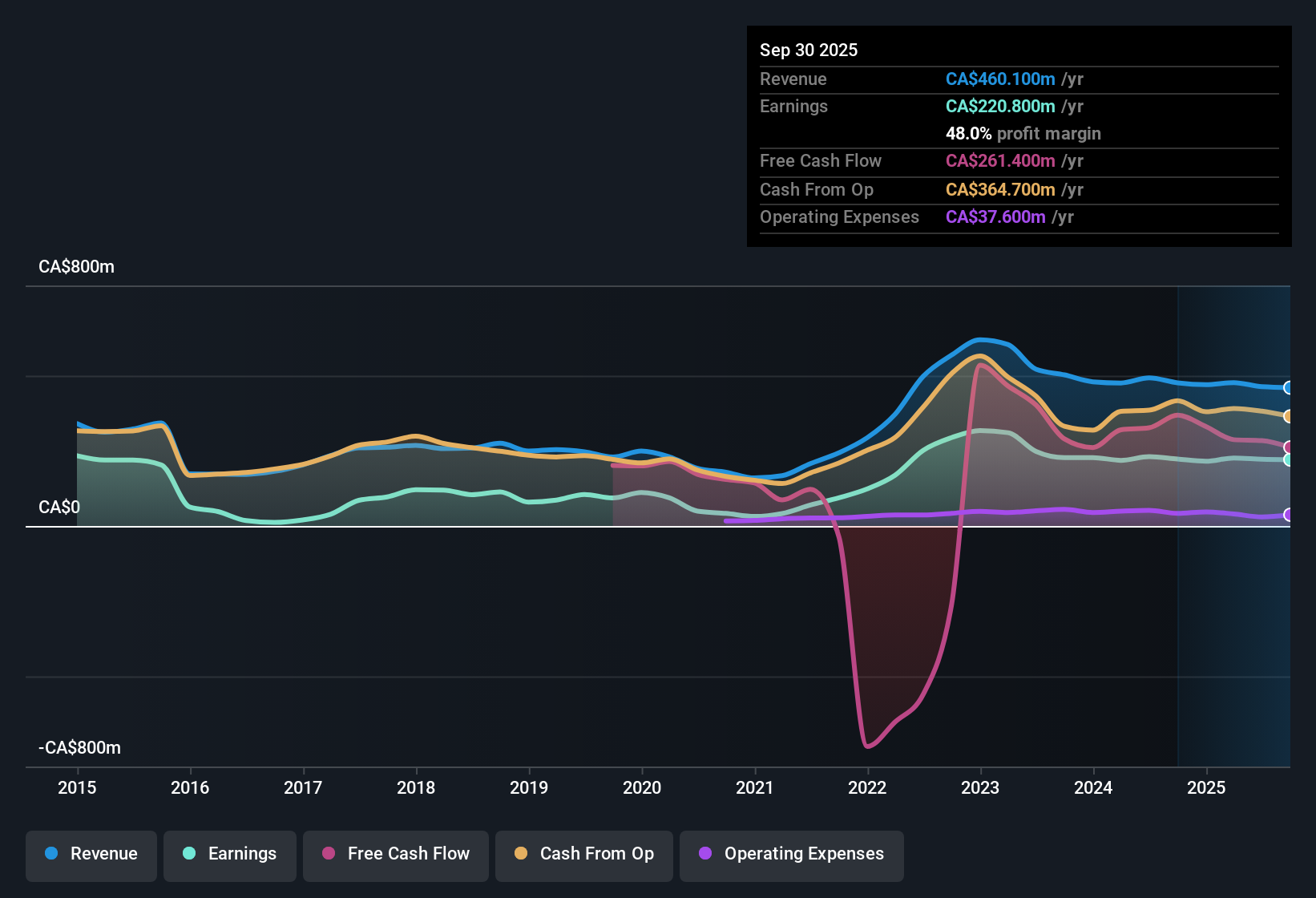

PrairieSky Royalty (TSX:PSK) posted net profit margins of 48%, up from last year’s 46.7%. Over the past five years, the company’s earnings have grown at an impressive 19.7% per year, and forecasts call for 7.4% annual earnings growth alongside 5.4% yearly revenue gains, topping the Canadian market’s 5% pace. With a solid track record and optimism for continued growth, investors have plenty to consider as profit margins remain high and future expansion is anticipated.

See our full analysis for PrairieSky Royalty.Now it’s time to see how these headline figures compare with the narratives that investors are watching. This helps to uncover whether the latest story backs up the buzz or challenges it.

Curious how numbers become stories that shape markets? Explore Community Narratives

Dividend Sustainability Flagged as Major Risk

- The company’s dividend sustainability is specifically noted as a present major risk, marking a key concern for income-seeking investors even as profit margins remain robust at 48%.

- Margin leadership underscores the payout appeal. However, the prevailing market view cautions that flagged dividend sustainability could act as a drag on sentiment.

- Risks tied to commodity prices and policy shifts add to this concern and could potentially impact future cash flows.

- Despite stable cash generation, dividend seekers may want to weigh reward potential against the explicit risk warning.

DCF Fair Value Nearly Double Current Price

- PrairieSky’s current share price of CA$25.23 trades well below its DCF fair value estimate of CA$52.17, creating a notable gap between what the market pays and the calculated intrinsic value.

- This valuation disconnect, as highlighted in the prevailing market view, supports a case for longer-term upside if market sentiment realigns with fundamentals.

- Peers trade at a price-to-earnings ratio of 21.8x and the broader industry at 12x, while PrairieSky’s 26.6x multiple could reflect a premium for perceived quality or anticipated future growth.

- Income and value investors may view the wide spread as justification for patience, although the highlighted dividend risk underscores the need for scrutiny.

Growth Outpaces Industry Despite Premium Valuation

- Forecast revenue growth of 5.4% per year and projected earnings growth of 7.4% both exceed the broader Canadian market’s expected 5% revenue pace, providing partial justification for PrairieSky’s premium price-to-earnings valuation.

- According to the prevailing market view, strong growth expectations and high-quality past earnings help defend the higher multiple. However, valuation concerns are amplified by industry context.

- Compared to the oil and gas industry average P/E of 12x, investors are paying a significant premium, indicating a bet on continued expansion and resilience.

- This optimism is balanced against flagged risks, suggesting that current pricing depends on the company delivering above-industry growth.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on PrairieSky Royalty's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Despite PrairieSky’s robust growth, its premium valuation and flagged dividend sustainability make it a riskier option for income-seeking investors.

If dependable payouts are your priority, consider these 2009 dividend stocks with yields > 3% that offer stronger dividend stability and yields above 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:PSK

PrairieSky Royalty

PrairieSky Royalty Ltd. holds crude oil and natural gas royalty interests in Canada.

Acceptable track record with mediocre balance sheet.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)