- Canada

- /

- Energy Services

- /

- TSX:PSD

TSX Penny Stocks To Watch In December 2025

Reviewed by Simply Wall St

As the Canadian market navigates policy shifts and global uncertainties, it's important to recognize the strong equity gains that have emerged, with the TSX on track for its best year since 2009. In this context, identifying promising investment opportunities involves looking at companies that combine value with growth potential. Penny stocks, often smaller or newer firms, continue to be relevant in this search when backed by solid financials. Here, we explore three such stocks that stand out for their financial strength and potential for long-term success.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Rewards & Risks |

| Westbridge Renewable Energy (TSXV:WEB) | CA$2.12 | CA$53.09M | ✅ 3 ⚠️ 3 View Analysis > |

| Canso Select Opportunities (TSXV:CSOC.A) | CA$4.11 | CA$21.03M | ✅ 2 ⚠️ 2 View Analysis > |

| Zoomd Technologies (TSXV:ZOMD) | CA$1.38 | CA$143.13M | ✅ 4 ⚠️ 1 View Analysis > |

| Montero Mining and Exploration (TSXV:MON) | CA$0.48 | CA$3.59M | ✅ 2 ⚠️ 4 View Analysis > |

| CEMATRIX (TSX:CEMX) | CA$0.365 | CA$54.82M | ✅ 3 ⚠️ 1 View Analysis > |

| Thor Explorations (TSXV:THX) | CA$1.26 | CA$838.27M | ✅ 3 ⚠️ 2 View Analysis > |

| Automotive Finco (TSXV:AFCC.H) | CA$1.15 | CA$23.19M | ✅ 2 ⚠️ 4 View Analysis > |

| Pulse Seismic (TSX:PSD) | CA$2.91 | CA$145.67M | ✅ 2 ⚠️ 1 View Analysis > |

| Hemisphere Energy (TSXV:HME) | CA$2.12 | CA$197.77M | ✅ 3 ⚠️ 2 View Analysis > |

| Matachewan Consolidated Mines (TSXV:MCM.A) | CA$0.78 | CA$10.92M | ✅ 2 ⚠️ 3 View Analysis > |

Click here to see the full list of 391 stocks from our TSX Penny Stocks screener.

Let's explore several standout options from the results in the screener.

Pulse Seismic (TSX:PSD)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Pulse Seismic Inc. acquires, markets, and licenses 2D and 3D seismic data for the energy sector in Canada, with a market cap of CA$145.67 million.

Operations: The company's revenue is derived from its Oil Well Equipment & Services segment, totaling CA$50.07 million.

Market Cap: CA$145.67M

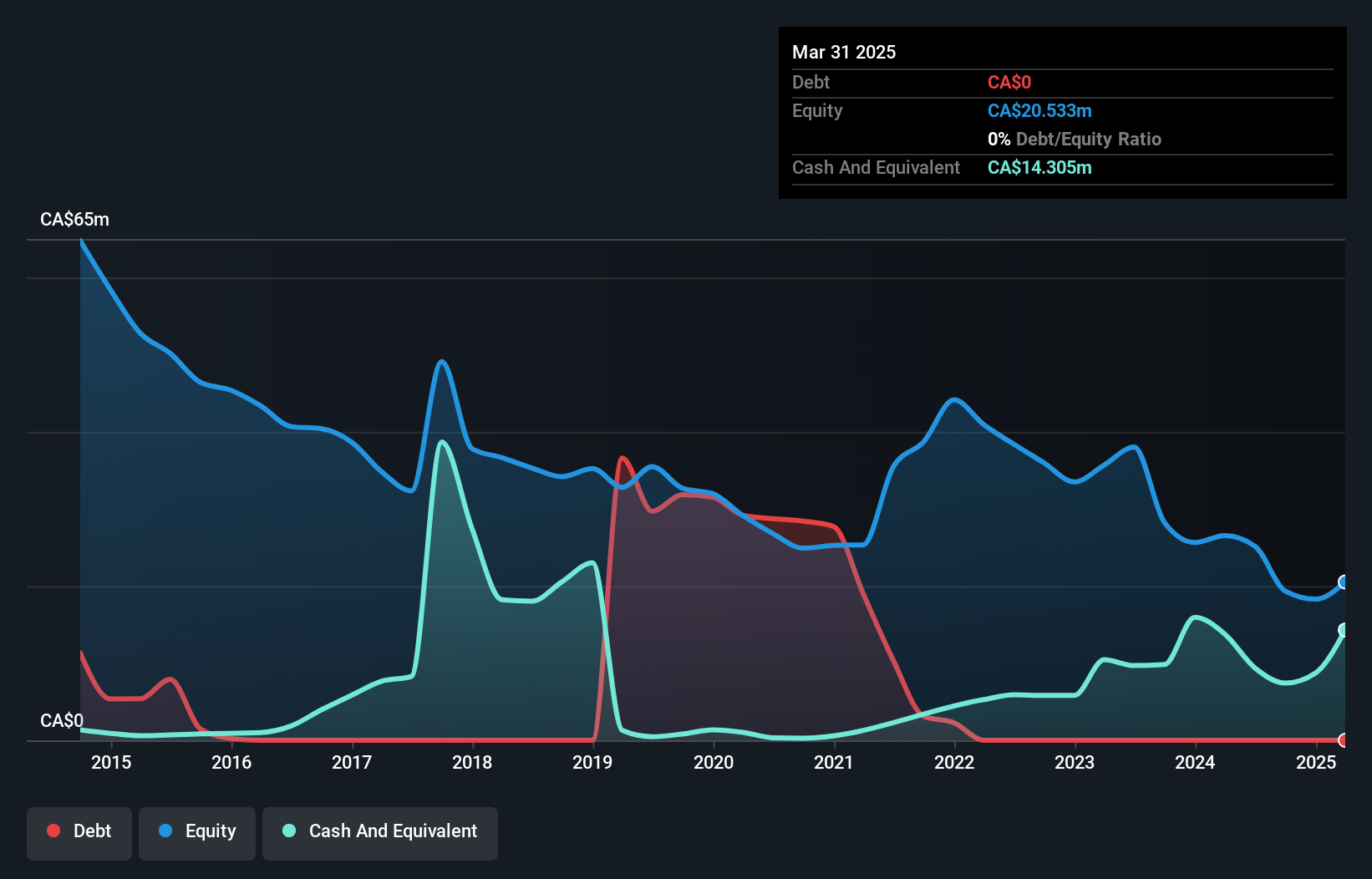

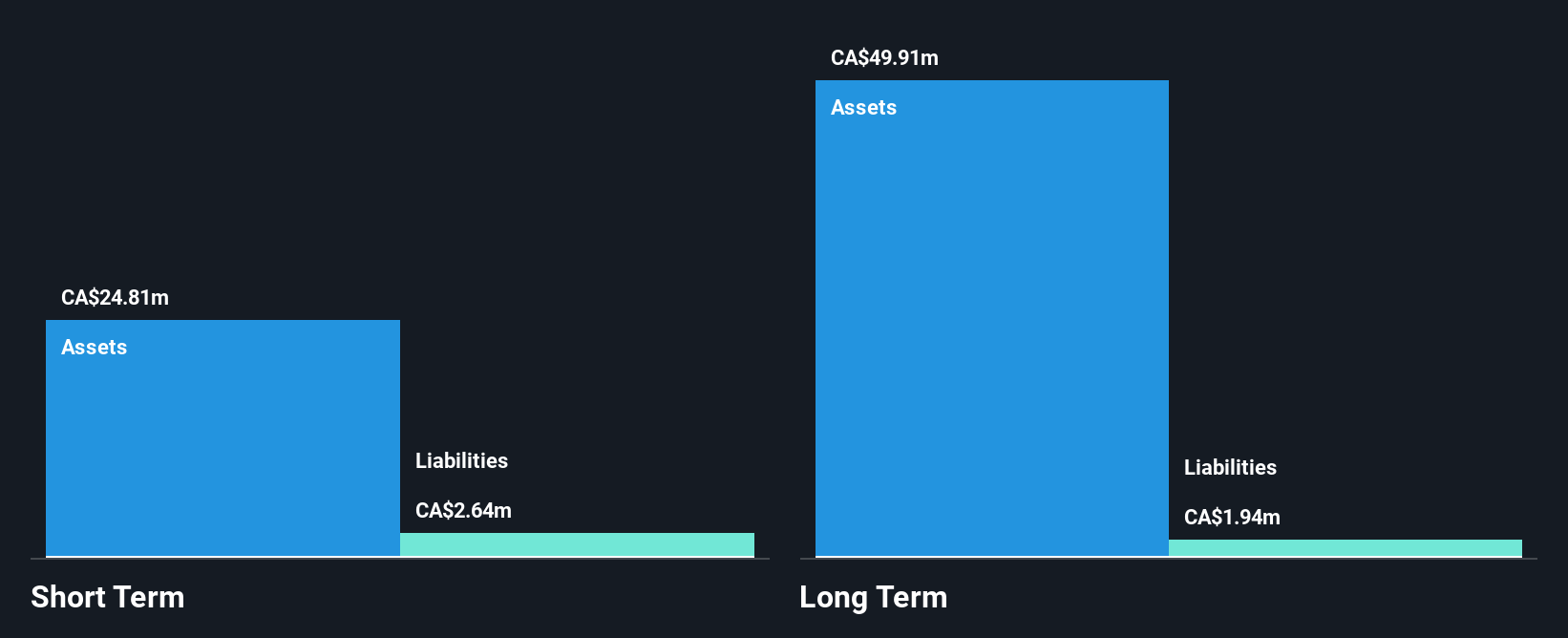

Pulse Seismic Inc. has demonstrated strong earnings growth, with a 103.4% increase over the past year, significantly outpacing its five-year average and the broader Energy Services industry. The company is debt-free, with short-term assets exceeding both short- and long-term liabilities, indicating financial stability. Despite an unstable dividend history, a recent quarterly dividend was declared. The board and management team are experienced, contributing to high-quality earnings and outstanding return on equity of 133.5%. However, recent third-quarter results showed a net loss of CA$1.5 million despite substantial nine-month net income gains compared to last year.

- Click here to discover the nuances of Pulse Seismic with our detailed analytical financial health report.

- Learn about Pulse Seismic's historical performance here.

FPX Nickel (TSXV:FPX)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: FPX Nickel Corp. is a junior mining company focused on acquiring, exploring, and developing nickel mineral resource properties in Canada with a market cap of CA$118 million.

Operations: FPX Nickel Corp. does not report any revenue segments.

Market Cap: CA$118M

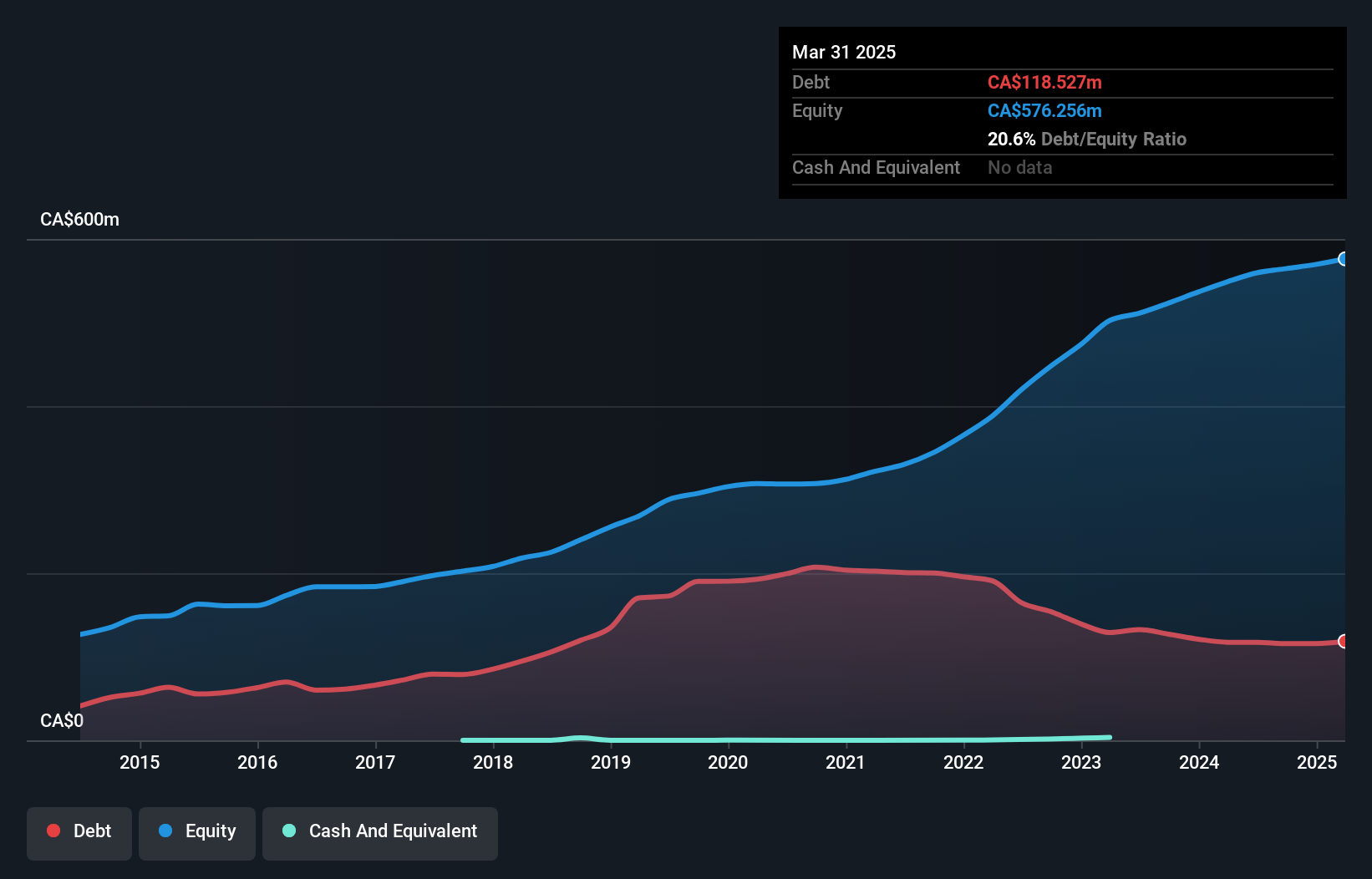

FPX Nickel Corp., a pre-revenue junior mining company with a market cap of CA$118 million, is focused on nickel exploration in Canada. Recent developments include an exploration agreement with the Takla Nation for the Klow property and an option to acquire the Advocate Nickel Property, supported by funding from JOGMEC. Despite being unprofitable, FPX has no debt and sufficient short-term assets to cover liabilities. The management team is experienced, though losses have increased over five years. A recent CA$3.5 million grant from Natural Resources Canada supports infrastructure development for its Baptiste Project in British Columbia.

- Unlock comprehensive insights into our analysis of FPX Nickel stock in this financial health report.

- Explore historical data to track FPX Nickel's performance over time in our past results report.

Yangarra Resources (TSX:YGR)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Yangarra Resources Ltd. is a junior oil and gas company focused on the exploration, development, and production of natural gas and conventional oil in Western Canada, with a market cap of CA$108.37 million.

Operations: The company's revenue stems from its activities in production, exploration, and development of resource properties, amounting to CA$111.40 million.

Market Cap: CA$108.37M

Yangarra Resources Ltd., with a market cap of CA$108.37 million, faces challenges typical of penny stocks, including significant long-term liabilities (CA$270 million) not covered by short-term assets (CA$35.9 million). Recent earnings reports show declining net income and profit margins compared to the previous year, though revenue is forecasted to grow annually by 10.08%. The company benefits from well-covered debt through operating cash flow and a reduced debt-to-equity ratio over five years. Despite insider selling and low return on equity (3.1%), Yangarra's seasoned management team maintains stable weekly volatility in its stock performance.

- Take a closer look at Yangarra Resources' potential here in our financial health report.

- Explore Yangarra Resources' analyst forecasts in our growth report.

Seize The Opportunity

- Click through to start exploring the rest of the 388 TSX Penny Stocks now.

- Want To Explore Some Alternatives? Explore 27 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:PSD

Pulse Seismic

Acquires, markets, and licenses two-dimensional (2D) and three-dimensional (3D) seismic data for the energy sector in Canada.

Outstanding track record with flawless balance sheet and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

TXT will see revenue grow 26% with a profit margin boost of almost 40%

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026