Pulse Seismic And 2 Other TSX Penny Stocks With Promising Prospects

Reviewed by Simply Wall St

As the Canadian market continues its strong momentum into 2025, investors are keeping an eye on potential curveballs that could affect their portfolios. In this context, penny stocks—typically smaller or newer companies—remain a relevant and intriguing investment area. Despite their vintage name, these stocks can offer significant growth opportunities at lower price points when backed by solid fundamentals and financial strength.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Financial Health Rating |

| Alvopetro Energy (TSXV:ALV) | CA$4.54 | CA$165.86M | ★★★★★★ |

| Amerigo Resources (TSX:ARG) | CA$1.74 | CA$288.49M | ★★★★★☆ |

| Pulse Seismic (TSX:PSD) | CA$2.34 | CA$119.07M | ★★★★★★ |

| PetroTal (TSX:TAL) | CA$0.63 | CA$574.88M | ★★★★★★ |

| Mandalay Resources (TSX:MND) | CA$3.52 | CA$330.8M | ★★★★★★ |

| Foraco International (TSX:FAR) | CA$2.18 | CA$215.73M | ★★★★★☆ |

| Findev (TSXV:FDI) | CA$0.455 | CA$13.03M | ★★★★★☆ |

| Silvercorp Metals (TSX:SVM) | CA$4.79 | CA$1.04B | ★★★★★★ |

| NamSys (TSXV:CTZ) | CA$1.07 | CA$28.74M | ★★★★★★ |

| Winshear Gold (TSXV:WINS) | CA$0.16 | CA$5.03M | ★★★★★★ |

Click here to see the full list of 960 stocks from our TSX Penny Stocks screener.

We're going to check out a few of the best picks from our screener tool.

Pulse Seismic (TSX:PSD)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Pulse Seismic Inc. acquires, markets, and licenses 2D and 3D seismic data for the energy sector in Canada, with a market cap of CA$119.07 million.

Operations: The company generates its revenue from the oil well equipment and services segment, amounting to CA$34.66 million.

Market Cap: CA$119.07M

Pulse Seismic has demonstrated significant earnings growth of 129.9% over the past year, surpassing both its five-year average and the broader energy services industry. Despite reporting a net loss of CA$1.41 million in Q3 2024, its nine-month net income remains positive at CA$2.62 million, though lower than the previous year. The company is debt-free with short-term assets exceeding liabilities, reflecting financial stability. Recent share buybacks and dividend affirmations indicate shareholder value focus, although dividends have been unstable historically. Trading significantly below estimated fair value suggests potential for price appreciation if operational improvements continue.

- Click here to discover the nuances of Pulse Seismic with our detailed analytical financial health report.

- Assess Pulse Seismic's previous results with our detailed historical performance reports.

High Tide (TSXV:HITI)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: High Tide Inc. operates in the cannabis retail sector across Canada, the United States, and internationally, with a market cap of CA$298.50 million.

Operations: The company's revenue streams are primarily from Canada, generating CA$470.33 million, followed by the United States with CA$38.74 million, and international markets contributing CA$2.04 million.

Market Cap: CA$298.5M

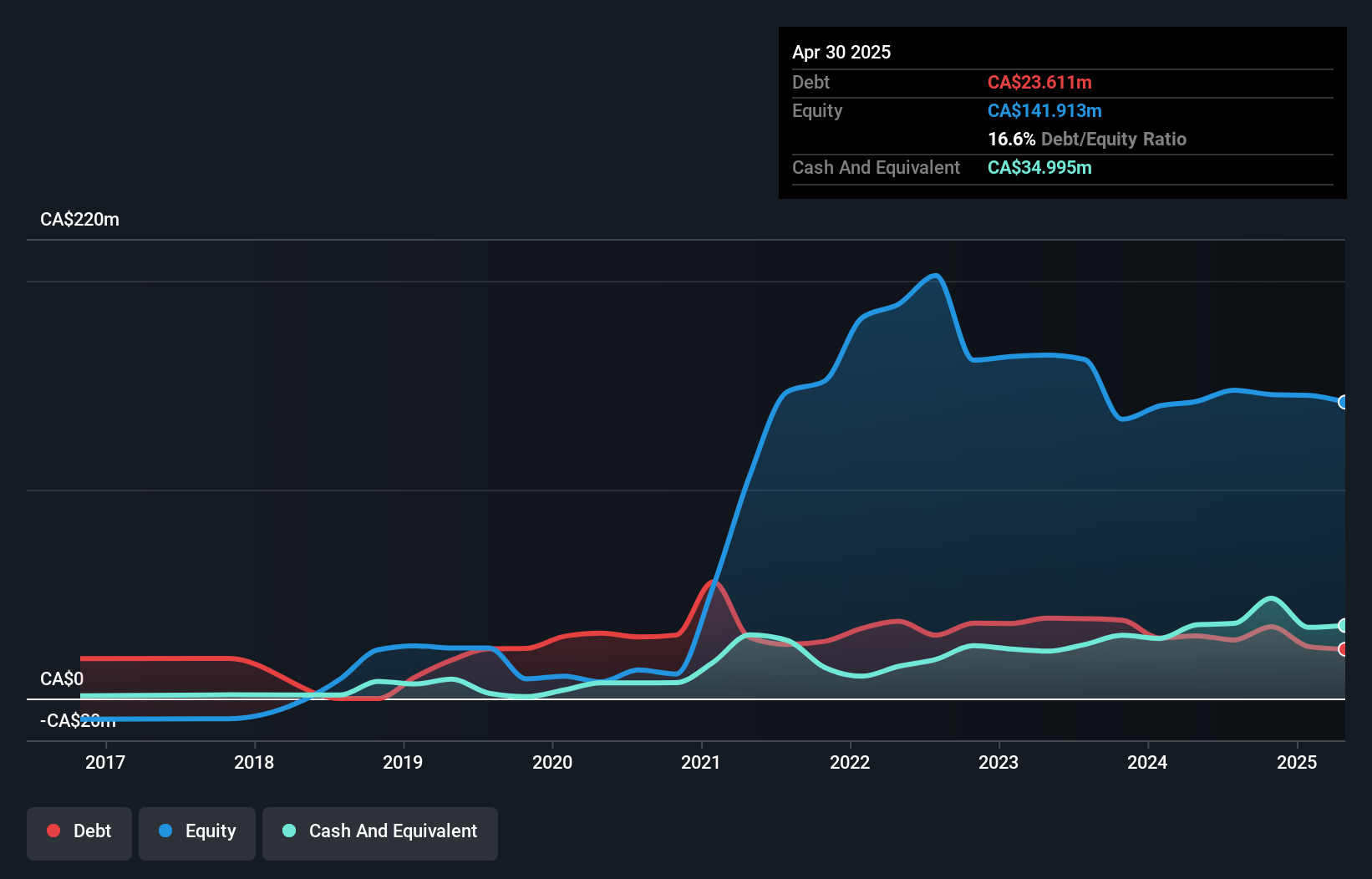

High Tide Inc., with a market cap of CA$298.50 million, is expanding its retail footprint in Canada, recently opening its 187th Canna Cabana store. Despite being unprofitable, the company has a robust cash position exceeding debt and maintains positive free cash flow sufficient for over three years. Trading at a significant discount to estimated fair value suggests potential for valuation gains. However, shareholder dilution and insider selling present concerns. Recent financing through debentures aims to support business growth and debt repayment. The management team is experienced, guiding strategic expansions and leveraging market share in Canada's competitive cannabis sector.

- Get an in-depth perspective on High Tide's performance by reading our balance sheet health report here.

- Review our growth performance report to gain insights into High Tide's future.

Orogen Royalties (TSXV:OGN)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Orogen Royalties Inc. is a mineral exploration company with operations in Canada, the United States, Mexico, Argentina, and Kenya, and has a market cap of CA$284.32 million.

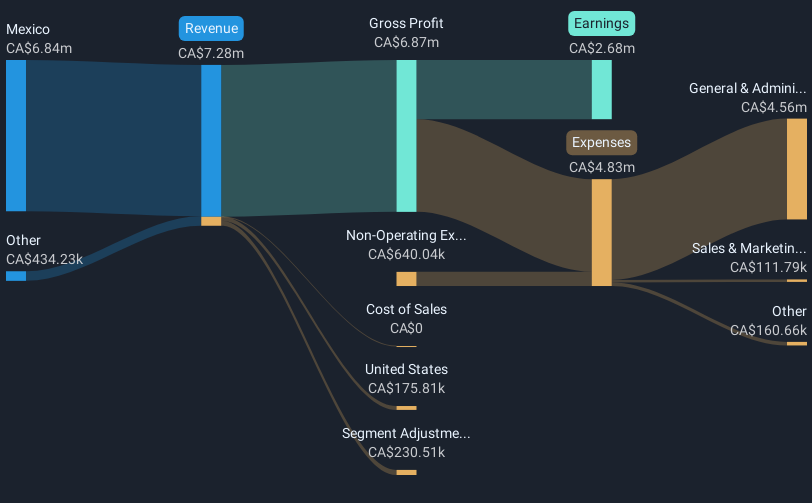

Operations: The company's revenue is derived from CA$6.87 million in mineral exploration activities.

Market Cap: CA$284.32M

Orogen Royalties Inc., with a market cap of CA$284.32 million, operates in mineral exploration across multiple countries. Despite generating CA$6.87 million in revenue, it lacks meaningful revenue streams, indicating a pre-revenue status typical for its industry. The company is debt-free and has strong short-term asset coverage over liabilities, which provides financial stability. However, shareholder dilution occurred last year with shares increasing by 4.3%. Orogen's management and board are experienced, supporting strategic oversight as the company navigates growth opportunities amid stable earnings growth of 46.6% over the past year compared to industry averages.

- Jump into the full analysis health report here for a deeper understanding of Orogen Royalties.

- Understand Orogen Royalties' earnings outlook by examining our growth report.

Key Takeaways

- Gain an insight into the universe of 960 TSX Penny Stocks by clicking here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if High Tide might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSXV:HITI

High Tide

Engages in the cannabis retail business in Canada, the United States, and internationally.

Flawless balance sheet and undervalued.