- Canada

- /

- Energy Services

- /

- TSX:PSD

3 TSX Penny Stocks With Market Caps Larger Than CA$10M To Watch

Reviewed by Simply Wall St

As Canada navigates the economic uncertainties stemming from new U.S. policies on tariffs and energy, the TSX index has shown resilience, buoyed by a healthy consumer base and positive economic growth. Amid this backdrop, penny stocks—often representing smaller or newer companies—remain an intriguing investment area for those looking to uncover hidden value beyond the major market players. Despite their vintage name, penny stocks can offer surprising potential when backed by strong financials, presenting opportunities for investors to explore promising avenues in today's market landscape.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Financial Health Rating |

| Alvopetro Energy (TSXV:ALV) | CA$4.99 | CA$189.37M | ★★★★★★ |

| Silvercorp Metals (TSX:SVM) | CA$4.34 | CA$933.34M | ★★★★★★ |

| Mandalay Resources (TSX:MND) | CA$4.50 | CA$406.63M | ★★★★★★ |

| Foraco International (TSX:FAR) | CA$2.24 | CA$222.46M | ★★★★★☆ |

| PetroTal (TSX:TAL) | CA$0.68 | CA$619.93M | ★★★★★★ |

| Pulse Seismic (TSX:PSD) | CA$2.46 | CA$123.03M | ★★★★★★ |

| Findev (TSXV:FDI) | CA$0.495 | CA$14.18M | ★★★★★★ |

| NamSys (TSXV:CTZ) | CA$1.00 | CA$26.86M | ★★★★★★ |

| East West Petroleum (TSXV:EW) | CA$0.04 | CA$3.62M | ★★★★★★ |

| Tornado Infrastructure Equipment (TSXV:TGH) | CA$1.03 | CA$140.31M | ★★★★★☆ |

Click here to see the full list of 937 stocks from our TSX Penny Stocks screener.

Let's dive into some prime choices out of the screener.

GoldMining (TSX:GOLD)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: GoldMining Inc. is a mineral exploration company that focuses on acquiring, exploring, and developing gold assets in the Americas with a market cap of CA$218.19 million.

Operations: Currently, there are no reported revenue segments for this mineral exploration company.

Market Cap: CA$218.19M

GoldMining Inc., with a market cap of CA$218.19 million, remains pre-revenue as it focuses on mineral exploration in the Americas. The company is debt-free and has not diluted shareholders significantly over the past year. Recent developments include a renewed at-the-market equity program to raise up to US$50 million, aimed at funding exploration, development, and potential acquisitions. Notably, their auger drilling program at the Sao Jorge Project in Brazil identified promising gold-in-bedrock targets with high-grade assay results exceeding expectations. These findings highlight potential for further resource expansion through planned deeper drilling in 2025.

- Take a closer look at GoldMining's potential here in our financial health report.

- Explore GoldMining's analyst forecasts in our growth report.

Pulse Seismic (TSX:PSD)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Pulse Seismic Inc. acquires, markets, and licenses 2D and 3D seismic data for the energy sector in Canada, with a market cap of CA$123.03 million.

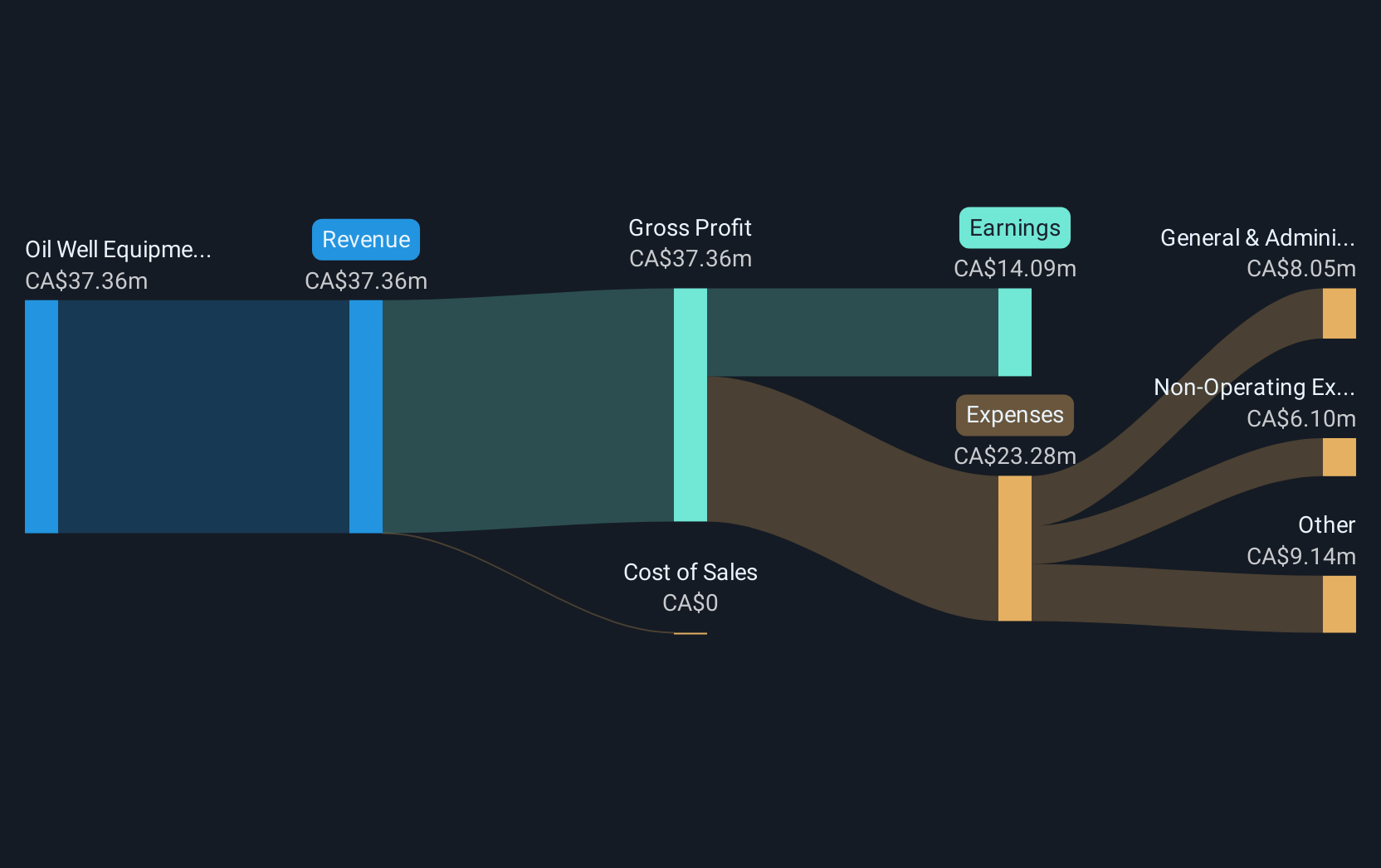

Operations: The company's revenue is derived from its Oil Well Equipment & Services segment, totaling CA$34.66 million.

Market Cap: CA$123.03M

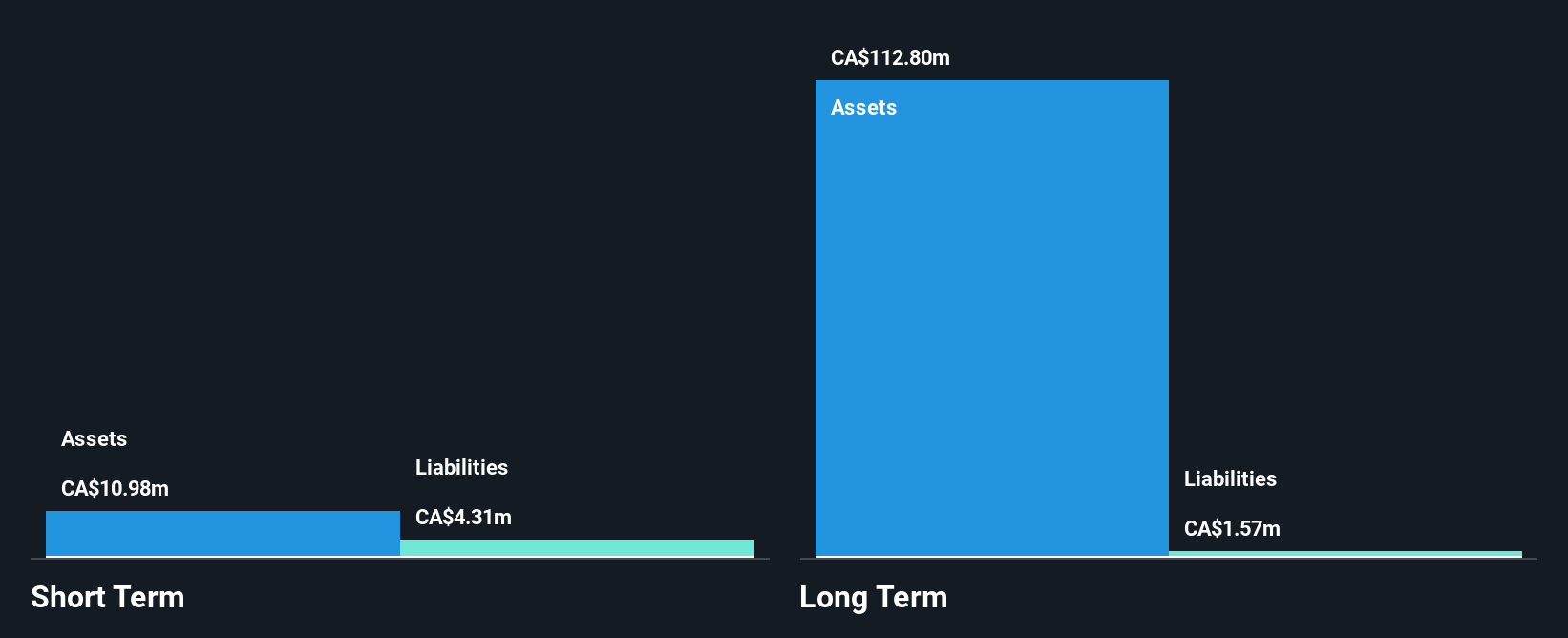

Pulse Seismic, with a market cap of CA$123.03 million, has demonstrated robust financial health and growth. The company boasts a high net profit margin of 31.5%, significantly improved from last year, and impressive earnings growth of 129.9% over the past year, outpacing the Energy Services industry average. It operates debt-free, ensuring stability in its financial structure while maintaining no significant shareholder dilution recently. Despite an unstable dividend track record, Pulse Seismic's seasoned management team and board contribute to its strong operational performance. The company's assets effectively cover both short- and long-term liabilities, underscoring fiscal prudence.

- Unlock comprehensive insights into our analysis of Pulse Seismic stock in this financial health report.

- Explore historical data to track Pulse Seismic's performance over time in our past results report.

Torrent Capital (TSXV:TORR)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Torrent Capital Ltd. is an investment company that focuses on investing in the securities of public and private companies, with a market cap of CA$18.90 million.

Operations: The company generates revenue from the mining of precious and base metals, amounting to CA$1.66 million.

Market Cap: CA$18.9M

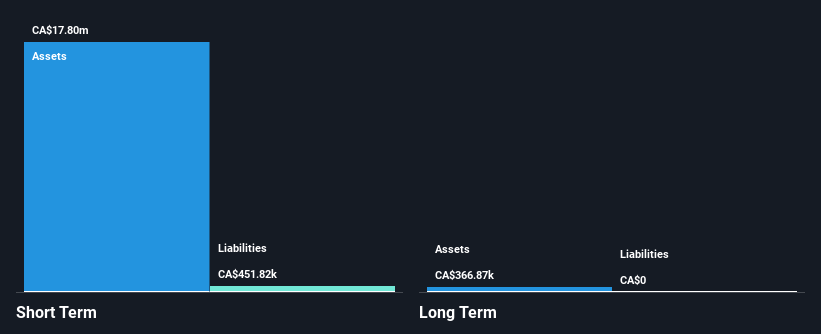

Torrent Capital Ltd. has shown a turnaround by becoming profitable in the last year, reporting CA$1.56 million in net income for Q3 2024 compared to a loss previously. The company's market cap is CA$18.90 million, and it operates debt-free, providing financial flexibility despite having no significant revenue streams from its investments yet. Recent developments include a private placement offering expected to raise CA$5 million, potentially enhancing its investment capabilities. Additionally, the appointment of Carl Sheppard as President and COO may bolster strategic growth initiatives through expanded business consulting services and joint ventures like Argentia Capital Inc.

- Get an in-depth perspective on Torrent Capital's performance by reading our balance sheet health report here.

- Evaluate Torrent Capital's historical performance by accessing our past performance report.

Seize The Opportunity

- Embark on your investment journey to our 937 TSX Penny Stocks selection here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:PSD

Pulse Seismic

Acquires, markets, and licenses two-dimensional (2D) and three-dimensional (3D) seismic data for the energy sector in Canada.

Outstanding track record with flawless balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives