- Canada

- /

- Energy Services

- /

- TSX:PSD

3 TSX Dividend Stocks With Up To 8.1% Yield For Your Portfolio

Reviewed by Simply Wall St

Despite experiencing significant volatility in the first half of 2025, the Canadian market has shown resilience, with the TSX reaching new all-time highs amid easing trade tensions and robust economic data. In this environment, dividend stocks can offer stability and income potential, making them an attractive option for investors seeking to navigate uncertainties while capitalizing on favorable market conditions.

Top 10 Dividend Stocks In Canada

| Name | Dividend Yield | Dividend Rating |

| Sun Life Financial (TSX:SLF) | 4.10% | ★★★★★☆ |

| Russel Metals (TSX:RUS) | 3.89% | ★★★★★☆ |

| Royal Bank of Canada (TSX:RY) | 3.42% | ★★★★★☆ |

| Pulse Seismic (TSX:PSD) | 8.11% | ★★★★★☆ |

| Power Corporation of Canada (TSX:POW) | 4.61% | ★★★★★☆ |

| National Bank of Canada (TSX:NA) | 3.35% | ★★★★★☆ |

| IGM Financial (TSX:IGM) | 5.30% | ★★★★★☆ |

| Canadian Imperial Bank of Commerce (TSX:CM) | 3.94% | ★★★★★☆ |

| Atrium Mortgage Investment (TSX:AI) | 9.69% | ★★★★★☆ |

| Acadian Timber (TSX:ADN) | 6.44% | ★★★★★☆ |

Click here to see the full list of 27 stocks from our Top TSX Dividend Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

High Liner Foods (TSX:HLF)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: High Liner Foods Incorporated processes and markets prepared and packaged frozen seafood products in North America, with a market cap of CA$544.32 million.

Operations: The company's revenue segment is primarily derived from the manufacturing and marketing of prepared and packaged frozen seafood, totaling $950.68 million.

Dividend Yield: 3.5%

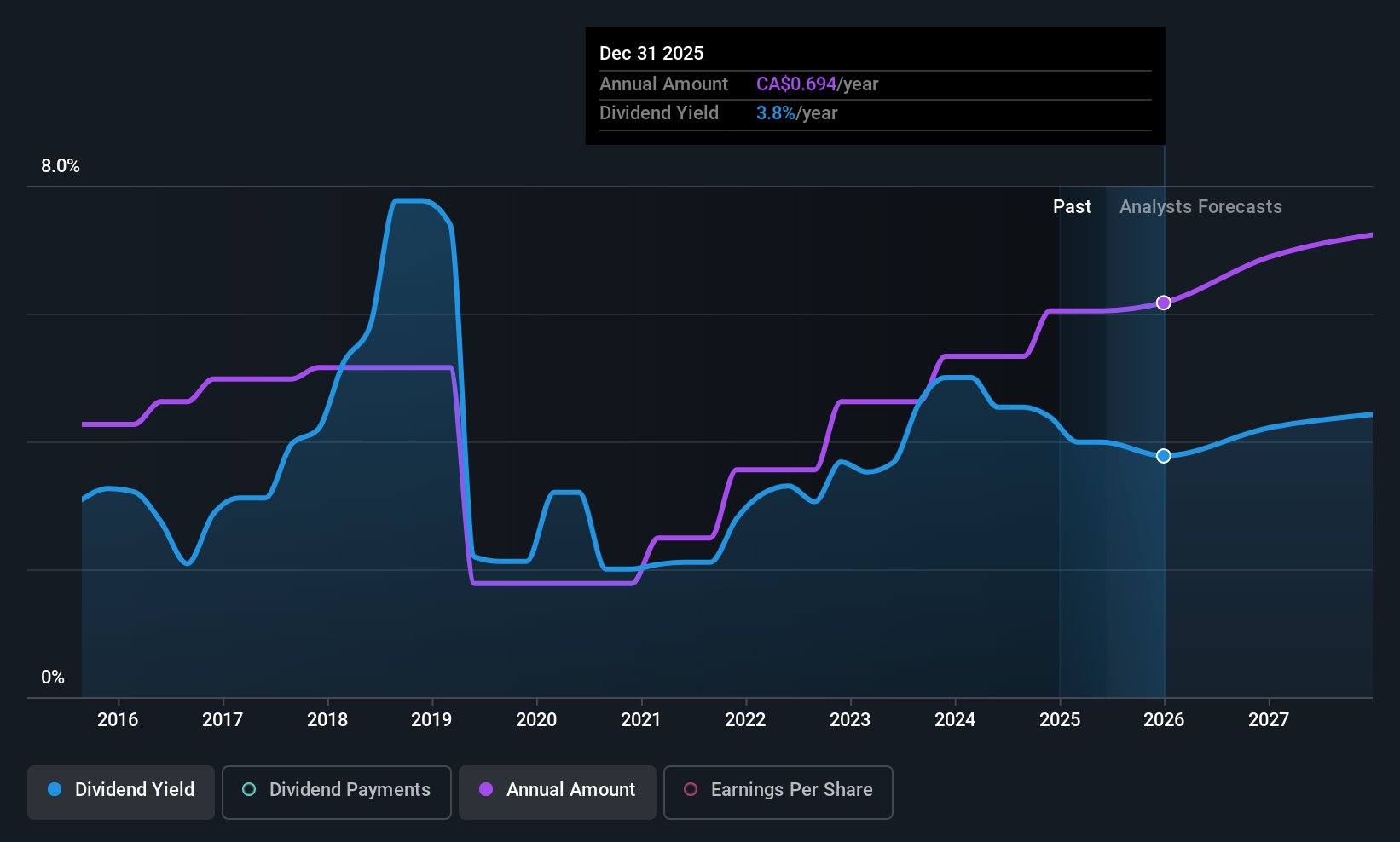

High Liner Foods' dividend payments have been volatile over the past decade, with a history of instability despite recent increases. The company's dividends are well-covered by both earnings (payout ratio: 23%) and cash flows (cash payout ratio: 35.9%), suggesting sustainability in current payouts. However, its dividend yield of 3.46% is lower than the top quartile in Canada. Recent earnings show slight declines in sales and net income compared to last year, yet EPS improved marginally.

- Delve into the full analysis dividend report here for a deeper understanding of High Liner Foods.

- In light of our recent valuation report, it seems possible that High Liner Foods is trading behind its estimated value.

Pulse Seismic (TSX:PSD)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Pulse Seismic Inc. acquires, markets, and licenses 2D and 3D seismic data for the energy sector in Canada, with a market cap of CA$181.20 million.

Operations: Pulse Seismic Inc. generates revenue of CA$37.36 million from licensing seismic data in the oil well equipment and services sector.

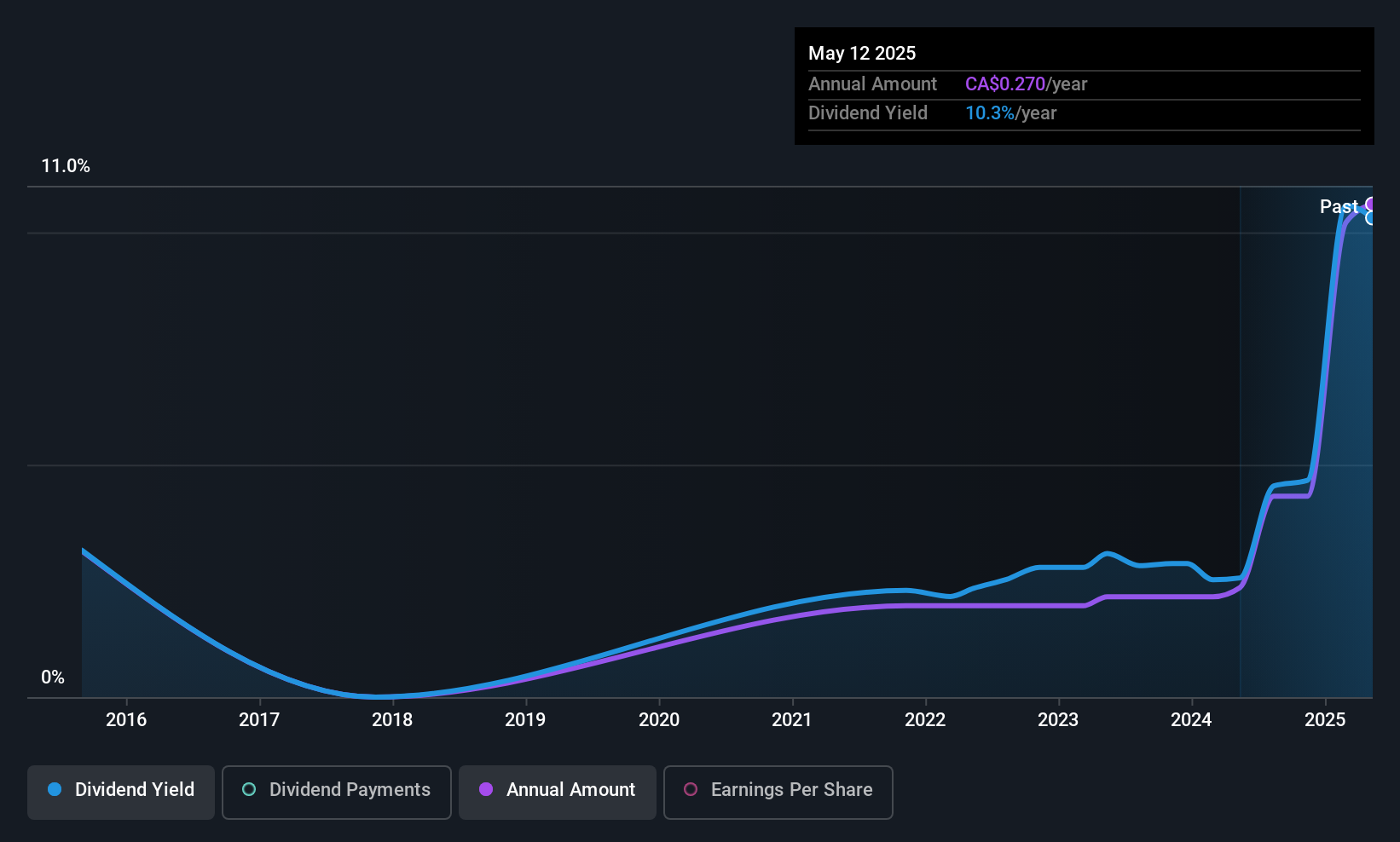

Dividend Yield: 8.1%

Pulse Seismic's dividend is well-covered by earnings, with a payout ratio of 21.8%, and cash flows, at 67.5%. Despite past volatility in payments, the recent 17% dividend increase to CAD 0.07 per share suggests improved reliability. The dividend yield of 8.11% ranks in the top quartile for Canadian stocks. Recent earnings show significant growth, with net income rising to CAD 13.38 million from CAD 2.68 million year-over-year, supporting future payouts.

- Unlock comprehensive insights into our analysis of Pulse Seismic stock in this dividend report.

- The valuation report we've compiled suggests that Pulse Seismic's current price could be inflated.

Whitecap Resources (TSX:WCP)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Whitecap Resources Inc. focuses on the acquisition, development, and production of petroleum and natural gas properties in Western Canada, with a market cap of CA$11.47 billion.

Operations: Whitecap Resources Inc. generates revenue primarily through its oil and gas exploration and production segment, amounting to CA$3.41 billion.

Dividend Yield: 7.9%

Whitecap Resources' dividend yield of 7.87% ranks in the top quartile among Canadian stocks, but its sustainability is questionable due to a high cash payout ratio of 140.4%. Recent earnings growth of 33.4% supports coverage by earnings, yet dividends have been unreliable over the past decade. The company recently affirmed a CAD 0.0608 per share dividend and completed a $300 million debt offering, enhancing financial stability with an upgraded BBB credit rating.

- Click here to discover the nuances of Whitecap Resources with our detailed analytical dividend report.

- According our valuation report, there's an indication that Whitecap Resources' share price might be on the cheaper side.

Next Steps

- Unlock our comprehensive list of 27 Top TSX Dividend Stocks by clicking here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:PSD

Pulse Seismic

Acquires, markets, and licenses two-dimensional (2D) and three-dimensional (3D) seismic data for the energy sector in Canada.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives