- Canada

- /

- Oil and Gas

- /

- TSX:POU

Did Share Buyback Expiry Just Shift Paramount Resources' (TSX:POU) Investment Narrative?

Reviewed by Simply Wall St

- Paramount Resources' share buyback plan expired on July 7, 2025, following a period of active repurchasing on the TSX under the symbol POU.

- This development could signal a shift in the company's capital allocation priorities, which may prompt stakeholders to reassess future expectations.

- We’ll explore how the conclusion of the buyback plan shapes Paramount Resources’ investment narrative and influences investor considerations.

Outshine the giants: these 19 early-stage AI stocks could fund your retirement.

What Is Paramount Resources' Investment Narrative?

To be a Paramount Resources shareholder, you need to see long-term value in a company with high net profit margins, exceptional return on equity, and a record of profit growth. At the same time, ongoing declines in revenue and consensus forecasts for falling earnings cannot be ignored. The recent expiration of Paramount’s share buyback plan may prompt investors to rethink how the company allocates capital going forward, but with only a modest share price uptick after the news broke, there are few signs of drastic market reactions. The focus likely returns to Paramount’s ability to sustain generous dividends given previous warnings about free cash flow coverage, and whether expected declines in the company’s top and bottom lines could become more pressing risks. Overall, the end of the buyback may not significantly alter the primary catalysts or risk factors in the near term. However, Paramount’s ongoing cash flow coverage of dividends is still a crucial risk investors should watch.

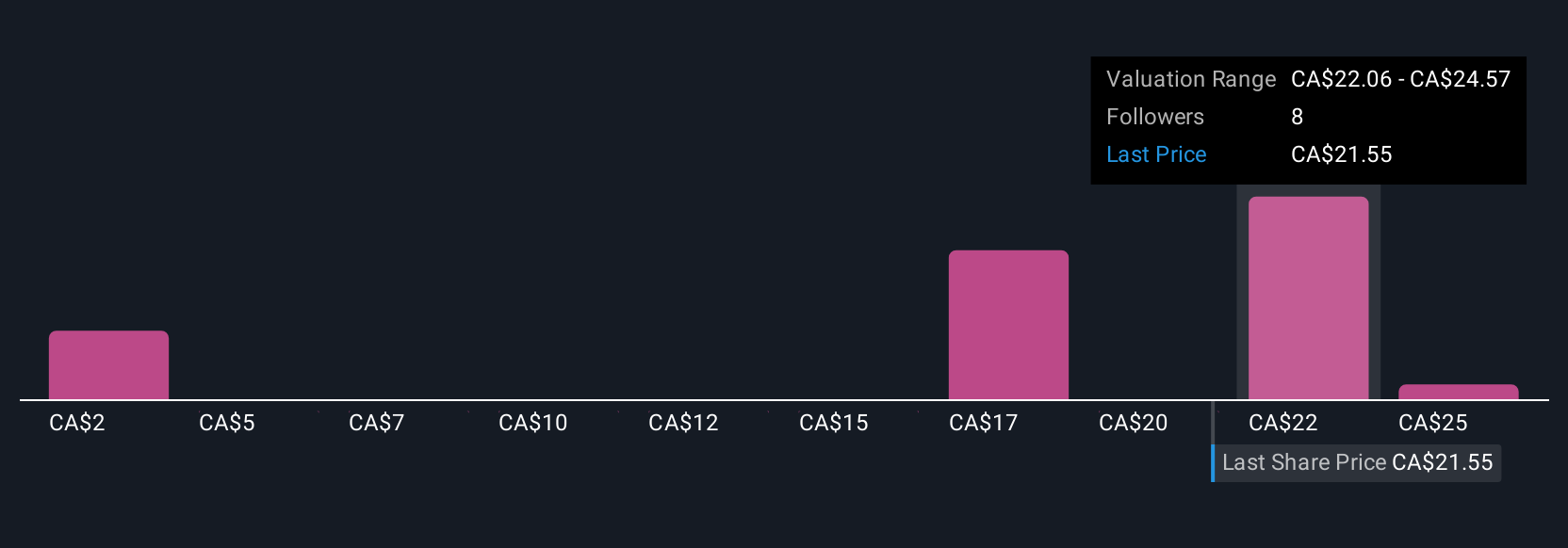

Paramount Resources' share price has been on the slide but might be up to 18% below fair value. Find out if it's a bargain.Exploring Other Perspectives

Build Your Own Paramount Resources Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Paramount Resources research is our analysis highlighting 3 key rewards and 4 important warning signs that could impact your investment decision.

- Our free Paramount Resources research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Paramount Resources' overall financial health at a glance.

Ready For A Different Approach?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- We've found 17 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:POU

Paramount Resources

An energy company, explores for and develops conventional and unconventional petroleum and natural gas reserves and resources in Canada.

Flawless balance sheet with solid track record.

Market Insights

Community Narratives