- Canada

- /

- Oil and Gas

- /

- TSX:PEY

Here's Why We Think Peyto Exploration & Development (TSE:PEY) Is Well Worth Watching

Investors are often guided by the idea of discovering 'the next big thing', even if that means buying 'story stocks' without any revenue, let alone profit. Unfortunately, these high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson. Loss making companies can act like a sponge for capital - so investors should be cautious that they're not throwing good money after bad.

So if this idea of high risk and high reward doesn't suit, you might be more interested in profitable, growing companies, like Peyto Exploration & Development (TSE:PEY). Even if this company is fairly valued by the market, investors would agree that generating consistent profits will continue to provide Peyto Exploration & Development with the means to add long-term value to shareholders.

Check out our latest analysis for Peyto Exploration & Development

How Fast Is Peyto Exploration & Development Growing Its Earnings Per Share?

In the last three years Peyto Exploration & Development's earnings per share took off; so much so that it's a bit disingenuous to use these figures to try and deduce long term estimates. Thus, it makes sense to focus on more recent growth rates, instead. Peyto Exploration & Development's EPS has risen over the last 12 months, growing from CA$1.74 to CA$1.97. There's little doubt shareholders would be happy with that 13% gain.

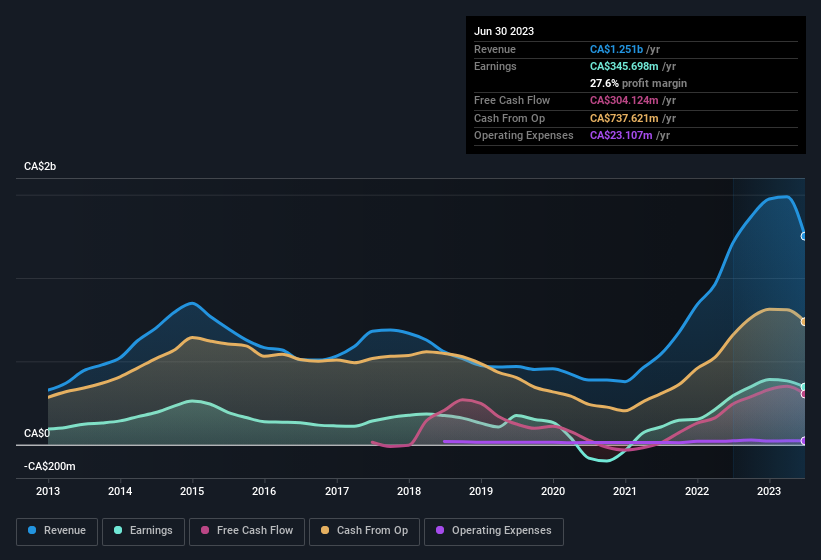

Top-line growth is a great indicator that growth is sustainable, and combined with a high earnings before interest and taxation (EBIT) margin, it's a great way for a company to maintain a competitive advantage in the market. Peyto Exploration & Development shareholders can take confidence from the fact that EBIT margins are up from 35% to 41%, and revenue is growing. That's great to see, on both counts.

You can take a look at the company's revenue and earnings growth trend, in the chart below. Click on the chart to see the exact numbers.

In investing, as in life, the future matters more than the past. So why not check out this free interactive visualization of Peyto Exploration & Development's forecast profits?

Are Peyto Exploration & Development Insiders Aligned With All Shareholders?

Insider interest in a company always sparks a bit of intrigue and many investors are on the lookout for companies where insiders are putting their money where their mouth is. That's because insider buying often indicates that those closest to the company have confidence that the share price will perform well. However, insiders are sometimes wrong, and we don't know the exact thinking behind their acquisitions.

It's pleasing to note that insiders spent CA$7.0m buying Peyto Exploration & Development shares, over the last year, without reporting any share sales whatsoever. The shareholders within the general public should find themselves expectant and certainly hopeful, that this large outlay signals prescient optimism for the business. Zooming in, we can see that the biggest insider purchase was by Independent Chairman of the Board Donald Gray for CA$3.8m worth of shares, at about CA$14.60 per share.

The good news, alongside the insider buying, for Peyto Exploration & Development bulls is that insiders (collectively) have a meaningful investment in the stock. Given insiders own a significant chunk of shares, currently valued at CA$77m, they have plenty of motivation to push the business to succeed. This would indicate that the goals of shareholders and management are one and the same.

While insiders are apparently happy to hold and accumulate shares, that is just part of the big picture. That's because Peyto Exploration & Development's CEO, JP Lachance, is paid at a relatively modest level when compared to other CEOs for companies of this size. The median total compensation for CEOs of companies similar in size to Peyto Exploration & Development, with market caps between CA$1.4b and CA$4.4b, is around CA$3.3m.

Peyto Exploration & Development offered total compensation worth CA$2.5m to its CEO in the year to December 2022. That is actually below the median for CEO's of similarly sized companies. CEO compensation is hardly the most important aspect of a company to consider, but when it's reasonable, that gives a little more confidence that leadership are looking out for shareholder interests. It can also be a sign of good governance, more generally.

Should You Add Peyto Exploration & Development To Your Watchlist?

One positive for Peyto Exploration & Development is that it is growing EPS. That's nice to see. Better yet, insiders are significant shareholders, and have been buying more shares. That should do plenty in prompting budding investors to undertake a bit more research - or even adding the company to their watchlists. We should say that we've discovered 2 warning signs for Peyto Exploration & Development that you should be aware of before investing here.

The good news is that Peyto Exploration & Development is not the only growth stock with insider buying. Here's a list of them... with insider buying in the last three months!

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSX:PEY

Peyto Exploration & Development

Engages in the exploration, development, and production of natural gas, oil, and natural gas liquids in Alberta’s deep basin.

Undervalued with proven track record.

Market Insights

Community Narratives