Stock Analysis

- Canada

- /

- Oil and Gas

- /

- TSX:PEY

Exploring TSX Dividend Stocks In May 2024

Reviewed by Simply Wall St

As the Canadian market mirrors favorable trends seen in the U.S., with moderating inflation and strong corporate earnings propelling stocks to new heights, investors are looking at a robust backdrop for exploring dividend-paying stocks on the TSX. In this environment, identifying stocks that offer sustainable dividends can be particularly appealing as they provide potential for steady income amidst ongoing economic growth and less restrictive monetary policies.

Top 10 Dividend Stocks In Canada

| Name | Dividend Yield | Dividend Rating |

| Bank of Nova Scotia (TSX:BNS) | 6.40% | ★★★★★★ |

| Whitecap Resources (TSX:WCP) | 7.00% | ★★★★★★ |

| Power Corporation of Canada (TSX:POW) | 5.74% | ★★★★★☆ |

| Enghouse Systems (TSX:ENGH) | 3.56% | ★★★★★☆ |

| Secure Energy Services (TSX:SES) | 3.51% | ★★★★★☆ |

| Boston Pizza Royalties Income Fund (TSX:BPF.UN) | 8.53% | ★★★★★☆ |

| Russel Metals (TSX:RUS) | 4.32% | ★★★★★☆ |

| Canadian Natural Resources (TSX:CNQ) | 3.99% | ★★★★★☆ |

| Royal Bank of Canada (TSX:RY) | 3.82% | ★★★★★☆ |

| Sun Life Financial (TSX:SLF) | 4.63% | ★★★★★☆ |

Click here to see the full list of 31 stocks from our Top TSX Dividend Stocks screener.

Let's uncover some gems from our specialized screener.

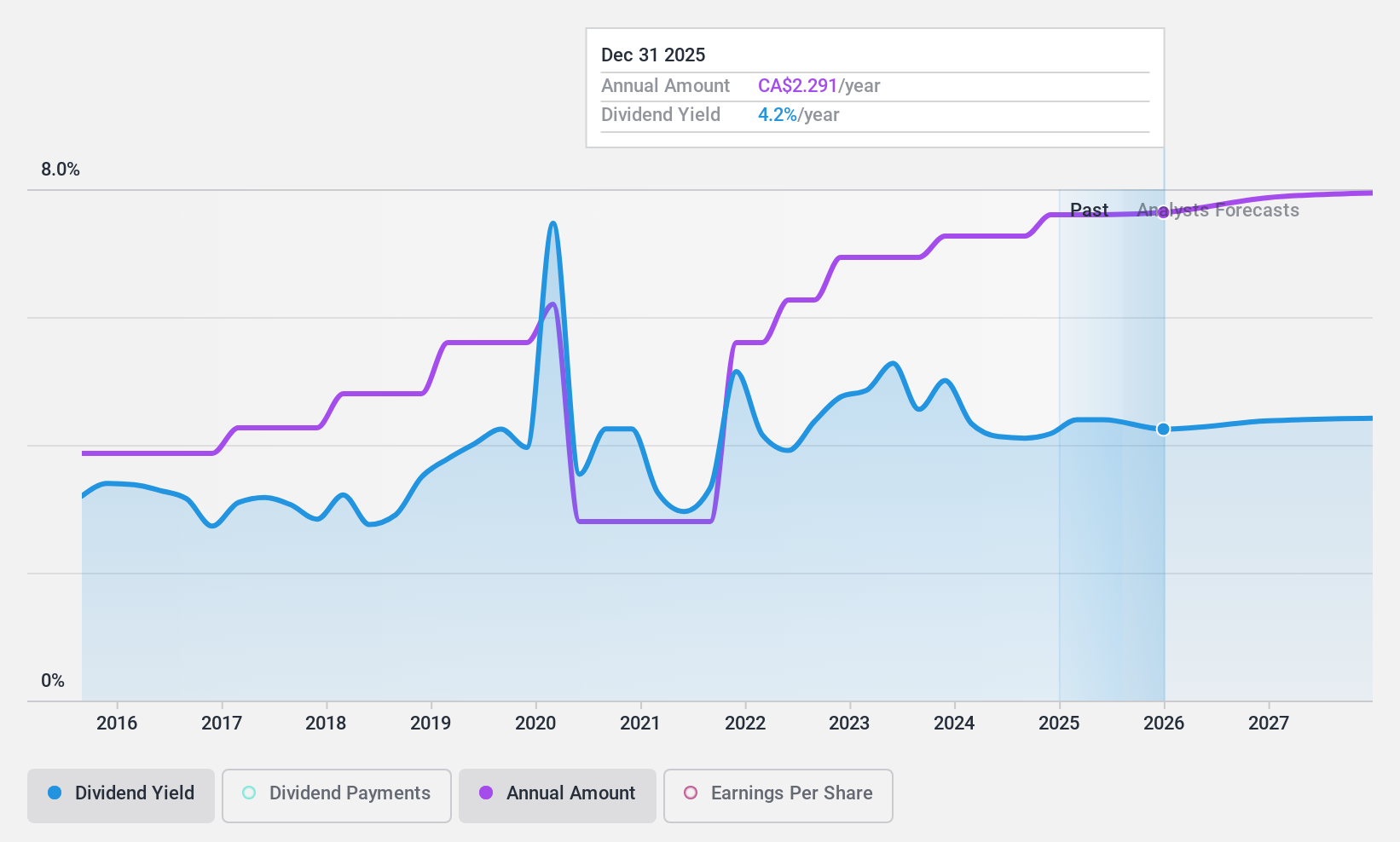

Enghouse Systems (TSX:ENGH)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Enghouse Systems Limited, a global enterprise software solutions provider, has a market capitalization of approximately CA$1.60 billion.

Operations: Enghouse Systems Limited generates its revenue primarily through two segments: the Asset Management Group, which contributed CA$184.48 million, and the Interactive Management Group, with CA$283.60 million in revenues.

Dividend Yield: 3.6%

Enghouse Systems has recently increased its quarterly dividend to CA$0.26 per share, reflecting an 18.2% rise, payable on May 31, 2024. The company's dividends are well-covered with a payout ratio of 69.3% and supported by both earnings and cash flows (cash payout ratio at 55%). Despite a reliable history of dividend payments over the past decade, Enghouse's yield stands at 3.56%, which is lower compared to top Canadian dividend payers. Additionally, the firm has committed to a share repurchase program, planning to buy back up to 5.41% of its shares by May 2025, signaling confidence in its financial health and commitment to returning value to shareholders.

- Delve into the full analysis dividend report here for a deeper understanding of Enghouse Systems.

- Our valuation report unveils the possibility Enghouse Systems' shares may be trading at a discount.

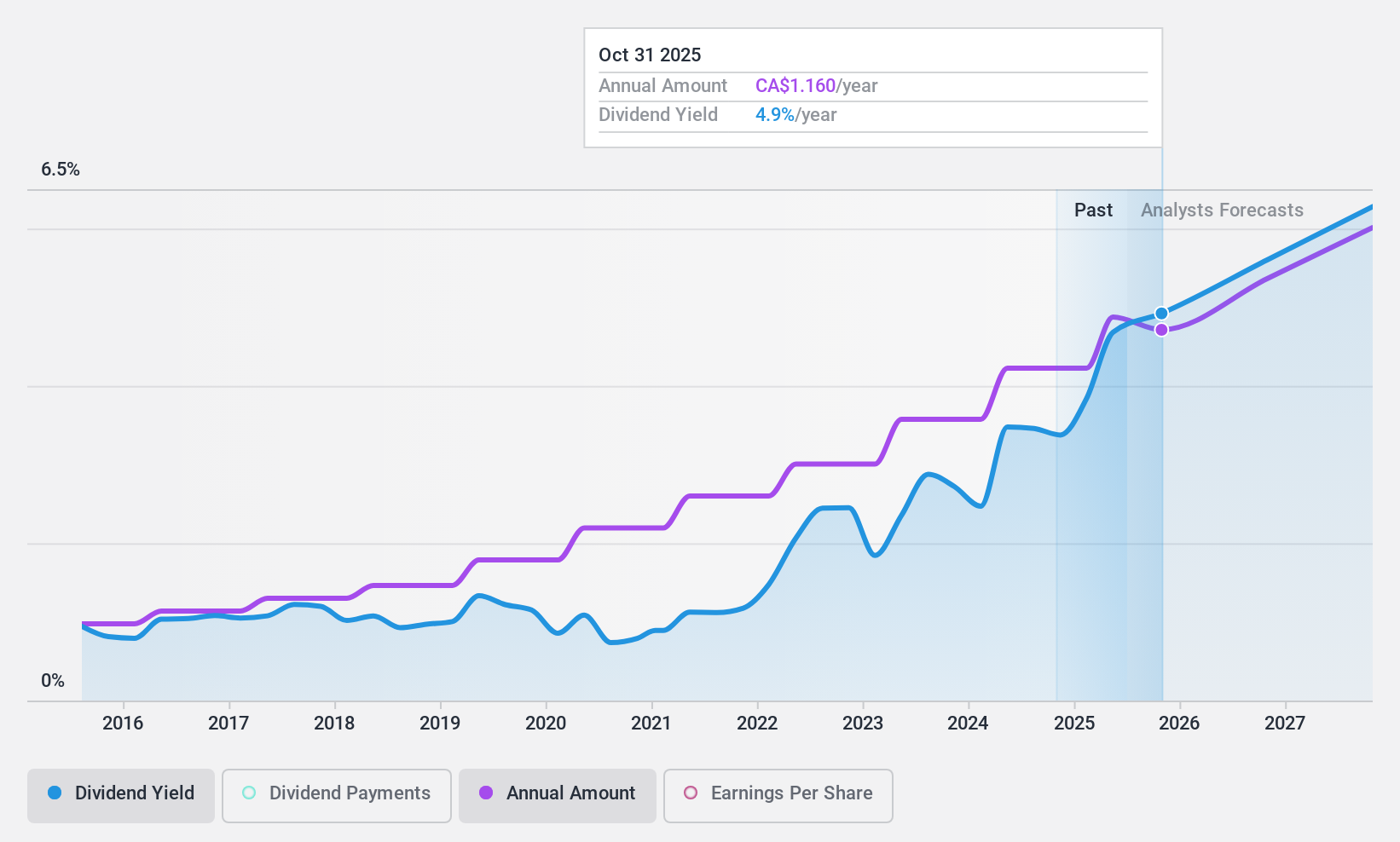

Peyto Exploration & Development (TSX:PEY)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Peyto Exploration & Development Corp. is an energy company focused on the exploration, development, and production of natural gas, oil, and natural gas liquids in Alberta's Deep Basin, with a market capitalization of approximately CA$3.08 billion.

Operations: Peyto Exploration & Development Corp. generates its revenue primarily from the exploration and production segment, totaling CA$876.26 million.

Dividend Yield: 8.3%

Peyto Exploration & Development Corp. offers a high dividend yield of 8.34%, ranking in the top 25% of Canadian payers, but its sustainability is questionable with both cash flows and earnings struggling to cover payouts; the cash payout ratio stands at 102.5%. Despite trading at 67% below its estimated fair value and increasing dividends over the past decade, Peyto's financial position is burdened by high debt levels, and recent earnings show volatility with a significant drop in net income from CAD 390.66 million in 2023 to CAD 292.64 million by year-end.

- Navigate through the intricacies of Peyto Exploration & Development with our comprehensive dividend report here.

- Our comprehensive valuation report raises the possibility that Peyto Exploration & Development is priced lower than what may be justified by its financials.

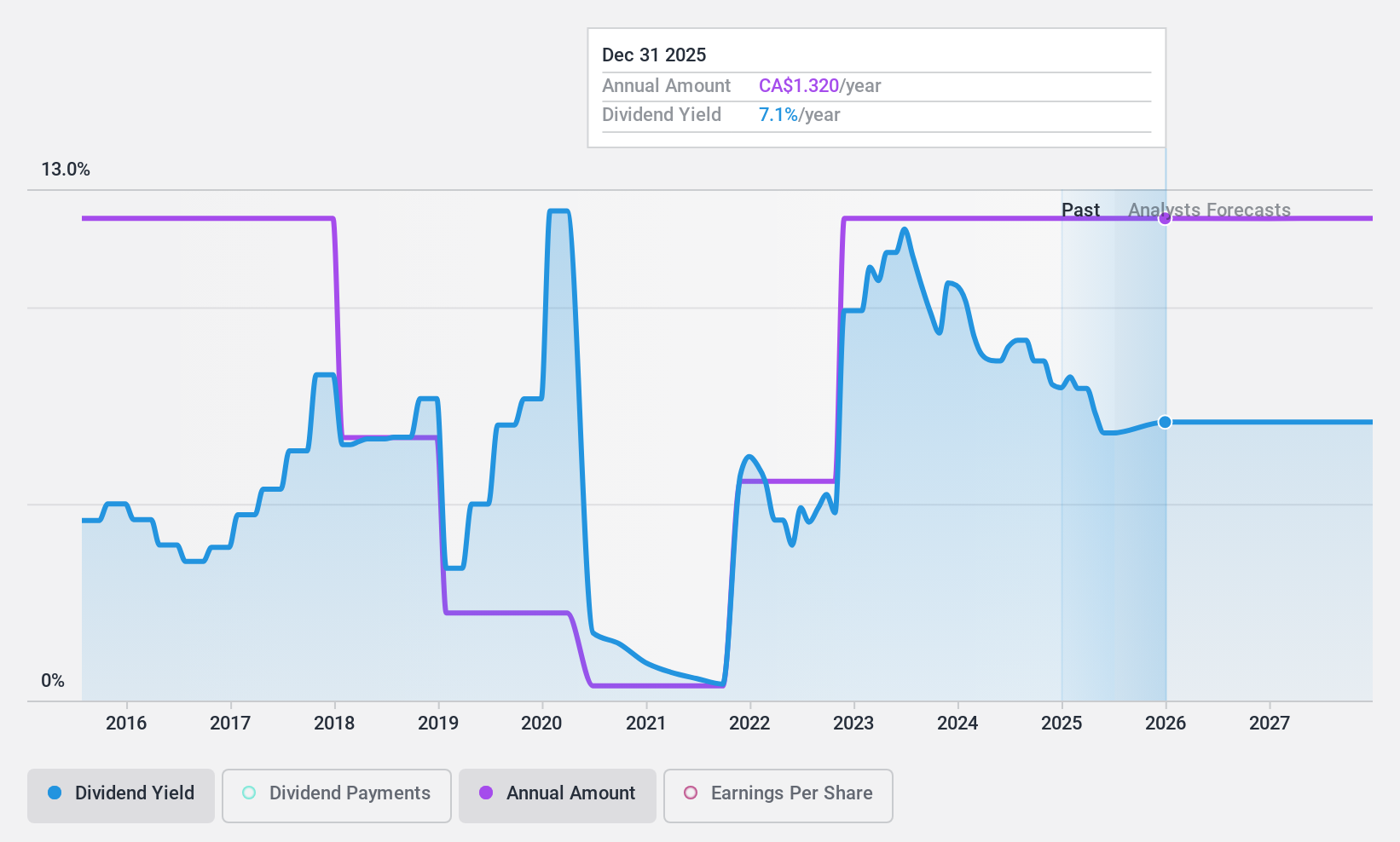

Suncor Energy (TSX:SU)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Suncor Energy Inc. is an integrated energy company with operations in Canada, the United States, and internationally, boasting a market capitalization of approximately CA$70.17 billion.

Operations: Suncor Energy Inc. generates revenue primarily through three segments: Oil Sands at CA$23.76 billion, Refining and Marketing at CA$31.51 billion, and Exploration and Production at CA$2.17 billion.

Dividend Yield: 3.9%

Suncor Energy's dividend sustainability is underpinned by a low payout ratio of 35.2%, indicating coverage by both earnings and cash flows. Despite trading at 47.5% below estimated fair value, the company's dividend history is marked by instability, with significant fluctuations over the past decade. Additionally, its dividend yield of 3.89% is modest compared to leading Canadian dividend stocks. Recent increases in production and processing capacities suggest operational growth, yet shareholder proposals on environmental strategies indicate potential governance challenges affecting future stability.

- Get an in-depth perspective on Suncor Energy's performance by reading our dividend report here.

- Our expertly prepared valuation report Suncor Energy implies its share price may be lower than expected.

Turning Ideas Into Actions

- Discover the full array of 31 Top TSX Dividend Stocks right here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're helping make it simple.

Find out whether Peyto Exploration & Development is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:PEY

Peyto Exploration & Development

An energy company, engages in the exploration, development, and production of natural gas, oil, and natural gas liquids in Deep Basin of Alberta.

Very undervalued with adequate balance sheet and pays a dividend.