- Canada

- /

- Oil and Gas

- /

- TSX:PEA

Would Shareholders Who Purchased Pieridae Energy's (TSE:PEA) Stock Three Years Be Happy With The Share price Today?

Every investor on earth makes bad calls sometimes. But really bad investments should be rare. So spare a thought for the long term shareholders of Pieridae Energy Limited (TSE:PEA); the share price is down a whopping 90% in the last three years. That would be a disturbing experience. The good news is that the stock is up 4.1% in the last week.

We really hope anyone holding through that price crash has a diversified portfolio. Even when you lose money, you don't have to lose the lesson.

View our latest analysis for Pieridae Energy

Pieridae Energy isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. When a company doesn't make profits, we'd generally expect to see good revenue growth. Some companies are willing to postpone profitability to grow revenue faster, but in that case one does expect good top-line growth.

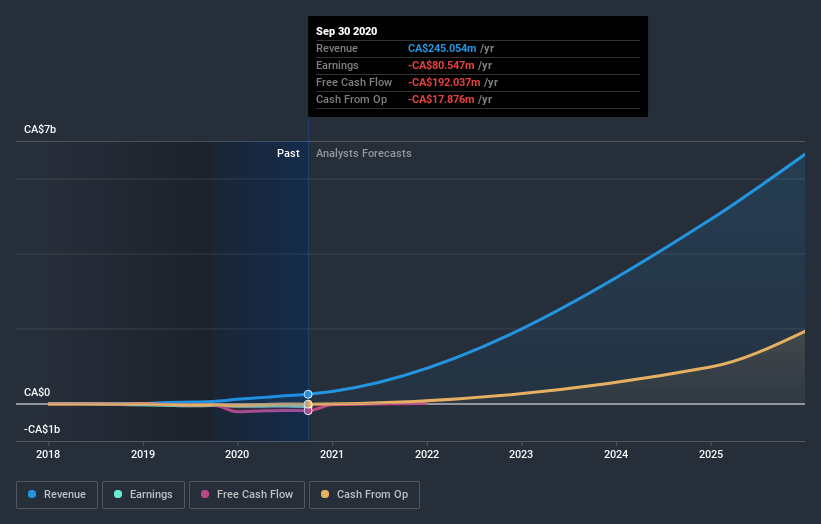

Over three years, Pieridae Energy grew revenue at 127% per year. That's well above most other pre-profit companies. So why has the share priced crashed 24% per year, in the same time? The share price makes us wonder if there is an issue with profitability. Ultimately, revenue growth doesn't amount to much if the business can't scale well. If the company is low on cash, it may have to raise capital soon.

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

We like that insiders have been buying shares in the last twelve months. Even so, future earnings will be far more important to whether current shareholders make money. So it makes a lot of sense to check out what analysts think Pieridae Energy will earn in the future (free profit forecasts).

A Different Perspective

Pleasingly, Pieridae Energy's total shareholder return last year was 89%. That certainly beats the loss of about 24% per year over three years. We're generally cautious about putting too much weigh on shorter term data, but the recent improvement is definitely a positive. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. For example, we've discovered 5 warning signs for Pieridae Energy (1 is a bit unpleasant!) that you should be aware of before investing here.

Pieridae Energy is not the only stock insiders are buying. So take a peek at this free list of growing companies with insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on CA exchanges.

If you decide to trade Pieridae Energy, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TSX:PEA

Pieridae Energy

Operates as an integrated midstream and upstream energy company in Canada.

Slightly overvalued very low.

Market Insights

Community Narratives