- Canada

- /

- Metals and Mining

- /

- TSX:OLA

TSX Growth Companies With High Insider Ownership

Reviewed by Simply Wall St

In recent months, Canadian large-cap stocks have reached new all-time highs, highlighting the resilience of the market amidst global economic uncertainties and persistent inflationary pressures. As investors navigate these conditions, identifying growth companies with high insider ownership can be a strategic approach, as such ownership often signals confidence in the company's potential and alignment with shareholder interests.

Top 10 Growth Companies With High Insider Ownership In Canada

| Name | Insider Ownership | Earnings Growth |

| Propel Holdings (TSX:PRL) | 36.5% | 33% |

| Robex Resources (TSXV:RBX) | 25.6% | 147.4% |

| Almonty Industries (TSX:AII) | 11.6% | 55.8% |

| goeasy (TSX:GSY) | 21.9% | 18.2% |

| Aritzia (TSX:ATZ) | 17.5% | 22.4% |

| Discovery Silver (TSX:DSV) | 17.5% | 49.4% |

| Enterprise Group (TSX:E) | 32.2% | 24.8% |

| Green Impact Partners (TSXV:GIP) | 19.9% | 125.3% |

| Allied Gold (TSX:AAUC) | 16% | 76% |

| Tenaz Energy (TSX:TNZ) | 10.4% | 151.2% |

Let's review some notable picks from our screened stocks.

Discovery Silver (TSX:DSV)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Discovery Silver Corp. is a mineral exploration company focused on acquiring, exploring, and developing mineral properties in Canada with a market cap of CA$2.03 billion.

Operations: Discovery Silver Corp. does not currently report any revenue segments, as it is primarily engaged in the exploration and development of mineral properties.

Insider Ownership: 17.5%

Discovery Silver has seen significant insider buying recently, despite reporting a net loss of C$9.26 million for Q1 2025. The company is trading significantly below its estimated fair value and is expected to achieve profitability within three years, with revenue growth forecasted at 41.5% annually—well above the Canadian market average. Recent management changes, including experienced industry leaders, aim to support strategic growth initiatives like the Porcupine Complex acquisition.

- Navigate through the intricacies of Discovery Silver with our comprehensive analyst estimates report here.

- Insights from our recent valuation report point to the potential overvaluation of Discovery Silver shares in the market.

North American Construction Group (TSX:NOA)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: North American Construction Group Ltd. offers mining and heavy civil construction services to the resource development and industrial construction sectors in Australia, Canada, and the United States, with a market cap of CA$715.80 million.

Operations: The company's revenue is primarily derived from providing services in mining and heavy civil construction across the resource development and industrial construction sectors in Australia, Canada, and the United States.

Insider Ownership: 10.6%

North American Construction Group has experienced substantial insider buying, aligning with forecasts of significant earnings growth at 52.7% annually, outpacing the Canadian market. Despite a recent decline in net income to C$6.16 million for Q1 2025 and profit margins dropping to 3.2%, the company is trading well below its estimated fair value. Recent debt financing of C$225 million aims to strengthen financial flexibility, though interest coverage remains a concern alongside an unsustainable dividend yield of 1.99%.

- Click here and access our complete growth analysis report to understand the dynamics of North American Construction Group.

- In light of our recent valuation report, it seems possible that North American Construction Group is trading behind its estimated value.

Orla Mining (TSX:OLA)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Orla Mining Ltd. is engaged in acquiring, exploring, developing, and exploiting mineral properties with a market cap of CA$4.14 billion.

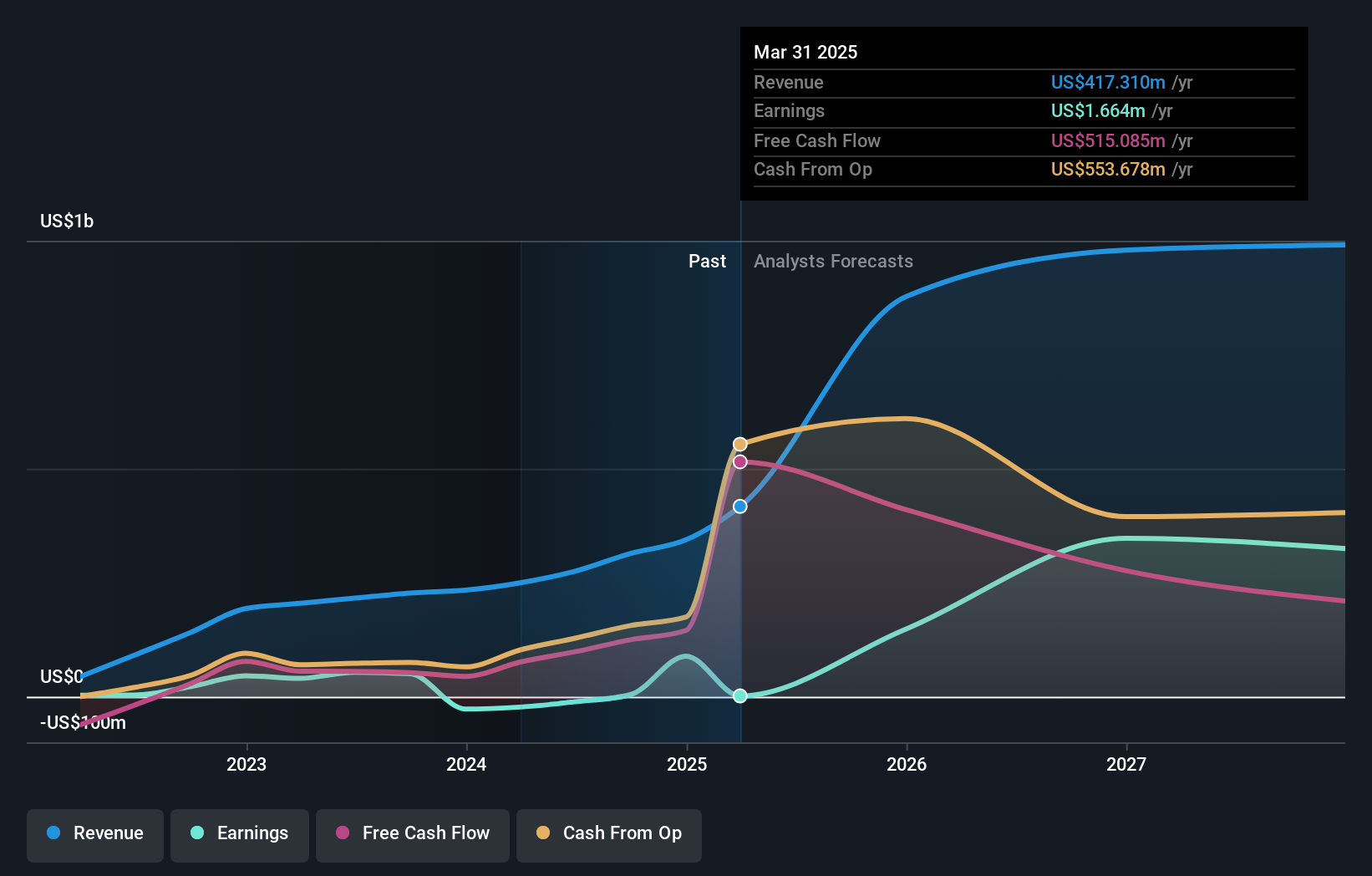

Operations: Orla Mining Ltd. generates revenue through the acquisition, exploration, development, and exploitation of mineral properties.

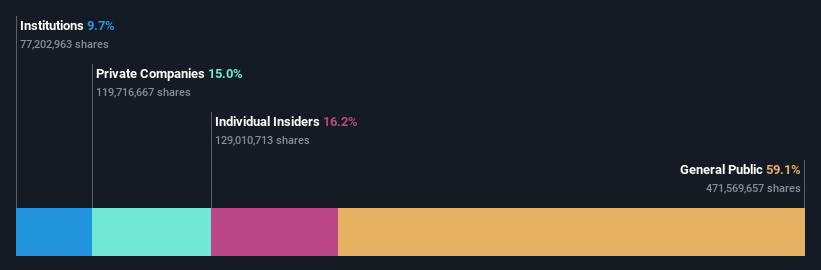

Insider Ownership: 11.1%

Orla Mining's projected revenue growth of 20.9% annually surpasses the Canadian market, with earnings expected to rise significantly by 47.8% per year. Recent insider activity shows more shares bought than sold, though significant selling occurred in the past three months. Despite a Q1 net loss of US$69.83 million, Orla's acquisition of Musselwhite Mine enhances production capacity and aligns with its strategic growth initiatives, as confirmed by updated gold production guidance for 2025 at Camino Rojo.

- Unlock comprehensive insights into our analysis of Orla Mining stock in this growth report.

- Upon reviewing our latest valuation report, Orla Mining's share price might be too optimistic.

Summing It All Up

- Gain an insight into the universe of 42 Fast Growing TSX Companies With High Insider Ownership by clicking here.

- Want To Explore Some Alternatives? This technology could replace computers: discover the 22 stocks are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:OLA

Orla Mining

Acquires, explores, develops, and exploits mineral properties.

High growth potential with solid track record.

Market Insights

Community Narratives