- Canada

- /

- Residential REITs

- /

- TSX:ERE.UN

Top Undervalued Small Caps On TSX With Insider Action In December 2024

Reviewed by Simply Wall St

As the Canadian market continues to benefit from robust consumer spending and positive real wage gains, small-cap stocks on the TSX are drawing attention for their potential amidst these favorable economic conditions. In this environment, identifying promising small caps involves looking at companies with strong fundamentals and insider activity that may indicate confidence in their future prospects.

Top 10 Undervalued Small Caps With Insider Buying In Canada

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Sagicor Financial | 1.2x | 0.3x | 32.31% | ★★★★★★ |

| Vermilion Energy | NA | 1.2x | 23.09% | ★★★★★★ |

| Primaris Real Estate Investment Trust | 13.3x | 3.6x | 41.09% | ★★★★★☆ |

| Calfrac Well Services | 11.7x | 0.2x | 36.25% | ★★★★★☆ |

| Nexus Industrial REIT | 12.7x | 3.2x | 27.44% | ★★★★★☆ |

| Flagship Communities Real Estate Investment Trust | 4.1x | 3.8x | 47.70% | ★★★★★☆ |

| First National Financial | 13.8x | 3.9x | 41.22% | ★★★★☆☆ |

| Parex Resources | 3.8x | 0.9x | 18.54% | ★★★★☆☆ |

| Hemisphere Energy | 6.1x | 2.3x | -112.76% | ★★★☆☆☆ |

| European Residential Real Estate Investment Trust | NA | 2.4x | -208.93% | ★★★☆☆☆ |

Here we highlight a subset of our preferred stocks from the screener.

European Residential Real Estate Investment Trust (TSX:ERE.UN)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: European Residential Real Estate Investment Trust is a company focused on owning and operating a portfolio of residential properties in Europe, with a market capitalization of approximately CAD $0.92 billion.

Operations: The primary revenue stream is derived from investment properties, totaling €97.04 million for the latest period. The gross profit margin has shown an upward trend, reaching 78.68% as of September 2024. Operating expenses are consistently below €9 million, contributing to the overall financial structure and performance outcomes observed in recent periods.

PE: -4.8x

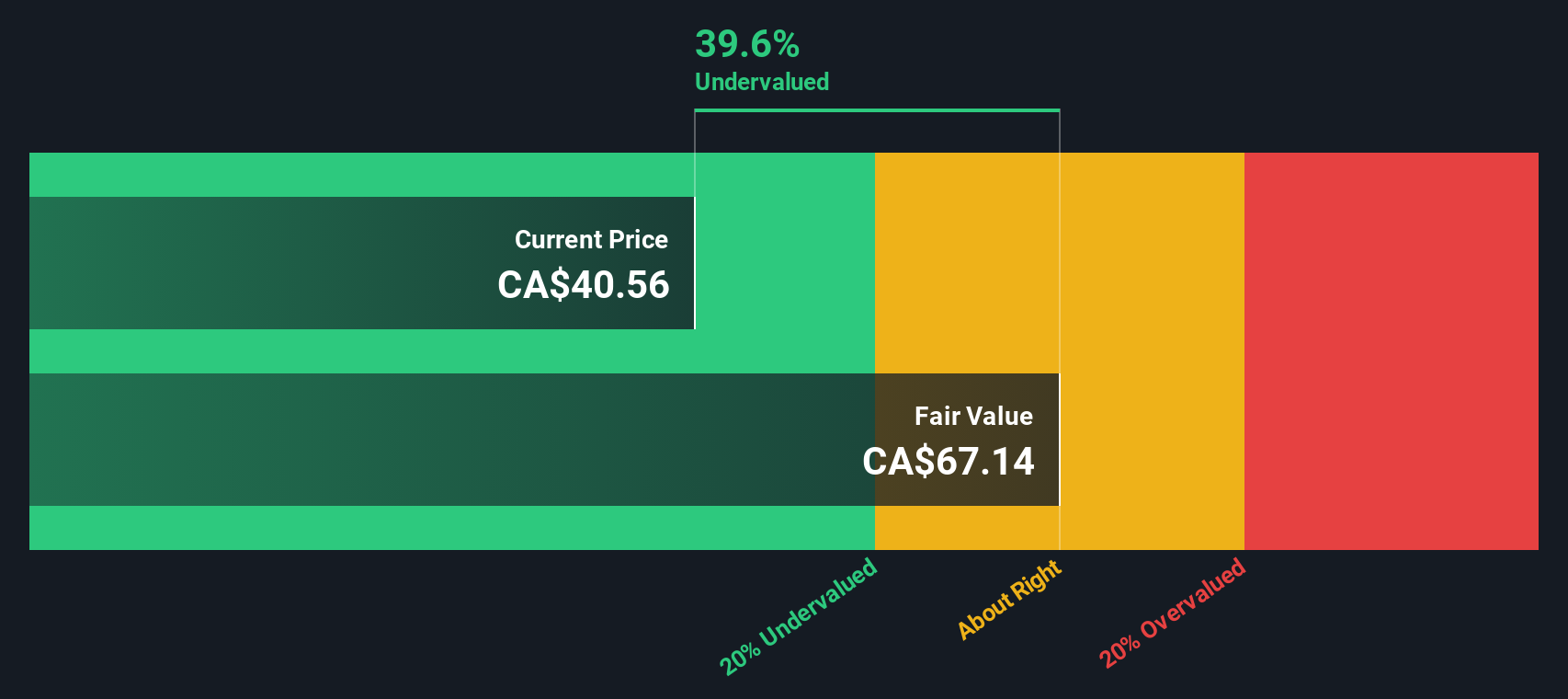

European Residential Real Estate Investment Trust, a smaller Canadian entity, has faced challenges with earnings declining 22.4% annually over the past five years. Despite this, insider confidence is evident through recent share purchases. The company announced a strategic move to reduce monthly distributions by 50% following asset dispositions expected to close by early 2025. This aligns with their aim to stabilize financials as they reported a net loss of €52 million for Q3 2024 compared to last year's profit.

First National Financial (TSX:FN)

Simply Wall St Value Rating: ★★★★☆☆

Overview: First National Financial is a Canadian company specializing in mortgage lending and servicing, with operations in both commercial and residential segments, and a market capitalization of approximately CA$2.73 billion.

Operations: The company's revenue streams are primarily derived from commercial and residential segments, amounting to CA$215.53 million and CA$423.75 million, respectively. Over recent periods, the net income margin has shown fluctuations, with a notable recent figure of 34.06%. Operating expenses have consistently impacted profitability, with general and administrative expenses reaching CA$221.12 million in the latest period analyzed.

PE: 13.8x

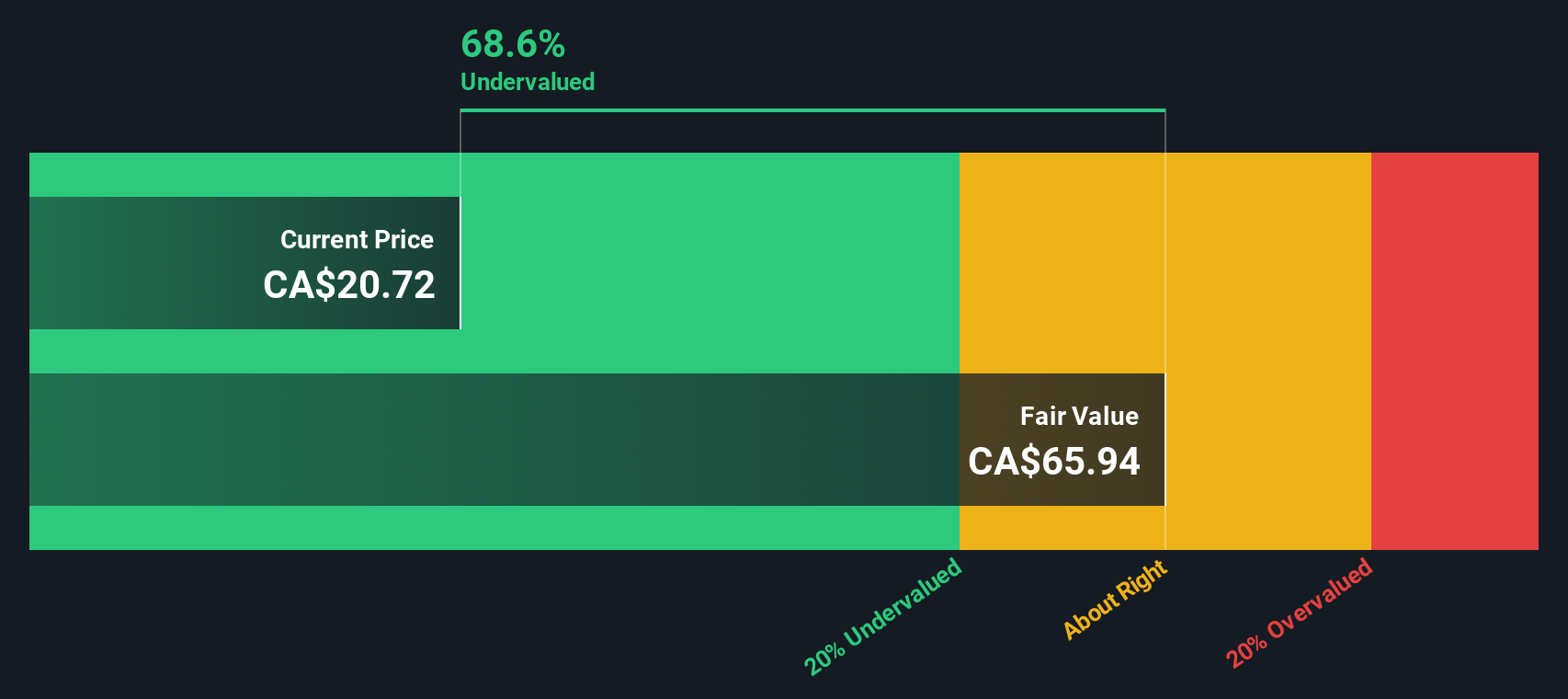

First National Financial, a smaller Canadian financial entity, has recently caught attention due to insider confidence. Stephen J. Smith increased their stake by acquiring 463,300 shares worth approximately C$20.44 million, reflecting a 2% rise in holdings. Despite a drop in Q3 net income to C$36 million from C$84 million the previous year and reliance on external borrowing for funding, the company maintains steady dividends with an annualized increase to C$2.50 per share and announced special payouts enhancing shareholder returns.

- Navigate through the intricacies of First National Financial with our comprehensive valuation report here.

Gain insights into First National Financial's past trends and performance with our Past report.

North American Construction Group (TSX:NOA)

Simply Wall St Value Rating: ★★★★☆☆

Overview: North American Construction Group is a Canadian company specializing in heavy construction and mining services, with a market cap of approximately CA$0.61 billion.

Operations: The company generates revenue primarily through its operations, with significant costs attributed to COGS and operating expenses. Notably, the gross profit margin has shown an upward trend, reaching 33.61% by the end of 2024. Operating expenses include general and administrative costs along with depreciation and amortization. The net income margin has varied over time but was recorded at 4.82% in late 2024.

PE: 14.0x

North American Construction Group, a smaller player in Canada, has caught attention with its recent moves. The company's Chairman of the Board, Martin Ferron, showed insider confidence by purchasing 19,000 shares valued at C$453,006 recently. Despite lower profit margins this year compared to last (4.8% vs. 8.2%), they secured a significant contract extension in the Canadian oil sands worth C$500 million over four years starting January 2025. Earnings guidance projects revenue between C$1.4 billion and C$1.6 billion for 2025, indicating potential growth amid high debt levels and reliance on external funding sources.

Summing It All Up

- Click this link to deep-dive into the 21 companies within our Undervalued TSX Small Caps With Insider Buying screener.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if European Residential Real Estate Investment Trust might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:ERE.UN

European Residential Real Estate Investment Trust

ERES is an unincorporated, open-ended real estate investment trust.

Slight and slightly overvalued.

Market Insights

Community Narratives