- Canada

- /

- Oil and Gas

- /

- TSX:MEG

A Fresh Look at MEG Energy (TSX:MEG) Valuation as Stock Pulls Back Following Year-to-Date Gains

Reviewed by Kshitija Bhandaru

See our latest analysis for MEG Energy.

After a strong run so far in 2024, MEG Energy’s 17.7% year-to-date share price return stands out, even as the stock has eased slightly in recent weeks. Short-term swings aside, the company’s multi-year total shareholder return of 59.5% over three years and an exceptional 940% over five years suggest momentum has been robust for patient investors.

If the recent energy sector moves have you thinking bigger, consider widening your outlook with a fresh batch of opportunities. Discover fast growing stocks with high insider ownership.

With MEG Energy’s impressive past returns, steady revenue growth, and a current share price just shy of analyst targets, the question now is whether there is hidden value left to unlock or if the market is already accounting for all future growth.

Most Popular Narrative: 3% Undervalued

Compared to its last close of CA$28.24, the latest narrative consensus sees MEG Energy trading modestly below an estimated fair value of CA$29.11. This slim margin suggests analysts see little room for re-rating unless major business drivers break decisively in the company’s favor.

Sustained focus on operational efficiency, such as reducing sustaining capital costs per barrel and extending turnaround cycles, should drive lower per-unit production costs. This supports margin expansion and improved net earnings as economies of scale are realized.

What’s the margin secret fueling this fair value? The analyst blueprint hinges on bold efficiency targets and margin plays that could rewrite MEG’s bottom line. The missing piece is their specific profit forecasts and how much the market is willing to pay for them. Cracking the code means diving into those assumptions yourself.

Result: Fair Value of $29.11 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, MEG’s dependence on a single project and ongoing exposure to fluctuating oil prices could quickly shift the outlook if conditions worsen.

Find out about the key risks to this MEG Energy narrative.

Another View: Looking at the Numbers Through Multiples

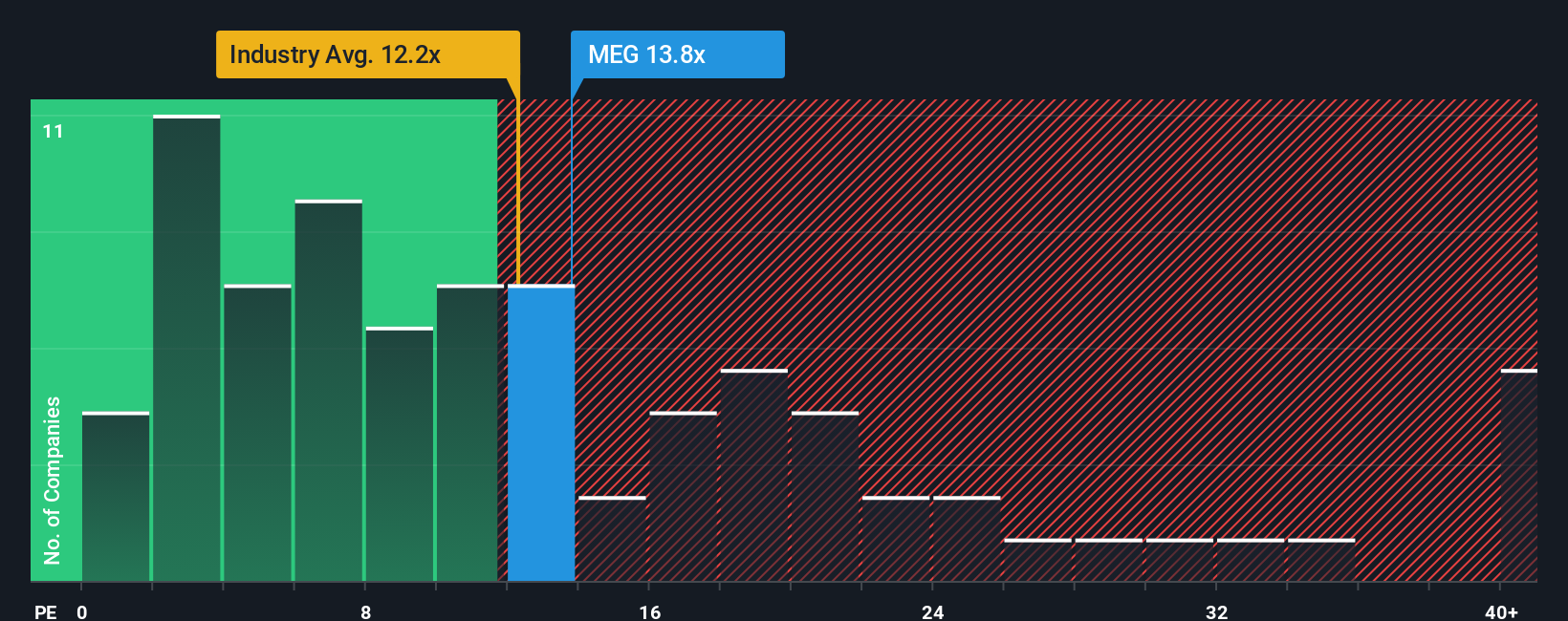

Taking a different approach, MEG Energy's price-to-earnings ratio sits at 13x. That is a notch above its industry average of 12.6x and higher than its fair ratio of 12.4x, suggesting the stock is a little expensive on this metric. When compared to its peers, however, MEG looks like decent value, as the peer average is much higher at 29.6x. Does this signal a hidden opportunity or an extra layer of risk for investors?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own MEG Energy Narrative

If you see the numbers differently or want to test your own investment views, you can build your own narrative quickly and easily, Do it your way.

A great starting point for your MEG Energy research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Smart Investment Opportunities?

Set yourself up for investing success by choosing ideas with long-term growth potential and strong financial foundations. It only takes a moment, but could change your financial future.

- Spot stocks offering potentially high yields and consistent performance when you check out these 19 dividend stocks with yields > 3% for opportunities above the 3% mark.

- Capitalize on the future of medicine by selecting from these 32 healthcare AI stocks which is powering breakthroughs in healthcare technology.

- Seize your advantage in AI innovation by reviewing these 25 AI penny stocks that are at the forefront of artificial intelligence breakthroughs.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:MEG

MEG Energy

An energy company, focuses on in situ thermal oil production in its Christina Lake Project in the southern Athabasca oil region of Alberta, Canada.

Excellent balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives